Geopolitical tensions around Taiwan, the fallout from the war in Ukraine and China’s zero-Covid policy and property sector crisis continue to unsettle commodity markets, testing the resilience of solar, wind, battery storage and utility supply chains.

The impact of the Russia-Ukraine conflict continues to cause market volatility. Competition from Russia, undercutting prices by 15-20%, continue to dent trade prospects in Asia and the subsequent EU Russia oil import ban will likely lead to a temporary tightening in the market while Russia crude oil exports find new homes.

Compounding these geopolitical issues further, transport and feedstock demand will remain weak particularly due to ongoing Chinese Covid lockdowns contracting demand.

The resulting energy shock and economic instability have put businesses strategies under the spotlight with particular attention being paid to supply market inflation and supply constraints.

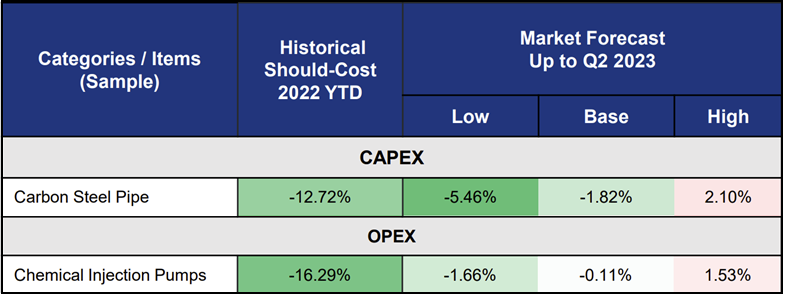

In our Q3 APAC Downstream inflation report, we look ahead to some of the impacts on key CAPEX categories including Carbon Steel Pipes, Control Systems, and Electrical Supplies and OPEX categories including Fuels and Specialty Chemicals.