Executive Summary

Leading ESG performance through Supply Chain

March 19, 2023 at 8:42 AM / by Wood Mackenzie Supply Chain posted in ESG

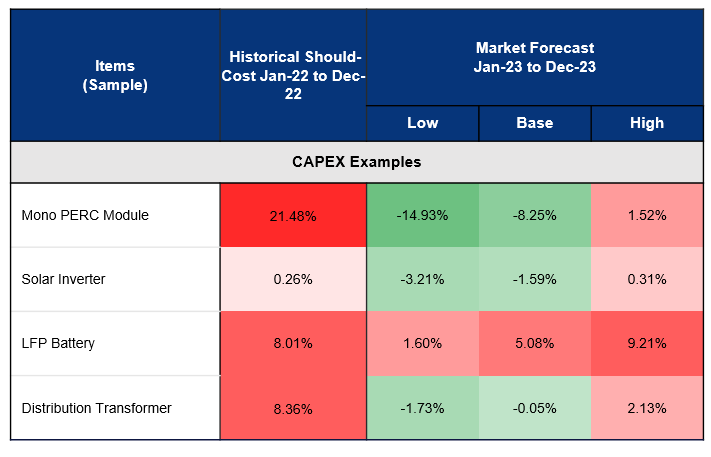

APAC Power & Renewables Cost Inflation Outlook 2023

March 16, 2023 at 2:47 PM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Power & Utilities, Renewables

The power and renewables sector heads into the new year in unchartered waters. Continuous commodity volatility, trade protectionism, and high interest rates will challenge operators in 2023.

In our APAC Power & Renewables Inflation Report, we delve into key themes, such as:

EMEA Mining Cost Inflation Trends YTD 2022

January 2, 2023 at 3:45 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Mining

Geopolitical tensions around Taiwan, the fallout from the war in Ukraine and China’s zero-Covid policy and property sector crisis continue to unsettle commodity markets, testing the resilience of solar, wind, battery storage and utility supply chains.

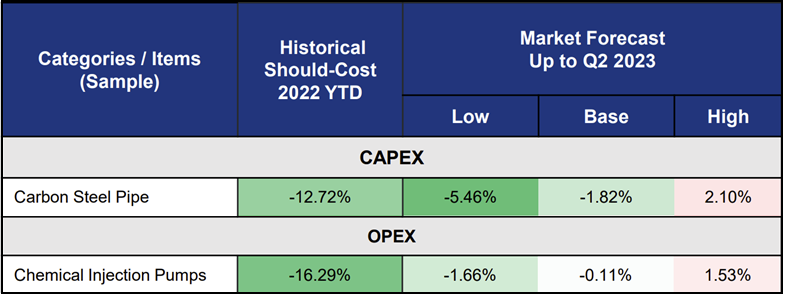

APAC Oil & Gas Downstream Cost Inflation Trends Q3 2022

January 2, 2023 at 3:45 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Oil & Gas

Geopolitical tensions around Taiwan, the fallout from the war in Ukraine and China’s zero-Covid policy and property sector crisis continue to unsettle commodity markets, testing the resilience of solar, wind, battery storage and utility supply chains.

APAC Oil & Gas Upstream Cost Inflation Trends Q3 2022

January 2, 2023 at 3:45 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Oil & Gas

Geopolitical tensions around Taiwan, the fallout from the war in Ukraine and China’s zero-Covid policy and property sector crisis continue to unsettle commodity markets, testing the resilience of solar, wind, battery storage and utility supply chains.

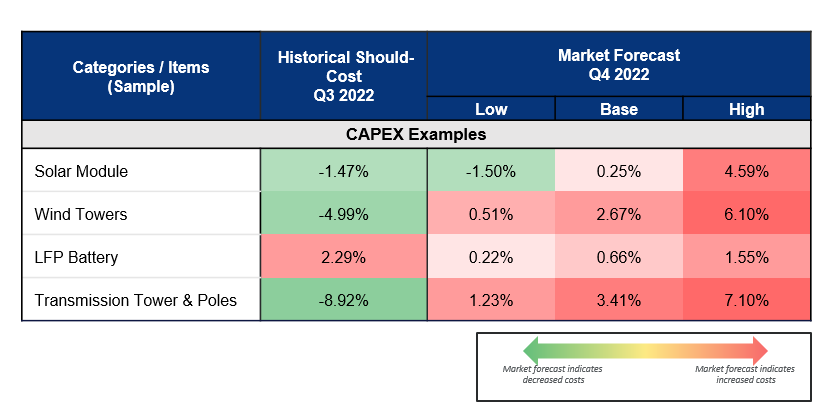

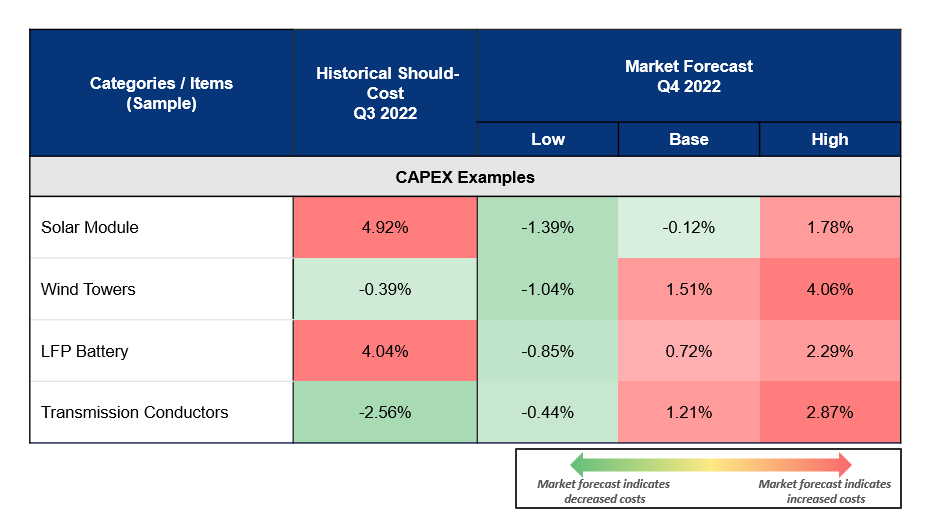

APAC Power & Renewables Cost Inflation Trends Q3 2022

December 13, 2022 at 9:11 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Power & Utilities, Renewables

Geopolitical tensions around Taiwan, the fallout from the war in Ukraine and China’s zero-Covid policy and property sector crisis continue to unsettle commodity markets, testing the resilience of solar, wind, battery storage and utility supply chains.

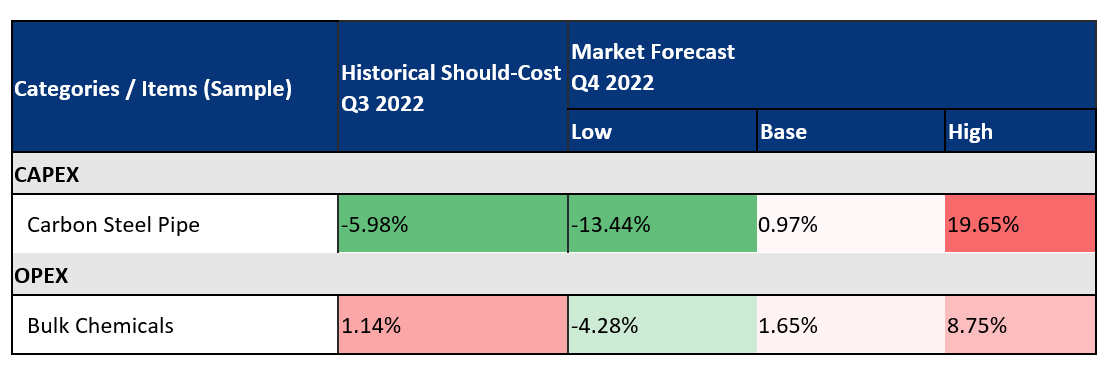

EMEA Oil & Gas Downstream Cost Inflation Trends – Q3 2022

November 11, 2022 at 11:45 AM / by Wood Mackenzie Supply Chain posted in Industry Insights, Oil & Gas

A recessionary outlook for the global economy, sanctions on Russia and the follow-on impacts as the world emerges from the COVID-19 pandemic continue to reverberate through the downstream sector. As policies and economies have adapted to the volatility, there has been an easing in the cost of some items in Q3, the high-case scenario of Wood Mackenzie Supply Chain’s Q3 inflation report indicates that volatility will linger in Q4 across key items, such as carbon steel pipe, rotating equipment, and bulk chemicals.

EMEA Power & Renewables Cost Inflation Trends - Q3 2022

November 11, 2022 at 11:45 AM / by Wood Mackenzie Supply Chain posted in Industry Insights, Power & Utilities, Renewables

A recessionary outlook for the global economy, sanctions on Russia and the follow-on impacts as the world emerges from the COVID-19 pandemic continue to reverberate through the power and renewables sector. Geopolitical fragmentation and trade tensions pose a monumental challenge to solar, wind, battery storage and utility supply chains at a time when energy security and the net-zero transition become more intertwined than ever before.

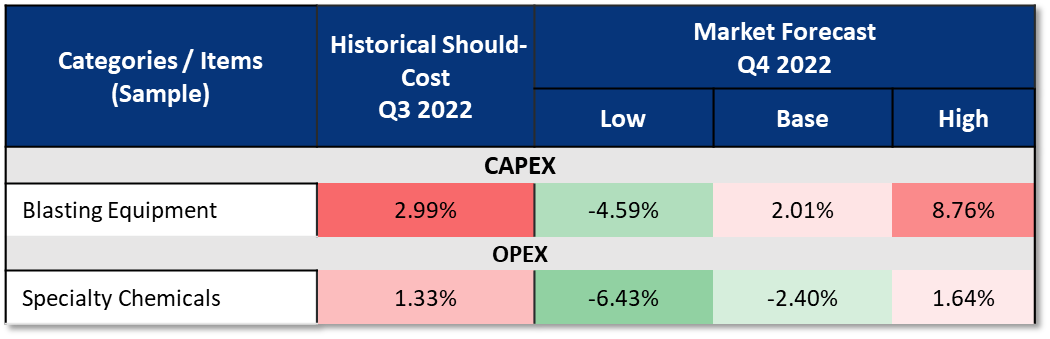

APAC Mining Cost Inflation Trends - Q3 2022

November 11, 2022 at 11:44 AM / by Wood Mackenzie Supply Chain posted in Industry Insights, Mining

A recessionary outlook for the global economy, sanctions on Russia and the follow-on impacts as the world emerges from the COVID-19 pandemic continue to reverberate through the mining industry.

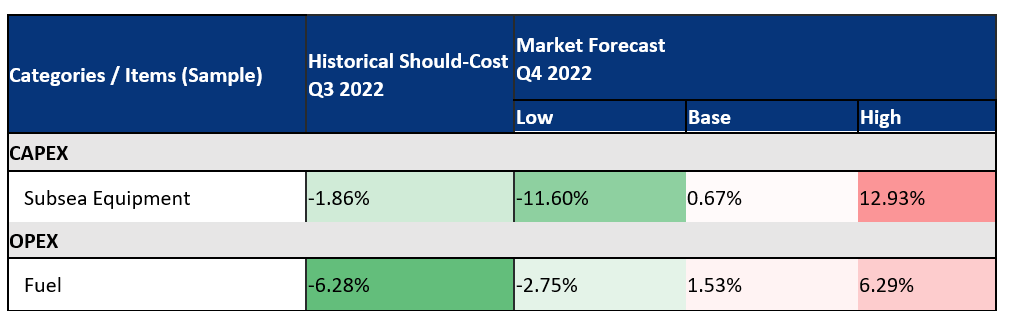

EMEA Oil & Gas Upstream Cost Inflation Trends – Q3 2022

November 11, 2022 at 11:44 AM / by Wood Mackenzie Supply Chain posted in Industry Insights, Oil & Gas

A recessionary outlook for the global economy, sanctions on Russia and the follow-on impacts as the world emerges from the COVID-19 pandemic continue to reverberate through the upstream sector. As policies and economies have adapted to the volatility, there has been an easing in the cost of some items in Q3, the high-case scenario of Wood Mackenzie Supply Chain’s Q3 inflation report indicates that volatility will linger in Q4 across key items, such as subsea equipment, fuels, and offshore maintenance services.