Negotiating with Oil & Gas suppliers is notoriously difficult: suppliers have a better sense of market demand, they have more data on their cost structures and overhead, and they have more visibility into their competitive landscape. Today, we share 3 research-backed negotiation tactics that Oil & Gas supply chain professionals can bring to the table to remedy that imbalance of information.

Whether you’re a seasoned negotiator or preparing for your first supplier negotiation, read on to learn more about the 3 psychological principles that Oil & Gas supply chain professionals can use to drive down costs.

1. Make the first move and anchor high

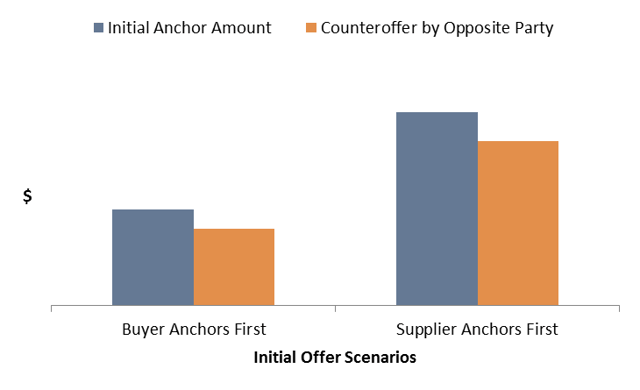

It’s commonly thought that making the first move sacrifices your negotiating power. However, research suggests that the opposite is true: making the first move gives you the opportunity to “anchor” the price point for the rest of the negotiations.

The concept of “anchoring” comes from psychology, where it’s used to mean that humans tend to estimate the answer to a question by making adjustments to some anchor or initial value that comes to mind. In other words, negotiators have a tendency to work around the first number they see.

This is especially valuable for Supply Chain professionals because it means that the person who cites the first number ends up securing the anchor point around which all other counter offers will be made. This advantage is not insignificant, either— on average, every dollar higher in the first offer translates into fifty more cents in the final agreement.

In a previous post, we discussed how should-cost models can help drive a fact-based approach to negotiations. Using a should-cost model to anchor a negotiation in your perspective on the market is a great way to start from a strong position.

Imagine the two possible negotiation scenarios; the situation in which the supplier must react to the buyer’s initial anchor is much more favorable for the buyer than the reverse.

2. Justify with visuals

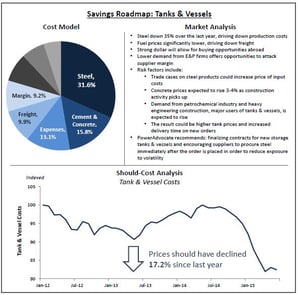

According to recent research, visuals that evoke scientific imagery (i.e. graphs, charts, and tables) can make the content of a message significantly more persuasive.

For instance, one study found that including elements like chemical formulas or charts made viewers significantly more likely to believe that a medication would work effectively.

For Supply Chain teams, this means that including data-driven graphics in your negotiations can strengthen your claim. Specifically, using this tactic might mean including:

- Charts of relevant indices that show how the cost inputs to the items you’re buying are moving

- Tables that compare suppliers’ unit pricing in order to create competition

- Scatter plots that show pricing and total spend with a supplier over time to ensure that you’re getting the best price and capturing volume discounts

- Pie charts of cost model breakdowns

- Charts that compare your total spend in a category vs. what you’re currently spending with Supplier X to show how much more revenue could be captured by striking a deal

An example of data-driven visualization that could lend extra credibility to your offer

3. Use geographic space to your advantage

When it comes to negotiations, psychologists agree that there’s a home-field advantage: according to one study, negotiating on your home turf can capture between 60% and 160% more value. For Supply Chain teams, that means:

- Requesting an on-site tour of your supplier’s location if you’re not on your home turf

- Hosting the negotiation in your own office, which gives off a greater perception of power and increases psychological comfort for the host

- Being able to control how many members from each side come to the table, which creates strength in numbers

- Getting the opportunity to invite multiple suppliers on-site, which creates an opportunity for a competitive bidding process

Whether it’s countering a pricing increase or negotiating for a discount, these 3 research-backed tactics help O&G Supply Chain professionals gain leverage and secure improved pricing and terms.

In fact, we’ve seen that the most successful Supply Chain organizations codify their findings into negotiation best practice checklists and playbook templates that include all the information required to make fact-based negotiations repeatable. Those templates might include should-cost analysis, analysis of past spend with the supplier, a cost model, recent KPI data, market analysis, cross-supplier price benchmarking, and more.

Interested in learning more about driving supplier negotiations or building out a playbook? Shoot us an email at costinsights@poweradvocate.com, and we’d be happy to get in touch.