Prices for caustic soda have dropped by more than 54% since they peaked in 2009.

But now, they’re going back up.

Do you have a plan in place to buffer against caustic soda price escalation and drive savings opportunities?

Click here to download our step-by-step guide on how to capture savings on caustic soda using market data and analysis.

A Step-by-Step Guide to Capturing Savings on Caustic Soda

November 23, 2016 at 10:03 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Oil & Gas

[Video] A Macroeconomic Update for O&G Supply Chain Teams

November 23, 2016 at 10:02 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Oil & Gas

In our latest macroeconomic update, our Energy Intelligence Group shares the latest on key economic factors affecting Oil & Gas Supply Chain teams today. Scroll down for a brief 15-minute update on:

- GDP movements

- The election's impact on Oil & Gas

- Our interest rate outlook

- The recent market rally

- Infrastructure spending

- Spikes in copper

- Protectionism and trade

Interested in learning more? We're always happy to talk: costinsights@poweradvocate.com

Tariff Determinations Change Line Pipe Sourcing Process

November 14, 2016 at 2:50 PM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Oil & Gas

In January 2015, monthly line pipe imports to the United States, including circular and welded line pipes, reached 315,000 metric tons. By September 2016, these imports dropped to 60,000 metric tons, more than an 80% decrease in 20 months. While low oil prices over the last two years might have discouraged investment in pipeline projects and thus decreased the demand for line pipe, they impacted less than 30% of US pipeline projects in 2015, according to the US Oil & Gas Association. One significant driver behind the drop in imports remains tariffs.

In today's post, we share some innovative new ways to approaching line pipe sourcing in a world of increasing tariff determinations.

How Saudi-Iran Tensions Could Generate a Windfall for E&P

November 14, 2016 at 2:47 PM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Oil & Gas

As oil prices began falling in mid-2014, oil market observers naturally assumed that OPEC would play its traditional role and cut production in order to stabilize prices. However, since then, the group has failed to implement any meaningful cuts, contributing to a massive global supply glut and a bear market in crude. While this course of action is partially a response to the economics of US shale plays, it has been driven by internal clashes within OPEC, particularly between Saudi Arabia and Iran.

[Webinar] Statoil Presents Cost Reduction and Avoidance Case Studies

September 20, 2016 at 7:12 PM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Oil & Gas

Two cost-reduction concerns are top-of-mind for Oil & Gas firms right now: 1) Ensuring maximum savings from the downturn, and 2) Protecting against price escalations from the rebound.

In a recent webinar attended by 60+ O&G peers, a leader in Statoil's supply chain discussed how her organization achieved wins in these areas, driving substantial cost-avoidance for high-spend, strategic categories.

In this webinar recording, you'll learn:

- How to create data-driven counteroffers in supplier negotiations and tie costs to specific indices

- How to position yourself in a market of increasing prices

- How Statoil took advantage of cost models to achieve more than $450K+ of cost reduction and avoidance

- And lots more...

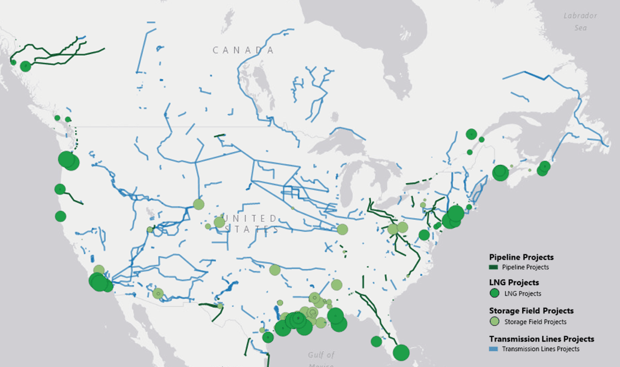

Midstream, Refining, and Petrochemical Project Forecast: 2016 through 2020

August 26, 2016 at 6:54 PM / by Energy Intelligence Group posted in Project Estimation, Cost Reduction, Oil & Gas

With the future of oil and gas prices still uncertain, many midstream and downstream firms are asking how much investment is still being planned for the coming years.

In today's project forecast update, we share how and where the market is planning projects in the midstream, refining, and petrochemical sectors over the next four years. Read on to view maps of the top areas of capital investment through 2020:

Billions are Planned in Gas Pipeline, LNG, and Energy Storage Projects

Sources: SNL, Oil & Gas Journal

This map of planned midstream investment suggests three important observations:

- Large LNG projects will ramp up over the next 4 years

- The Gulf Coast continues to be an area of some of the largest investments, with many pipeline projects still planned for the Northeast

- Storage projects are not to be overlooked as an area of competing investment

Let's next take a look at the downstream market.

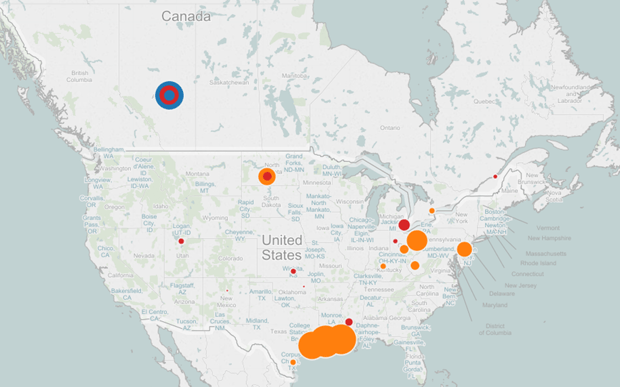

More than $100B of Downstream Projects Planned through 2020

Sources: Oil & Gas Journal, Petrochemical Update, ICIS Chemical Business Magazine

[Video] Oil & Gas Labor Market Update

August 26, 2016 at 5:11 PM / by Energy Intelligence Group posted in Cost Reduction, Oil & Gas

With billions of dollars of Oil & Gas projects still in the forecast, craft labor markets are becoming more and more constrained. And at the same time that demand for labor is rising, supply of skilled laborers has declined drastically and benefits & health care costs have risen to new highs.

The result is an especially challenging labor market for Oil & Gas firms working with welders, equipment operators, electricians, pipefitters, carpenters, and other craft laborers.

In our latest Labor Market Update, we share:

- Why labor market supply has plummeted since the recession and which sectors are experiencing the greatest hit

- Where supply/demand dynamics are expected to result in the greatest risks

- Which wage build-up components you can negotiate against in service RFP's

- And lots more...

Interested in viewing the labor update? Click here to access the brief 20-minute recording:

[Video] Taking Advantage of Currency Markets: A Guide for Oil & Gas

August 26, 2016 at 4:45 PM / by Energy Intelligence Group posted in Cost Reduction, Oil & Gas

Two months ago, the British Pound lost 15% overnight. Since 2012, the Japanese Yen has lost 58%. So how do those drastic changes in currency markets impact Oil & Gas?

In our latest Oil & Gas currency update, we share:

- Why it's so important for O&G firms to pay attention to currency markets

- Specific tactics for taking advantage of currency volatility and achieving millions in savings

- How currency wars and competitive devaluation drive risk and opportunity for O&G

This presentation was the most highly rated content at our annual User Group conference, and it has since been viewed by more than 40 energy firms.

Interested in viewing the currency update? Click here to access the brief 20-minute recording:

3 Moves O&G Supply Chain Negotiators Could Be Bringing to the Negotiation Table

August 19, 2016 at 8:56 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Oil & Gas

Negotiating with Oil & Gas suppliers is notoriously difficult: suppliers have a better sense of market demand, they have more data on their cost structures and overhead, and they have more visibility into their competitive landscape. Today, we share 3 research-backed negotiation tactics that Oil & Gas supply chain professionals can bring to the table to remedy that imbalance of information.

Whether you’re a seasoned negotiator or preparing for your first supplier negotiation, read on to learn more about the 3 psychological principles that Oil & Gas supply chain professionals can use to drive down costs.

Post-Brexit Market Events to Keep an Eye On

August 11, 2016 at 4:45 PM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Oil & Gas

Brexit didn't have to shock the markets as badly as it did. Increased volatility that this event created (see here for our webinar on the topic) highlights the importance of tracking market trends against a calendar of geopolitical events relevant to your business. Such events have demonstrated time and again their ability to jolt markets, and even cause inflection points that drive economies into severe downturns. It is therefore important to look forward to the following international developments relevant to O&G: