Geopolitical tensions around Taiwan, the fallout from the war in Ukraine and China’s zero-Covid policy and property sector crisis continue to unsettle commodity markets, testing the resilience of solar, wind, battery storage and utility supply chains.

APAC Oil & Gas Downstream Cost Inflation Trends Q3 2022

January 2, 2023 at 3:45 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Oil & Gas

APAC Oil & Gas Upstream Cost Inflation Trends Q3 2022

January 2, 2023 at 3:45 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Oil & Gas

Geopolitical tensions around Taiwan, the fallout from the war in Ukraine and China’s zero-Covid policy and property sector crisis continue to unsettle commodity markets, testing the resilience of solar, wind, battery storage and utility supply chains.

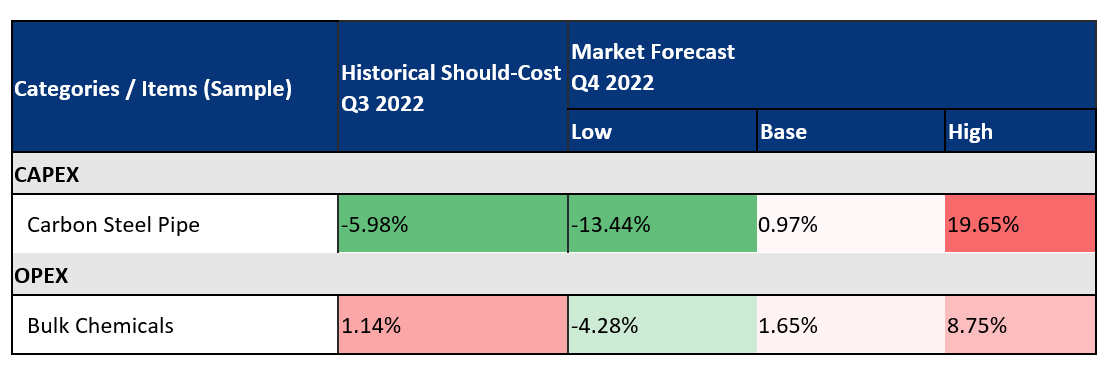

EMEA Oil & Gas Downstream Cost Inflation Trends – Q3 2022

November 11, 2022 at 11:45 AM / by Wood Mackenzie Supply Chain posted in Industry Insights, Oil & Gas

A recessionary outlook for the global economy, sanctions on Russia and the follow-on impacts as the world emerges from the COVID-19 pandemic continue to reverberate through the downstream sector. As policies and economies have adapted to the volatility, there has been an easing in the cost of some items in Q3, the high-case scenario of Wood Mackenzie Supply Chain’s Q3 inflation report indicates that volatility will linger in Q4 across key items, such as carbon steel pipe, rotating equipment, and bulk chemicals.

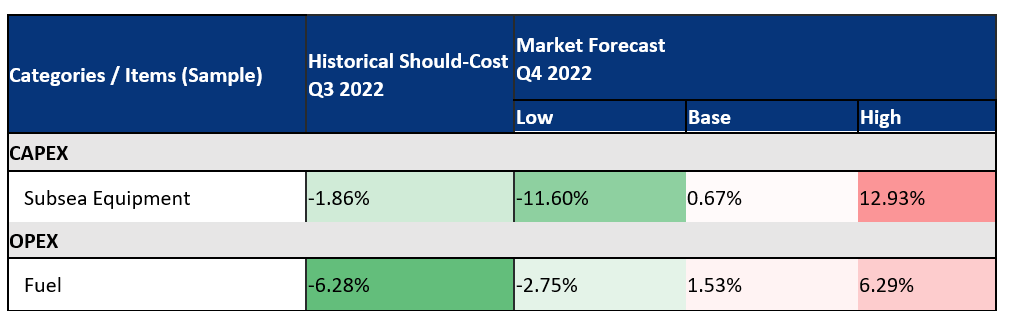

EMEA Oil & Gas Upstream Cost Inflation Trends – Q3 2022

November 11, 2022 at 11:44 AM / by Wood Mackenzie Supply Chain posted in Industry Insights, Oil & Gas

A recessionary outlook for the global economy, sanctions on Russia and the follow-on impacts as the world emerges from the COVID-19 pandemic continue to reverberate through the upstream sector. As policies and economies have adapted to the volatility, there has been an easing in the cost of some items in Q3, the high-case scenario of Wood Mackenzie Supply Chain’s Q3 inflation report indicates that volatility will linger in Q4 across key items, such as subsea equipment, fuels, and offshore maintenance services.

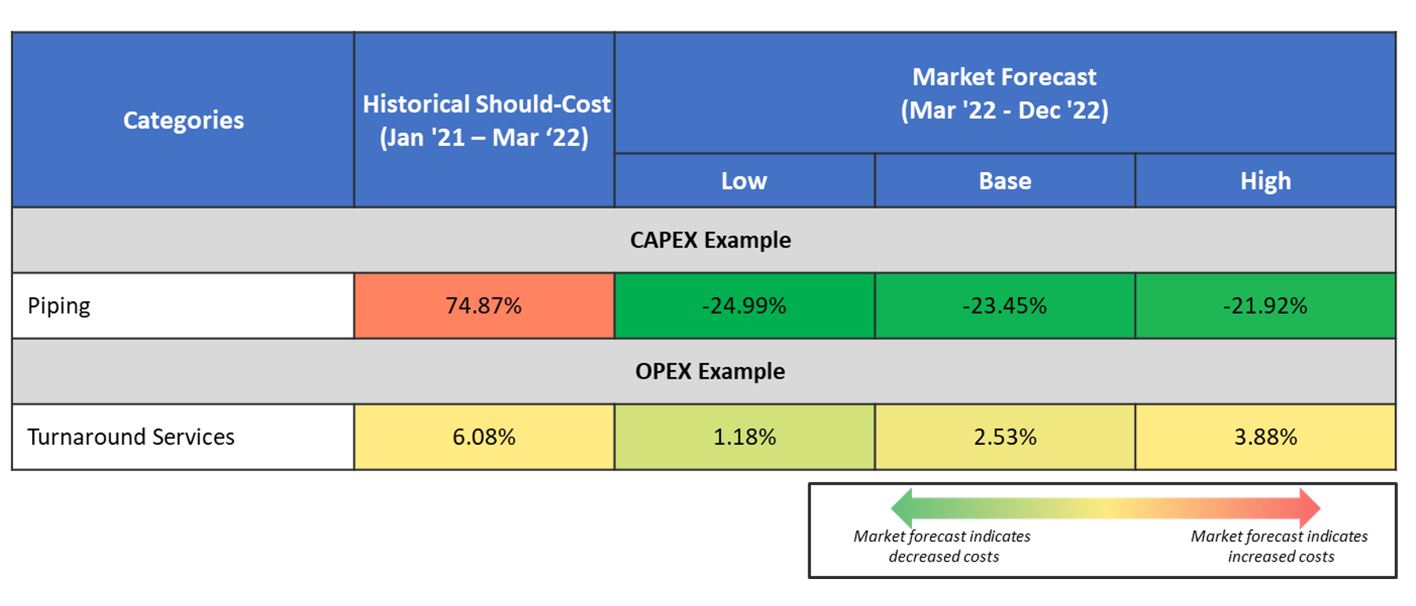

Key Cost Trends in EMEA Downstream: March 2022 - December 2022 Forecast

May 5, 2022 at 11:22 AM / by Wood Mackenzie Supply Chain posted in Industry Insights, Oil & Gas

As turbulent times continue, mitigating for volatile markets is supported by appropriate CAPEX and OPEX forecasting. This report provides proprietary low, medium and high forecast scenarios for key categories of spend. Energy players are leveraging these forecasts to estimate key cost changes, forecast spend and to optimise costs in 2022.

PowerAdvocate is integrating with our sister company Wood Mackenzie to become its Supply Chain Cost Management Practice. We leverage proprietary data from our >$6.5T energy spend factbase and 10k+ cost models and benchmarks to provide actionable insights on hundreds of critical downstream categories which aid in supplier negotiations and budget planning.

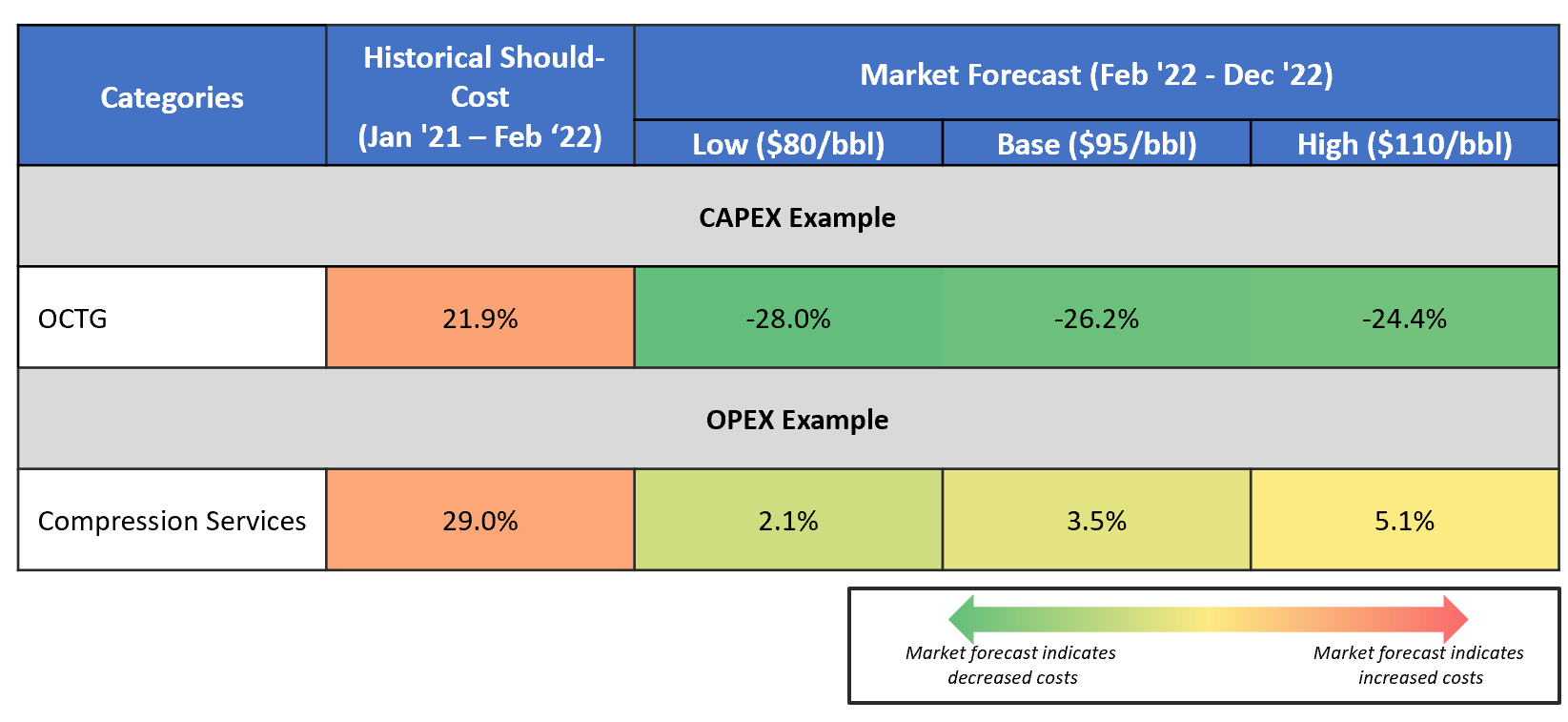

Key Cost Trends in EMEA Upstream: February 2022 - December 2022 Forecast

May 5, 2022 at 11:14 AM / by Wood Mackenzie Supply Chain posted in Industry Insights, Oil & Gas

As turbulent times continue, mitigating for volatile markets is supported by appropriate CAPEX and OPEX forecasting.

This report provides proprietary, low, medium and high forecast scenarios for key commodities across CapEx and OpEx categories. Energy players are leveraging these forecasts to estimate key cost changes, forecast spend, and use industry data to optimise costs in 2022.

PowerAdvocate is integrating with our sister company Wood Mackenzie to become its Supply Chain Cost Management Practice. We leverages proprietary data from our >$6.5T energy spend factbase and 10k+ cost models and benchmarks to provide actionable insights on hundreds of critical upstream categories which aid in supplier negotiations and budget planning.

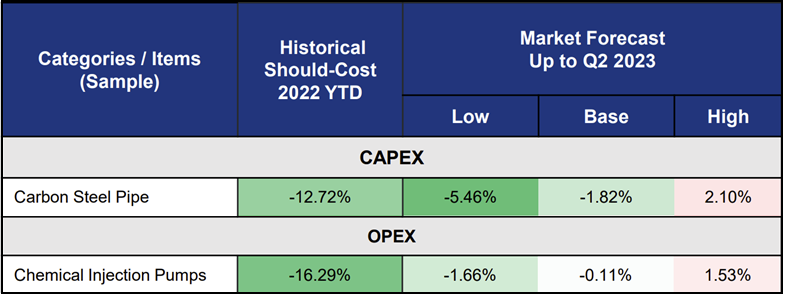

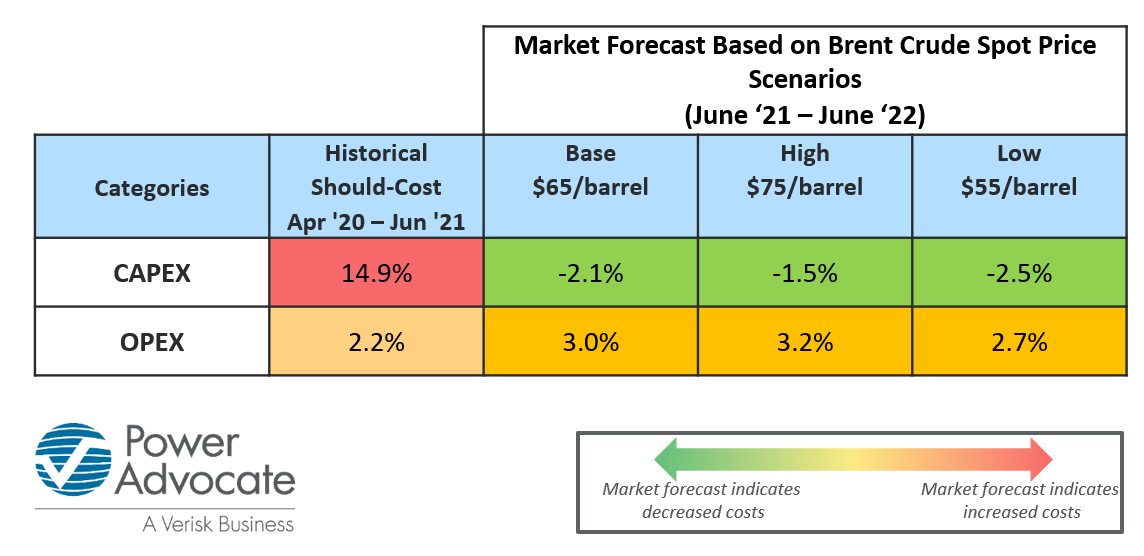

Key Cost Trends in EMEA Upstream: July 2021 - June 2022

September 27, 2021 at 10:44 AM / by Wood Mackenzie Supply Chain posted in Industry Insights, Oil & Gas

2021 marks an opportunity for upstream operators to overcome cost challenges presented amid last year's turbulent market through appropriate CAPEX and OPEX forecasting.

In our July update, we identify and provide cost forecasts for key CAPEX categories including OCTG, onshore & offshore drilling rigs; and OPEX categories including production chemicals and equipment rental.

Some notable trends include equipment rental likely to experience one of the most notable cost increase (~5%) amid price increases in 2022.

Operators are leveraging these forecasts to estimate key cost changes, forecast spend, and use industry data to optimise costs in 2021.

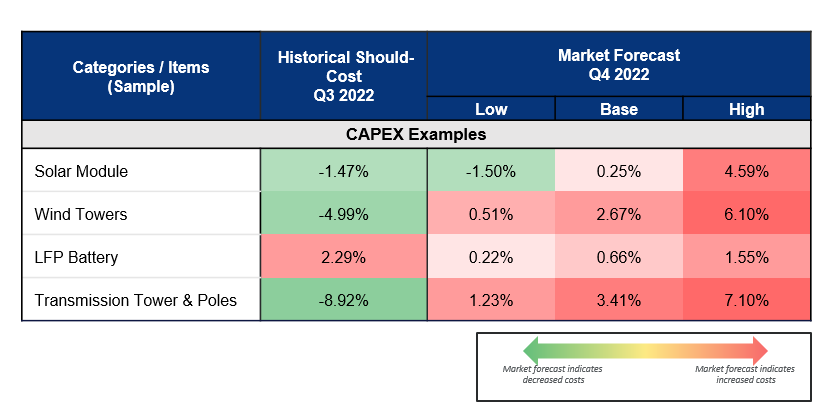

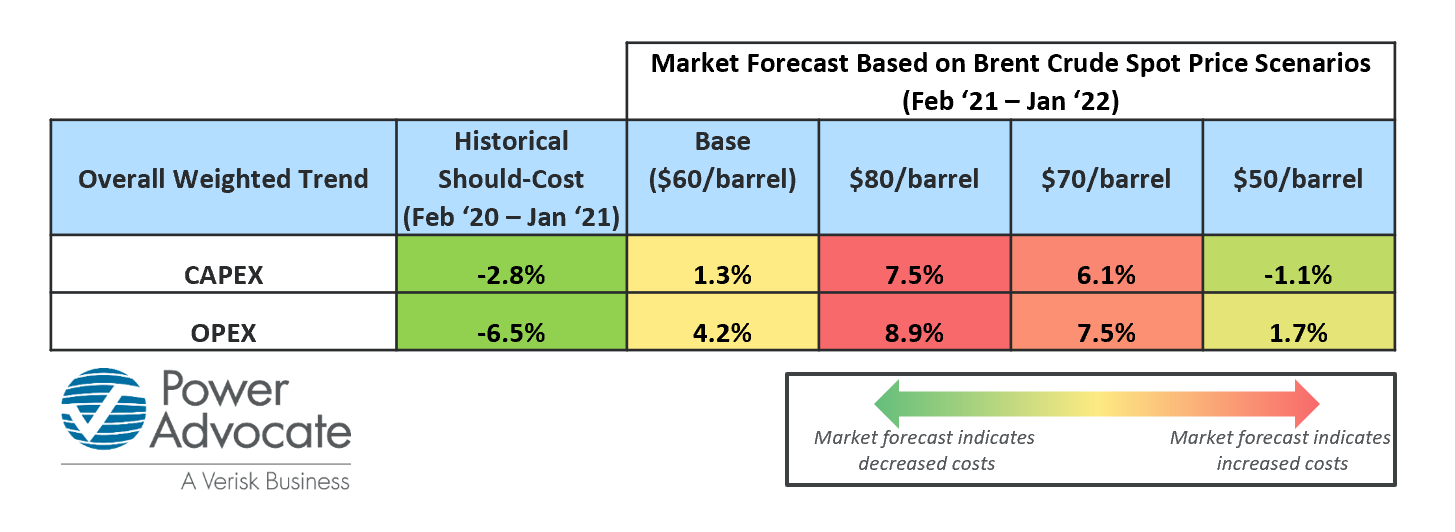

Europe O&G: 2021 Upstream Market Forecasts

March 9, 2021 at 10:13 AM / by Wood Mackenzie Supply Chain posted in Industry Insights, Oil & Gas

2021 marks an opportunity for upstream operators to overcome cost challenges presented amid last year's turbulent market through appropriate CapEx and OpEx forecasting.

In our latest market report, we provide cost forecasts for key CapEx & OpEx categories and outline why we see cost increases across almost all of them which are forecast to rise between ~1%-12% between February 2021 and January 2022.

Some of the top categories with notable inflationary/deflationary trends included in the report are:

- CapEx: OCTG, onshore & offshore drilling rigs, and wellhead equipment services

- OpEx: Production chemicals, compression services, and offshore support vessels

As operators focus on optimizing their costs in 2021, it is key to leverage market forecasts to estimate key cost changes and forecast spend.

Market Forecast Overall Weighted Trend Based on Brent Crude Spot Price Scenarios

Europe O&G: 2021 Downstream Market Reflections

February 8, 2021 at 3:24 PM / by Wood Mackenzie Supply Chain posted in Industry Insights, Oil & Gas

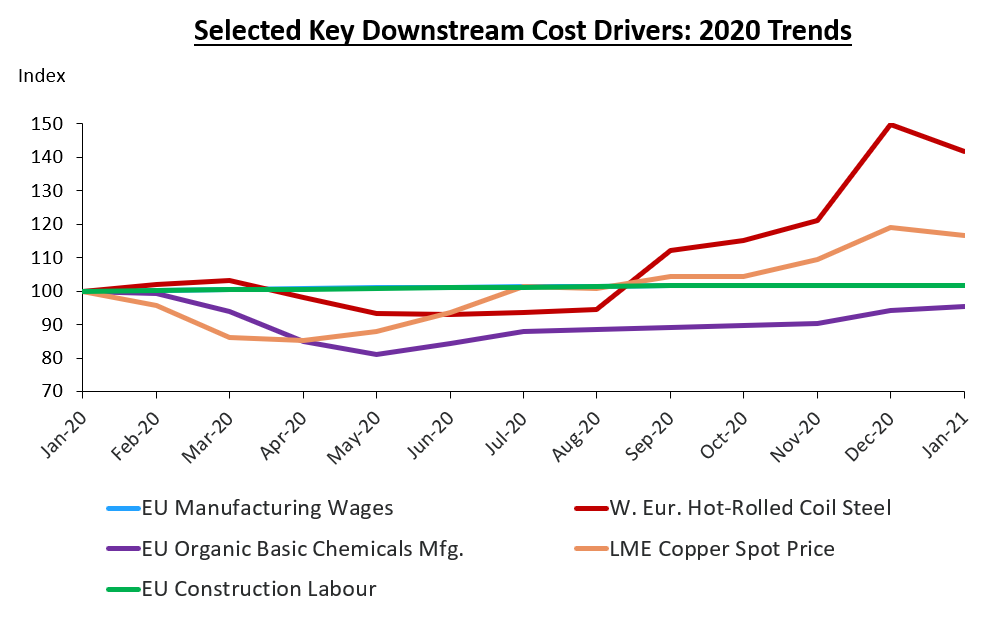

2020 has been a volatile year for downstream supply markets, and several key cost categories have moved sharply. For example, since last January,

- Hot-Rolled Coil Steel costs have increased by 40%+

- Copper costs have increased by 16%+

- Organic Basic Chemicals costs have decreased by 4%+

As operators refine their CapEx and OpEx programs for 2021, we have found that it is important to understand both how key downstream commodities have trended, and the impacts of those trends on key cost categories – for example, the 16%+ increase in copper costs contributed to a 7%+ increase in Electrical Supplies.

Europe O&G: 2020 Upstream Cost Top Movers

December 17, 2020 at 10:34 AM / by Wood Mackenzie Supply Chain posted in Industry Insights, Oil & Gas

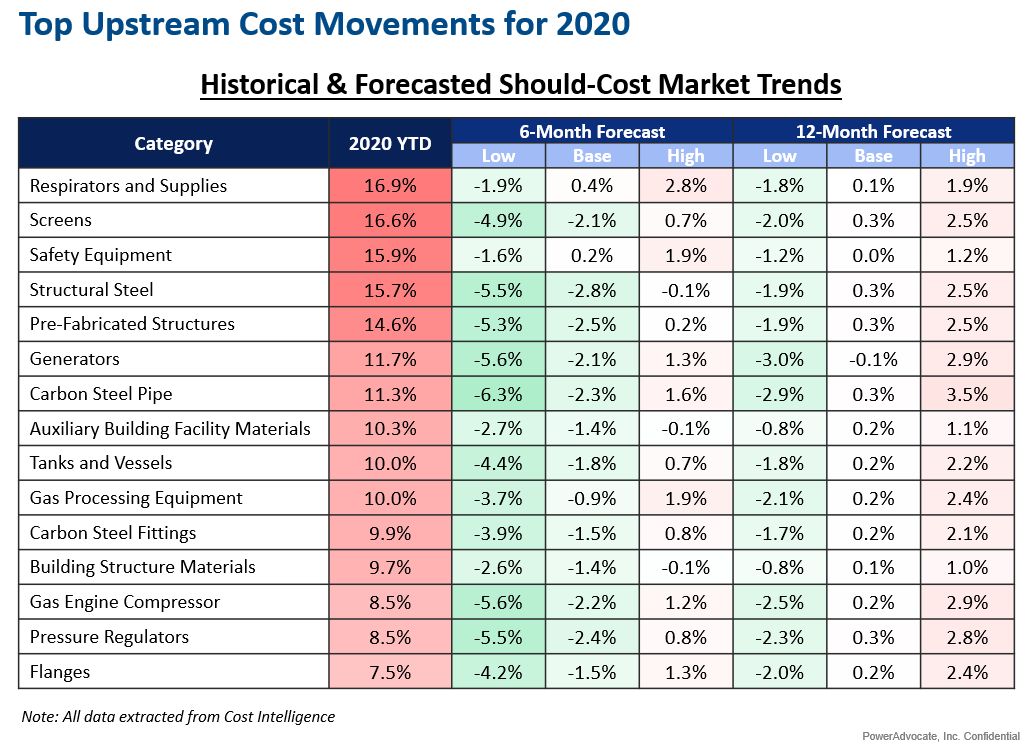

2020 has been a volatile year for upstream supply markets in Europe, and several key cost categories have experienced inflationary pressure. For example, since January,

- Screen costs have increased by 16.6%

- Generator costs have increased by 11.7%

- Carbon Steel Pipe costs have increased by 11.3%

Understanding how key cost markets are trending unlocks value across the entire cost management lifecycle: from identifying market-driven opportunities and risks to support category strategy development, to executing data-driven vendor negotiations, to tying contracts to favorable indices to underpin contract resilience.

Our team recently put together a list of upstream cost categories which experienced the most inflationary pressure during 2020.