Geopolitical tensions around Taiwan, the fallout from the war in Ukraine and China’s zero-Covid policy and property sector crisis continue to unsettle commodity markets, testing the resilience of solar, wind, battery storage and utility supply chains.

EMEA Mining Cost Inflation Trends YTD 2022

January 2, 2023 at 3:45 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Mining

APAC Mining Cost Inflation Trends - Q3 2022

November 11, 2022 at 11:44 AM / by Wood Mackenzie Supply Chain posted in Industry Insights, Mining

A recessionary outlook for the global economy, sanctions on Russia and the follow-on impacts as the world emerges from the COVID-19 pandemic continue to reverberate through the mining industry.

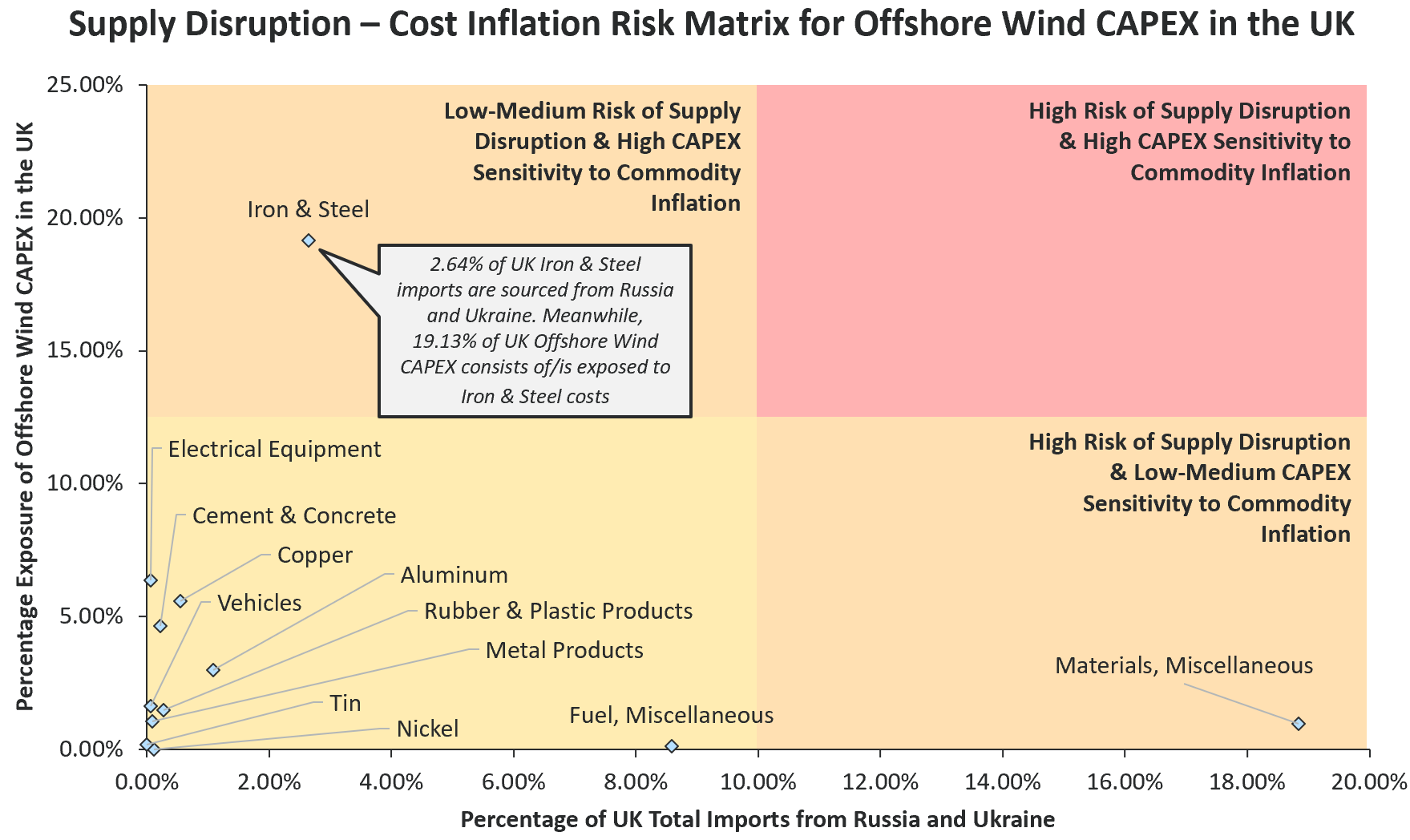

Russia-Ukraine Conflict Cost Risk Analysis Series: Offshore Wind CAPEX in the UK

April 11, 2022 at 10:00 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Mining

The Russia-Ukraine conflict has rattled global commodity markets, sending crude oil prices to their highest level in more than a decade, while prices for natural gas, nickel and aluminium have also spiked. Transport disruptions and the possibility of additional sanctions on Russia have raised the prospect of tighter supplies for various commodities.

In our Russia-Ukraine Conflict Cost Risk Analysis Series, we focus on key commodities assessing: 1. the risk of supply disruption as conflict interrupts the normal flow of trade exports from Russia and Ukraine; and 2. the cost inflation impact of such disruption on high spend and critical items within the Energy & Natural Resources industry.

This report in particular examines the risks for Offshore Wind CAPEX in the UK.

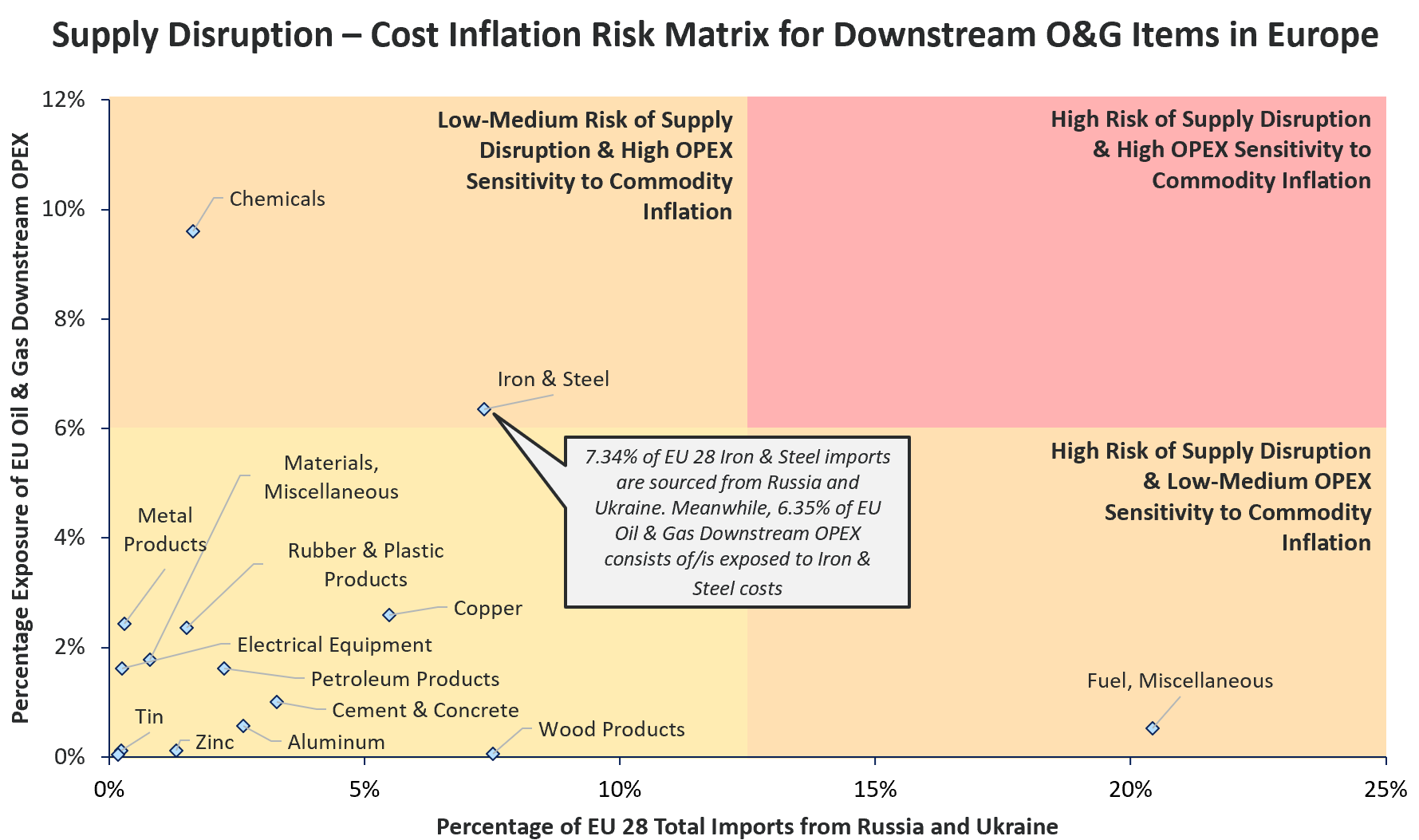

Russia-Ukraine Conflict Cost Risk Analysis Series: O&G Downstream OPEX in Europe

April 8, 2022 at 10:00 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Mining

The Russia-Ukraine conflict has rattled global commodity markets, sending crude oil prices to their highest level in more than a decade, while prices for natural gas, nickel and aluminium have also spiked. Transport disruptions and the possibility of additional sanctions on Russia have raised the prospect of tighter supplies for various commodities.

In our Russia-Ukraine Conflict Cost Risk Analysis Series, we focus on key commodities assessing: 1. the risk of supply disruption as conflict interrupts the normal flow of trade exports from Russia and Ukraine; and 2. the cost inflation impact of such disruption on high spend and critical items within the Energy & Natural Resources industry.

This report in particular examines the risks for O&G Downstream OPEX in Europe.

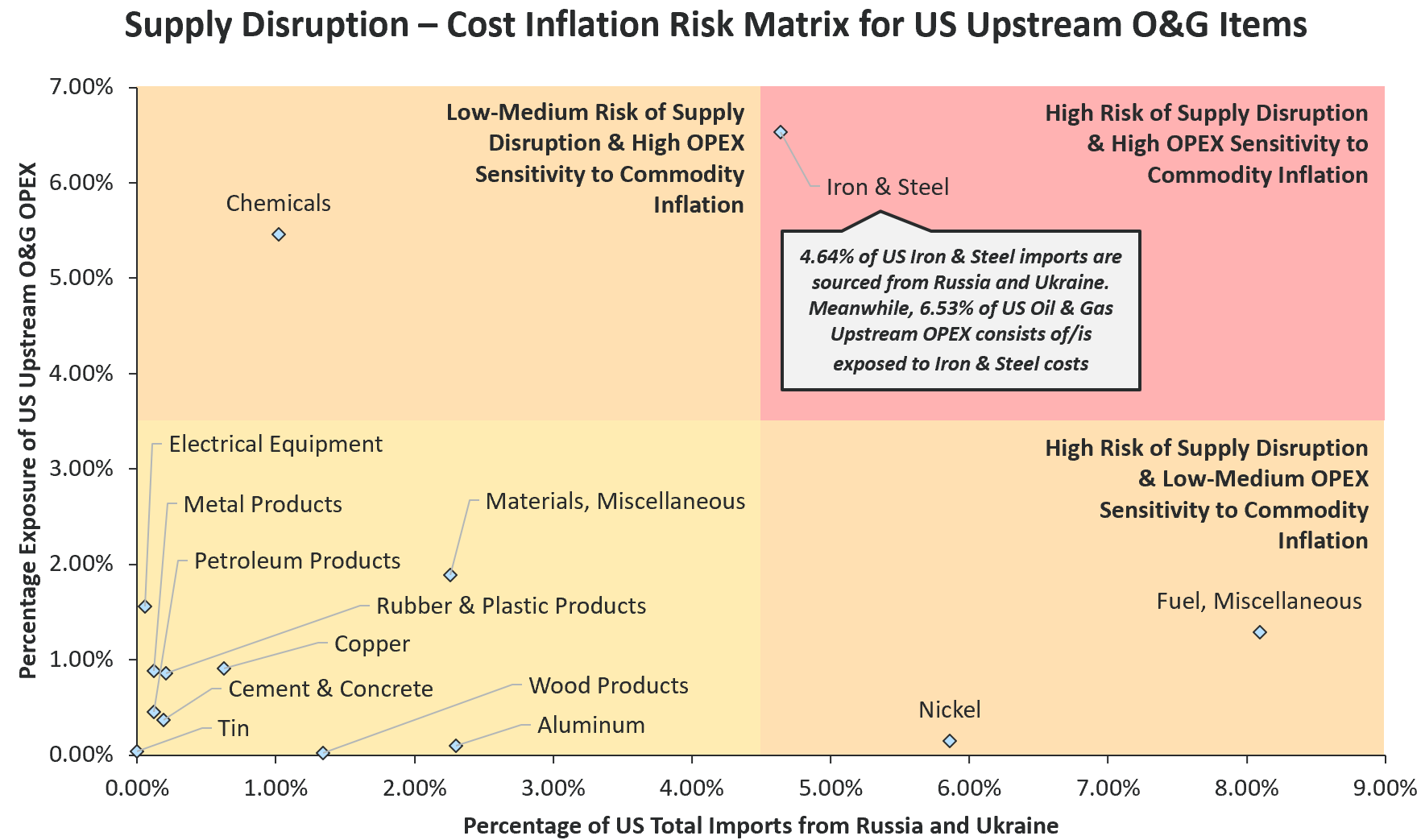

Russia-Ukraine Conflict Cost Risk Analysis Series: O&G Upstream OPEX in the US

April 7, 2022 at 10:00 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Mining

The Russia-Ukraine conflict has rattled global commodity markets, sending crude oil prices to their highest level in more than a decade, while prices for natural gas, nickel and aluminium have also spiked. Transport disruptions and the possibility of additional sanctions on Russia have raised the prospect of tighter supplies for various commodities.

In our Russia-Ukraine Conflict Cost Risk Analysis Series, we focus on key commodities assessing: 1. the risk of supply disruption as conflict interrupts the normal flow of trade exports from Russia and Ukraine; and 2. the cost inflation impact of such disruption on high spend and critical items within the Energy & Natural Resources industry.

This report in particular examines the risks for O&G Upstream OPEX in the US.

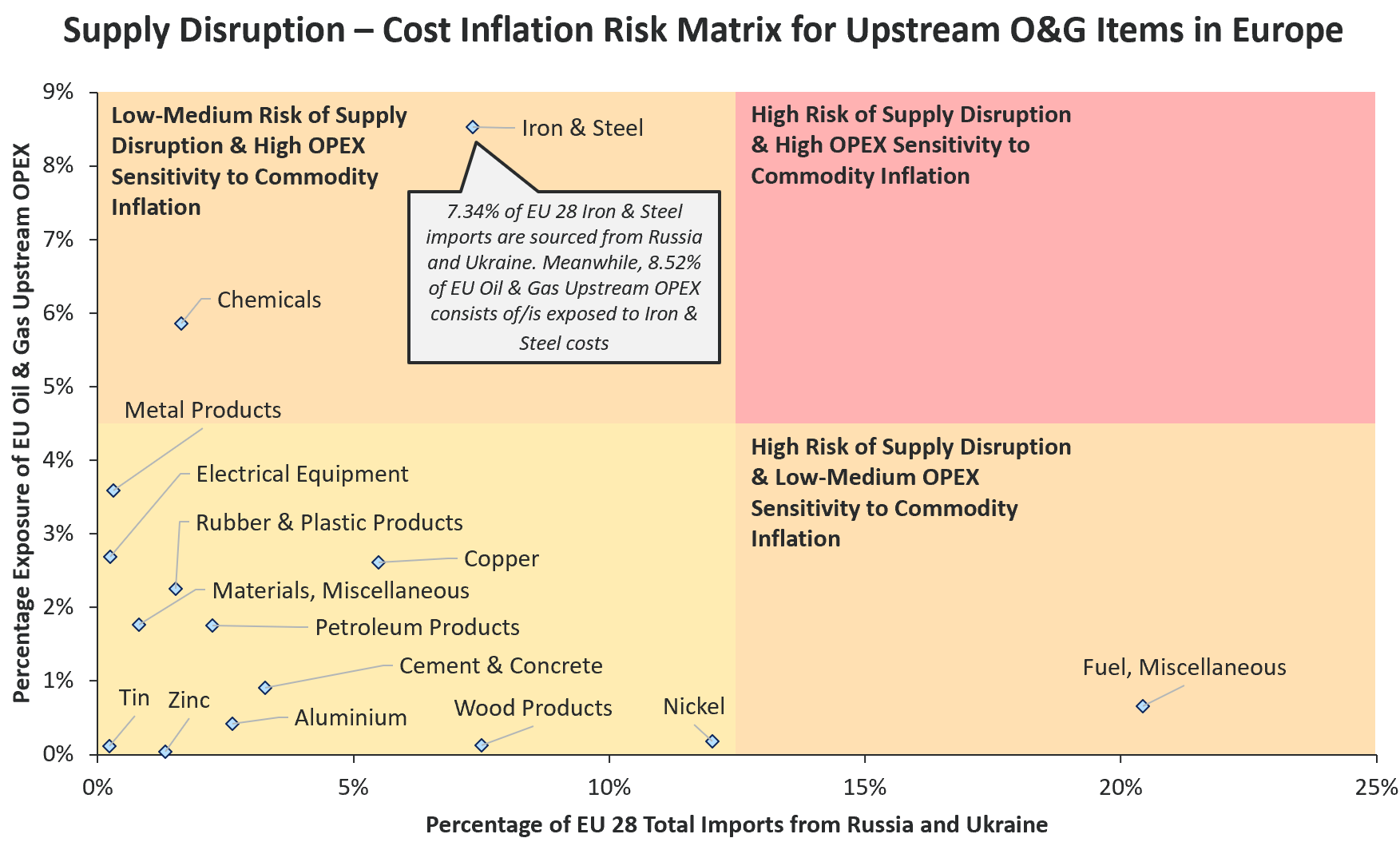

Russia-Ukraine Conflict Cost Risk Analysis Series: O&G Upstream OPEX in Europe

April 6, 2022 at 9:50 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Mining

The Russia-Ukraine conflict has rattled global commodity markets, sending crude oil prices to their highest level in more than a decade, while prices for natural gas, nickel and aluminium have also spiked. Transport disruptions and the possibility of additional sanctions on Russia have raised the prospect of tighter supplies for various commodities.

In our Russia-Ukraine Conflict Cost Risk Analysis Series, we focus on key commodities assessing: 1. the risk of supply disruption as conflict interrupts the normal flow of trade exports from Russia and Ukraine; and 2. the cost inflation impact of such disruption on high spend and critical items within the Energy & Natural Resources industry.

This report in particular examines the risks for O&G Upstream OPEX in Europe.

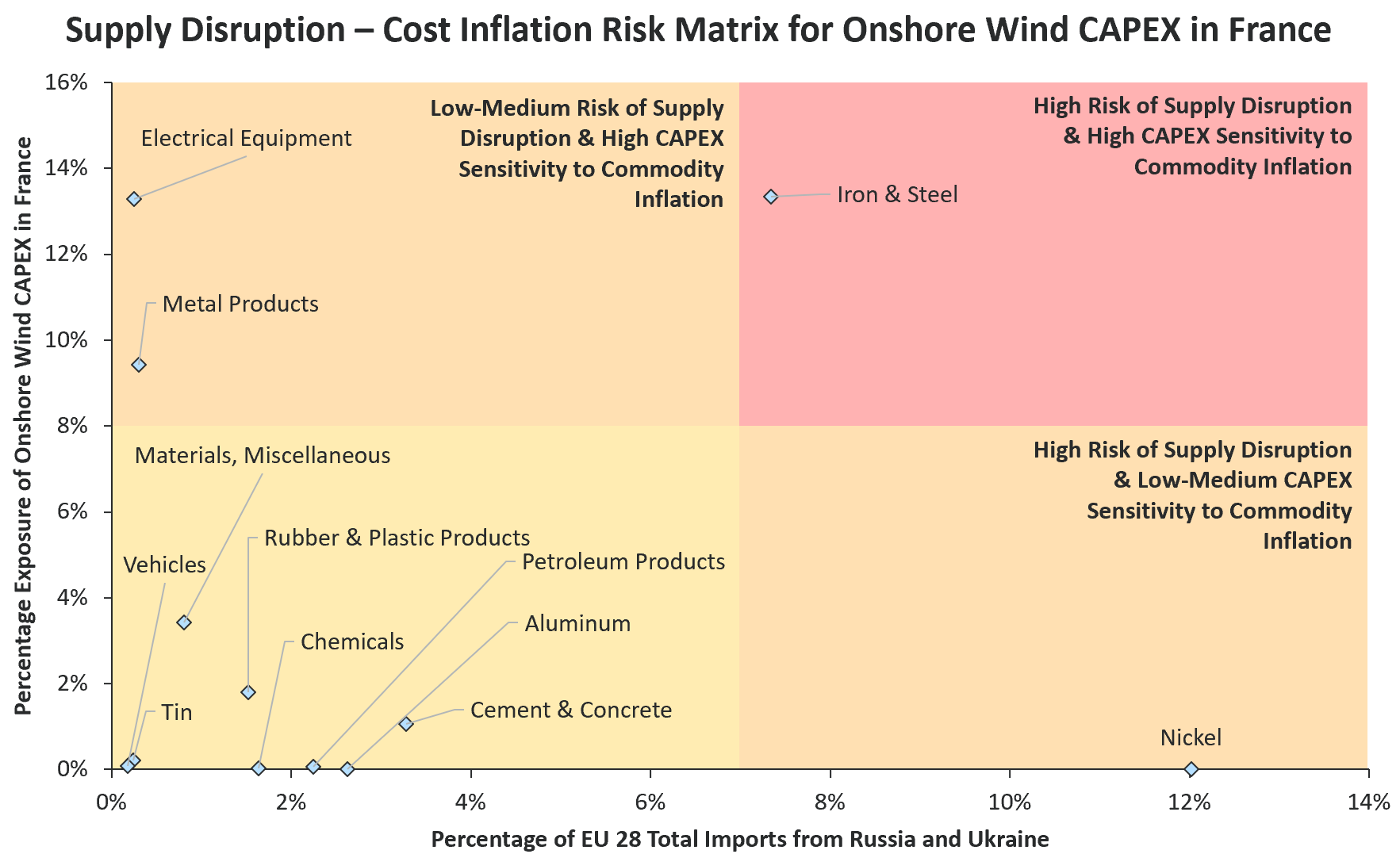

Russia-Ukraine Conflict Cost Risk Analysis Series: Onshore Wind CAPEX in France

April 5, 2022 at 9:40 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Mining

The Russia-Ukraine conflict has rattled global commodity markets, sending crude oil prices to their highest level in more than a decade, while prices for natural gas, nickel and aluminium have also spiked. Transport disruptions and the possibility of additional sanctions on Russia have raised the prospect of tighter supplies for various commodities.

In our Russia-Ukraine Conflict Cost Risk Analysis Series, we focus on key commodities assessing: 1. the risk of supply disruption as conflict interrupts the normal flow of trade exports from Russia and Ukraine; and 2. the cost inflation impact of such disruption on high spend and critical items within the Energy & Natural Resources industry.

This report in particular examines the risks for Onshore Wind CAPEX in France.

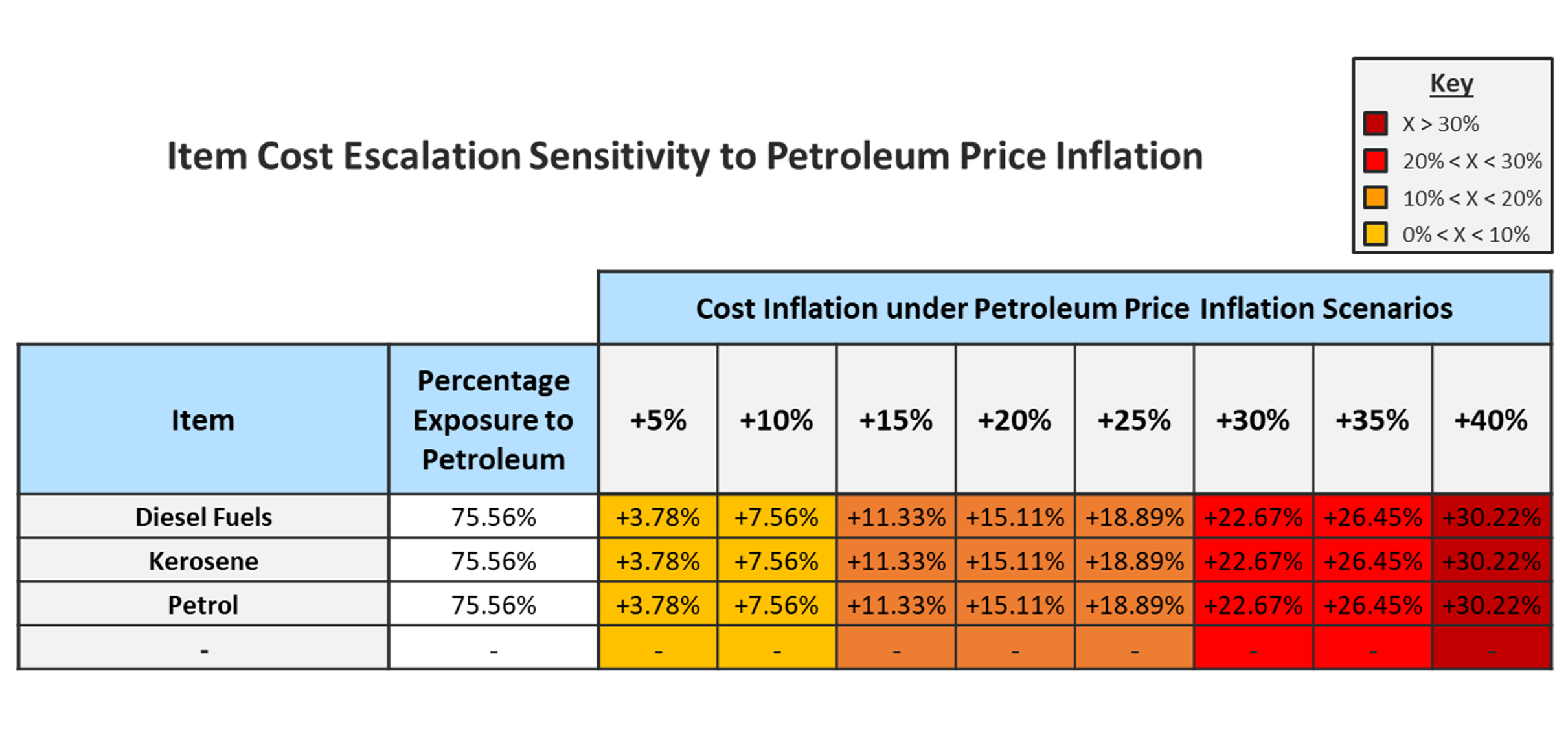

Russia-Ukraine Conflict Cost Risk Analysis Series: Mining in Australia

April 4, 2022 at 9:30 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Mining

The Russia-Ukraine conflict has rattled global commodity markets, sending crude oil prices to their highest level in more than a decade, while prices for natural gas, nickel and aluminum have also spiked. Transport disruptions and the possibility of additional sanctions on Russia have raised the prospect of tighter supplies for various commodities.

Given high oil and gas price volatility and uncertainty going forward, an understanding of the cost exposure to petroleum prices of key equipment and services procured by mining operators is key to strategically managing costs.

The following analysis leverages PowerAdvocate’s proprietary cost models to provide visibility into the exposure of key mining equipment and services to petroleum prices across the following commodities: fuel, miscellaneous; gasoline & diesel; natural gas; and petroleum products.

Wood Mackenzie - Ukraine Conflict Supply Chain Impacts

March 17, 2022 at 11:28 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Mining

The ongoing Russia-Ukraine conflict has provoked new geopolitical tensions, prompted international sanctions, and disrupted global economies. Amidst growing uncertainty to the trajectory and implications of this conflict, energy firm supply chains face new risks that may impact their costs and disrupt their procurement processes. In this whitepaper, we identify and provide commentary on 3 core themes that bare increased risk as a result of this conflict: Commodity Price Inflation, Sanctioned Supplier Exposure, and Exposure to Impacted Vendors.

Key Global Cost Trends in Mining: December 2021 - December 2022 Forecast

February 2, 2022 at 2:55 PM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Mining

2022 presents a challenging cost environment for mining operators as inflation in cost inputs pressures operating margins. Meanwhile, the stakes of effective cost management will be high as operators face complex capital allocation decision-making as they re-position for the Energy Transition.

In our January report, we provide global 12-month forecasts for key mining cost categories, including mining loading and hauling equipment, explosives and maintenance services.

Operators leverage these forecasts to enhance their budgeting accuracy and to drive market-based cost reductions.