Current global macroeconomic factors such as trade tensions and energy security due to the war between Russia and Ukraine, the cost-of-living crisis in Europe, and market pressures on commodity prices are affecting how renewable supply chains are operating.

Renewable Energy Series: Optimising Renewables Procurement Performance

September 29, 2022 at 11:46 AM / by Wood Mackenzie Supply Chain posted in Industry Insights, Power & Utilities

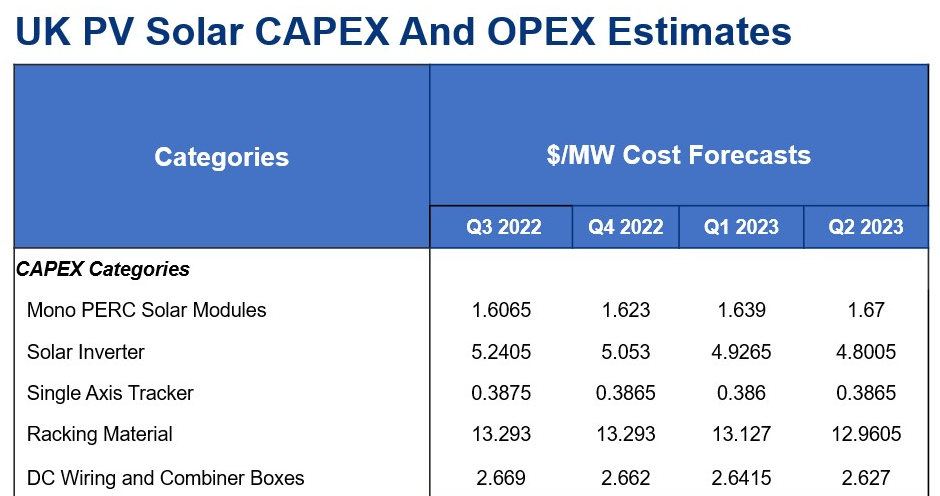

European Solar Market Insights

August 1, 2022 at 12:23 PM / by Wood Mackenzie Supply Chain posted in Industry Insights, Power & Utilities

Amid incessant market volatility, we support solar supply chain decision-making through data-driven CAPEX and OPEX forecasting. This report provides proprietary low, medium, and high forecast scenarios for key categories of solar spend. Our solar forecasts are accompanied by an updated outlook for key commodity indices and freight rates.

PowerAdvocate is integrating with our sister company Wood Mackenzie to become its Supply Chain Cost Management Practice. We leverage proprietary data from our >$6.5T energy spend factbase and 10k+ cost models and benchmarks to provide actionable insights on hundreds of critical spend categories across all verticals within Energy & Natural Resources which aid in supplier negotiations and budget planning.

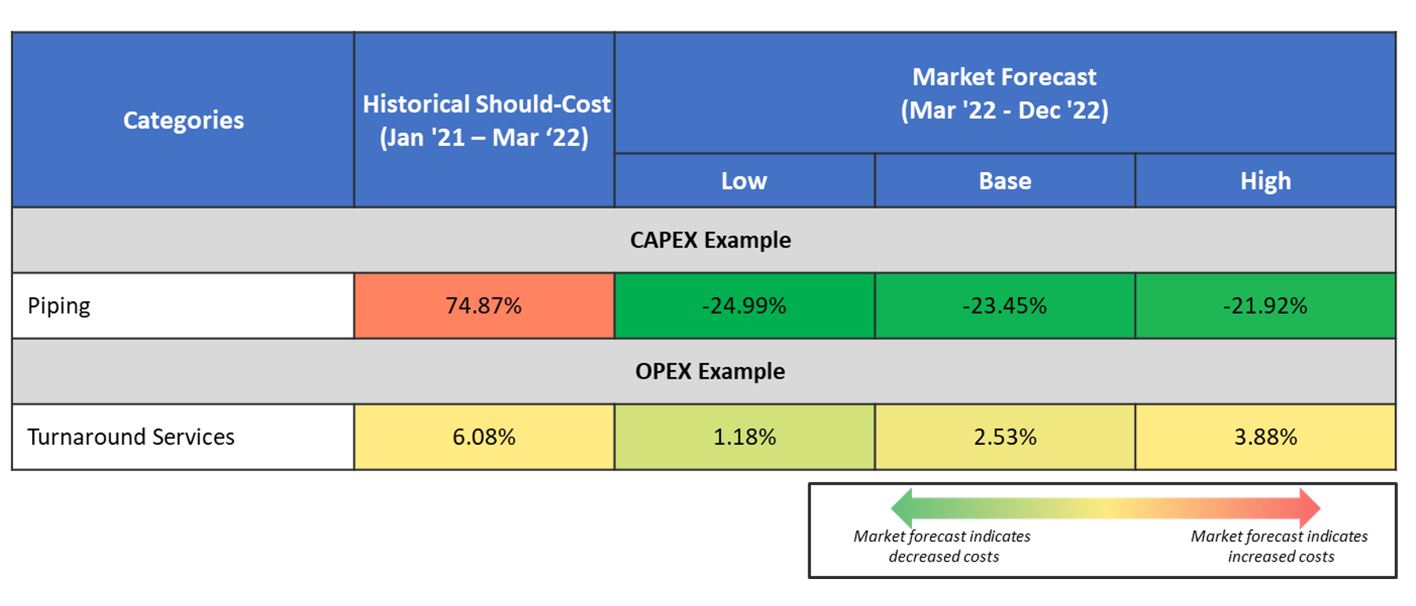

Key Cost Trends in EMEA Downstream: March 2022 - December 2022 Forecast

May 5, 2022 at 11:22 AM / by Wood Mackenzie Supply Chain posted in Industry Insights, Oil & Gas

As turbulent times continue, mitigating for volatile markets is supported by appropriate CAPEX and OPEX forecasting. This report provides proprietary low, medium and high forecast scenarios for key categories of spend. Energy players are leveraging these forecasts to estimate key cost changes, forecast spend and to optimise costs in 2022.

PowerAdvocate is integrating with our sister company Wood Mackenzie to become its Supply Chain Cost Management Practice. We leverage proprietary data from our >$6.5T energy spend factbase and 10k+ cost models and benchmarks to provide actionable insights on hundreds of critical downstream categories which aid in supplier negotiations and budget planning.

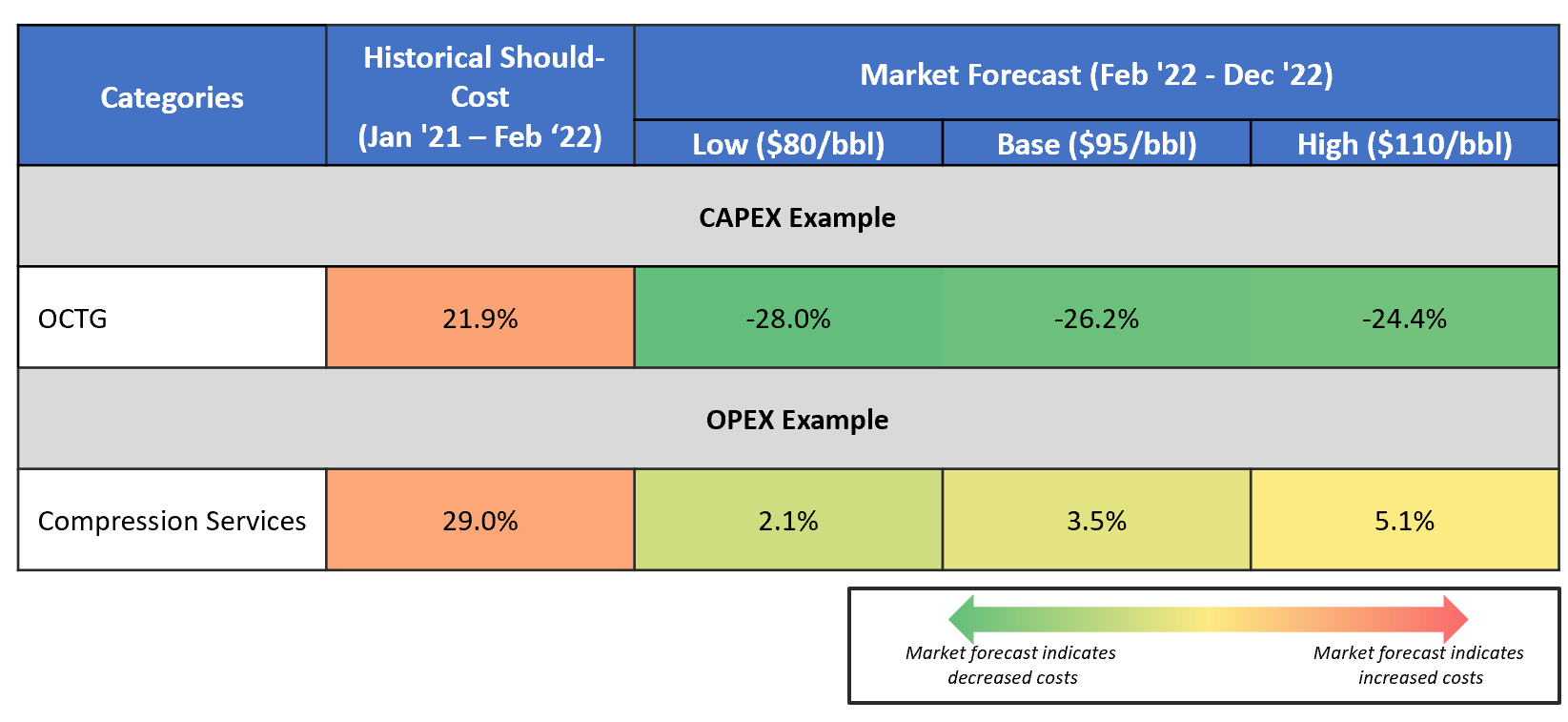

Key Cost Trends in EMEA Upstream: February 2022 - December 2022 Forecast

May 5, 2022 at 11:14 AM / by Wood Mackenzie Supply Chain posted in Industry Insights, Oil & Gas

As turbulent times continue, mitigating for volatile markets is supported by appropriate CAPEX and OPEX forecasting.

This report provides proprietary, low, medium and high forecast scenarios for key commodities across CapEx and OpEx categories. Energy players are leveraging these forecasts to estimate key cost changes, forecast spend, and use industry data to optimise costs in 2022.

PowerAdvocate is integrating with our sister company Wood Mackenzie to become its Supply Chain Cost Management Practice. We leverages proprietary data from our >$6.5T energy spend factbase and 10k+ cost models and benchmarks to provide actionable insights on hundreds of critical upstream categories which aid in supplier negotiations and budget planning.

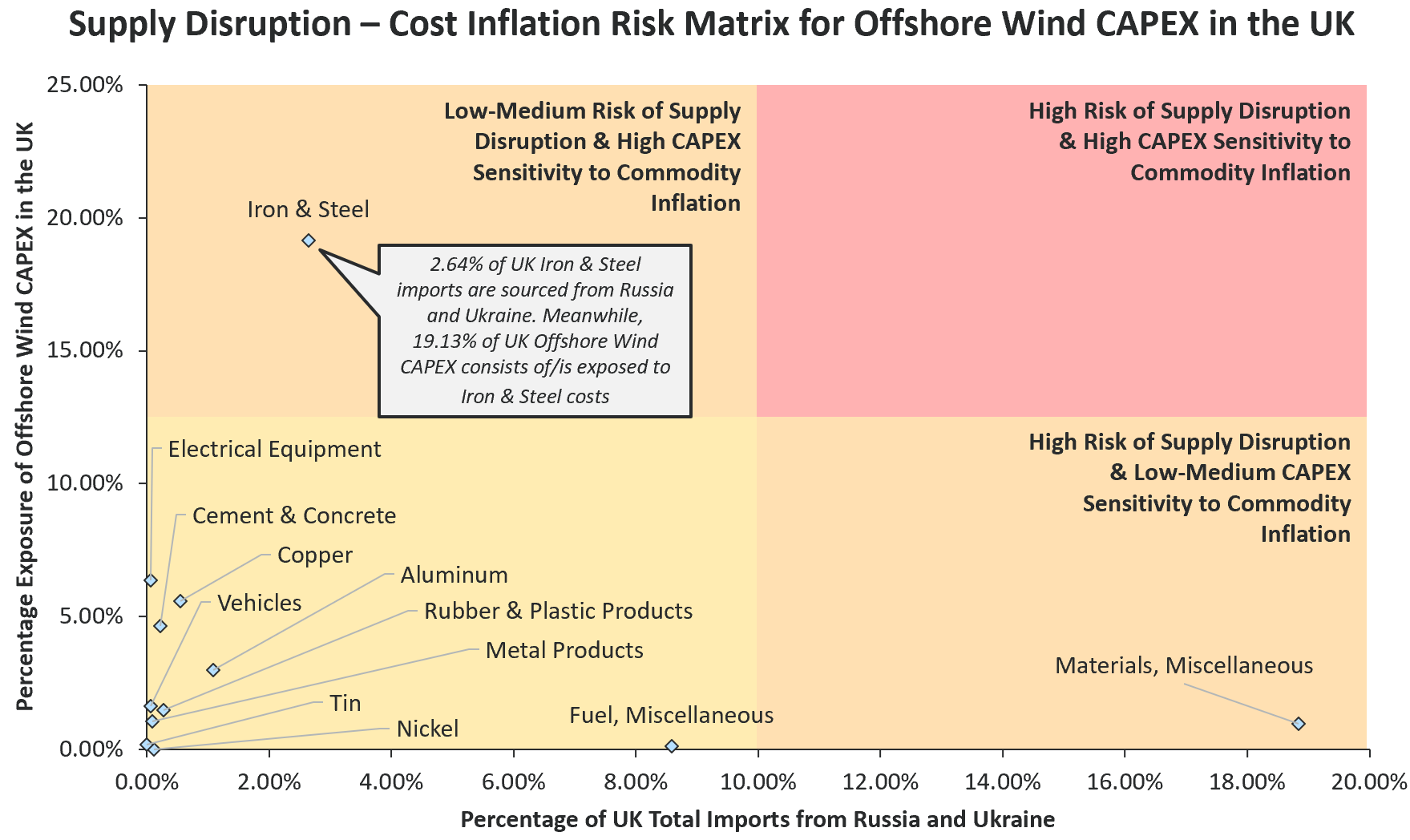

Russia-Ukraine Conflict Cost Risk Analysis Series: Offshore Wind CAPEX in the UK

April 11, 2022 at 10:00 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Mining

The Russia-Ukraine conflict has rattled global commodity markets, sending crude oil prices to their highest level in more than a decade, while prices for natural gas, nickel and aluminium have also spiked. Transport disruptions and the possibility of additional sanctions on Russia have raised the prospect of tighter supplies for various commodities.

In our Russia-Ukraine Conflict Cost Risk Analysis Series, we focus on key commodities assessing: 1. the risk of supply disruption as conflict interrupts the normal flow of trade exports from Russia and Ukraine; and 2. the cost inflation impact of such disruption on high spend and critical items within the Energy & Natural Resources industry.

This report in particular examines the risks for Offshore Wind CAPEX in the UK.

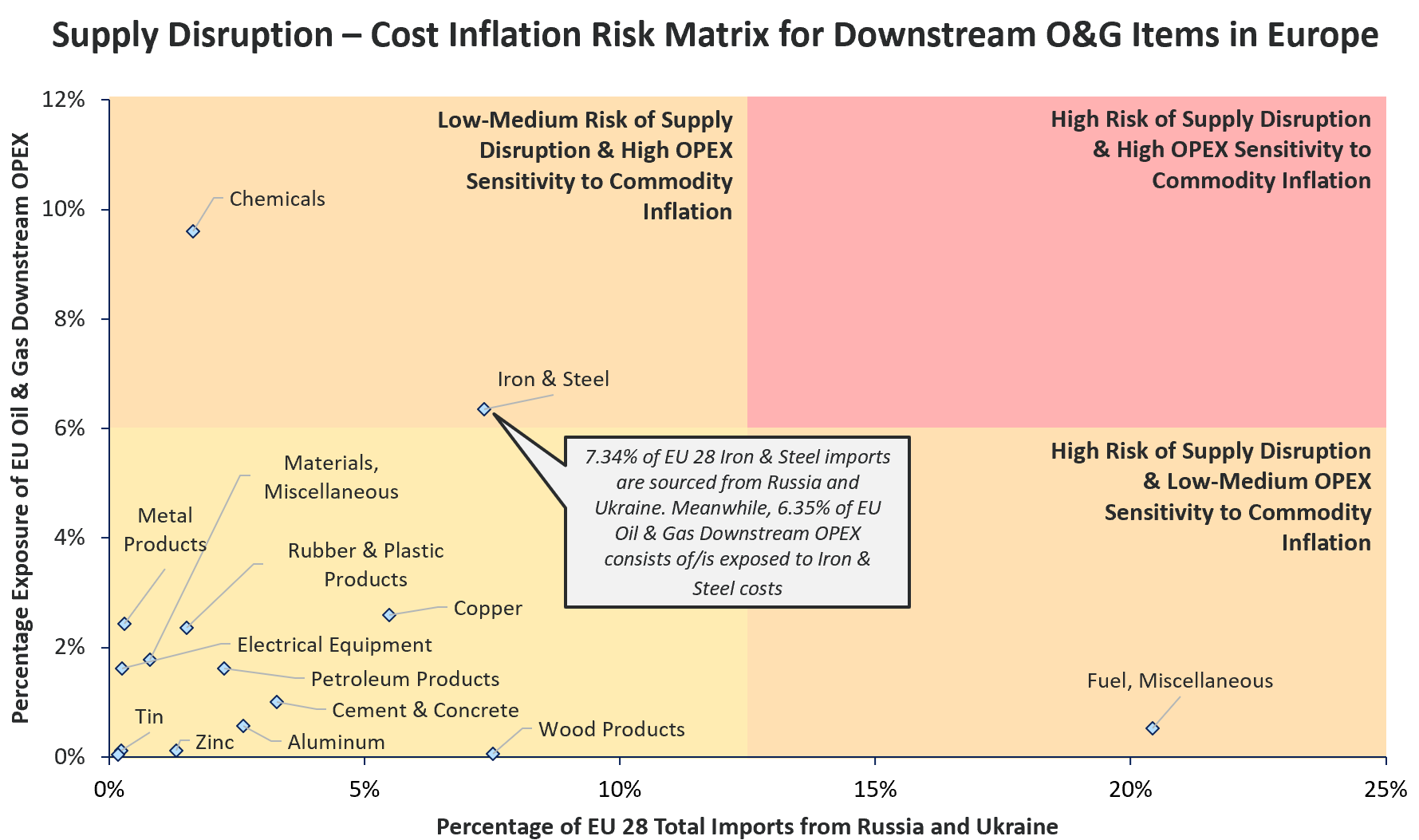

Russia-Ukraine Conflict Cost Risk Analysis Series: O&G Downstream OPEX in Europe

April 8, 2022 at 10:00 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Mining

The Russia-Ukraine conflict has rattled global commodity markets, sending crude oil prices to their highest level in more than a decade, while prices for natural gas, nickel and aluminium have also spiked. Transport disruptions and the possibility of additional sanctions on Russia have raised the prospect of tighter supplies for various commodities.

In our Russia-Ukraine Conflict Cost Risk Analysis Series, we focus on key commodities assessing: 1. the risk of supply disruption as conflict interrupts the normal flow of trade exports from Russia and Ukraine; and 2. the cost inflation impact of such disruption on high spend and critical items within the Energy & Natural Resources industry.

This report in particular examines the risks for O&G Downstream OPEX in Europe.

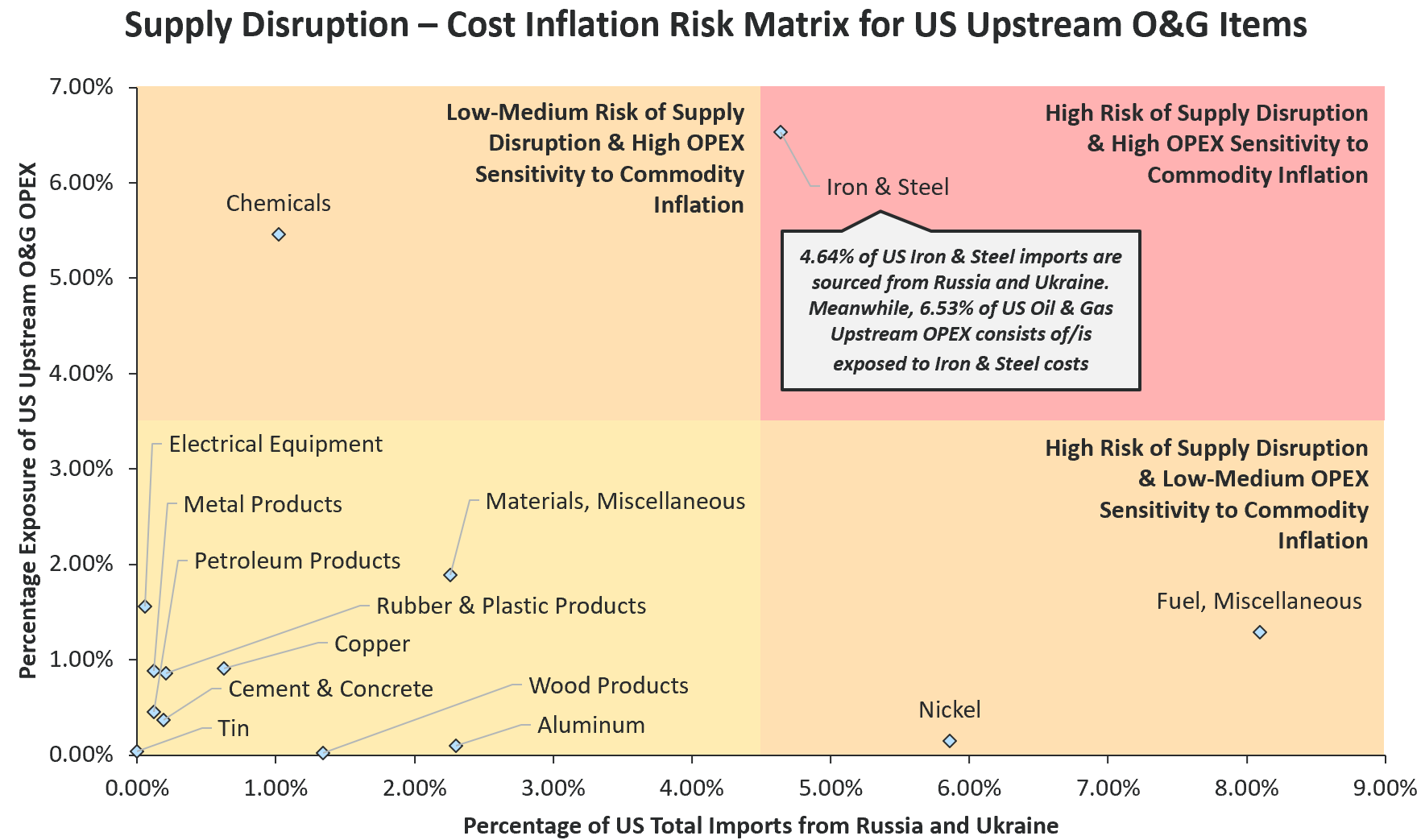

Russia-Ukraine Conflict Cost Risk Analysis Series: O&G Upstream OPEX in the US

April 7, 2022 at 10:00 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Mining

The Russia-Ukraine conflict has rattled global commodity markets, sending crude oil prices to their highest level in more than a decade, while prices for natural gas, nickel and aluminium have also spiked. Transport disruptions and the possibility of additional sanctions on Russia have raised the prospect of tighter supplies for various commodities.

In our Russia-Ukraine Conflict Cost Risk Analysis Series, we focus on key commodities assessing: 1. the risk of supply disruption as conflict interrupts the normal flow of trade exports from Russia and Ukraine; and 2. the cost inflation impact of such disruption on high spend and critical items within the Energy & Natural Resources industry.

This report in particular examines the risks for O&G Upstream OPEX in the US.

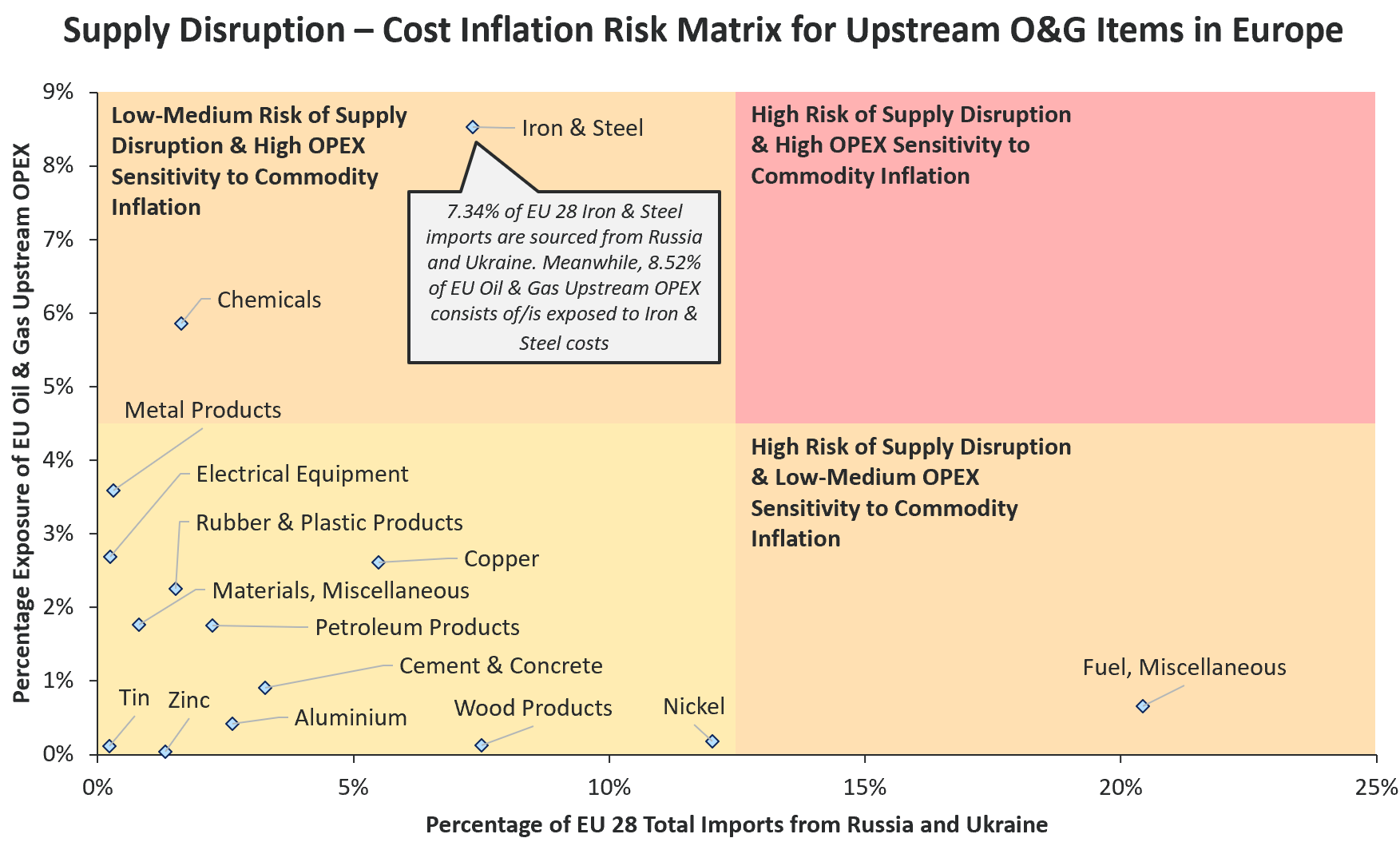

Russia-Ukraine Conflict Cost Risk Analysis Series: O&G Upstream OPEX in Europe

April 6, 2022 at 9:50 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Mining

The Russia-Ukraine conflict has rattled global commodity markets, sending crude oil prices to their highest level in more than a decade, while prices for natural gas, nickel and aluminium have also spiked. Transport disruptions and the possibility of additional sanctions on Russia have raised the prospect of tighter supplies for various commodities.

In our Russia-Ukraine Conflict Cost Risk Analysis Series, we focus on key commodities assessing: 1. the risk of supply disruption as conflict interrupts the normal flow of trade exports from Russia and Ukraine; and 2. the cost inflation impact of such disruption on high spend and critical items within the Energy & Natural Resources industry.

This report in particular examines the risks for O&G Upstream OPEX in Europe.

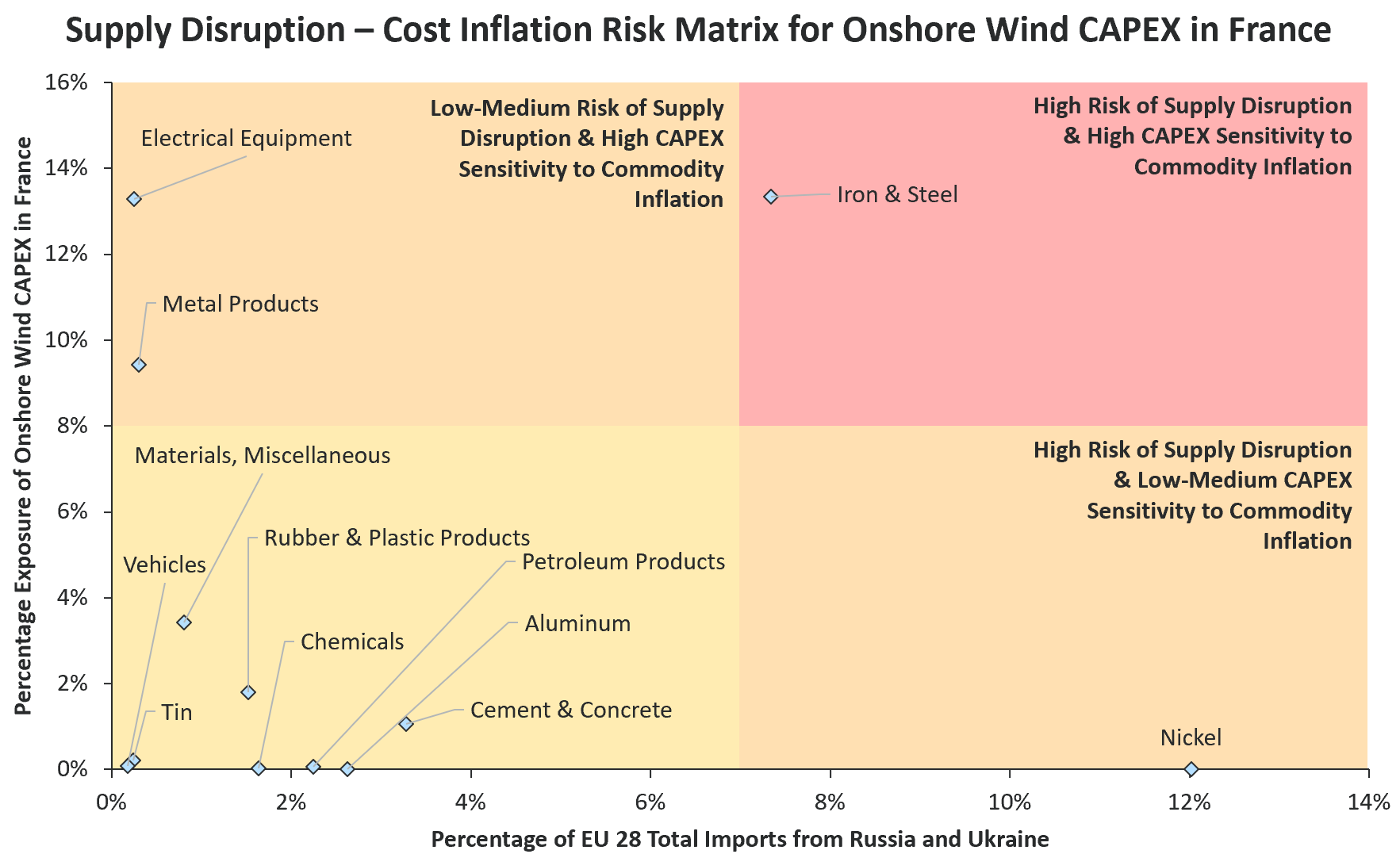

Russia-Ukraine Conflict Cost Risk Analysis Series: Onshore Wind CAPEX in France

April 5, 2022 at 9:40 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Mining

The Russia-Ukraine conflict has rattled global commodity markets, sending crude oil prices to their highest level in more than a decade, while prices for natural gas, nickel and aluminium have also spiked. Transport disruptions and the possibility of additional sanctions on Russia have raised the prospect of tighter supplies for various commodities.

In our Russia-Ukraine Conflict Cost Risk Analysis Series, we focus on key commodities assessing: 1. the risk of supply disruption as conflict interrupts the normal flow of trade exports from Russia and Ukraine; and 2. the cost inflation impact of such disruption on high spend and critical items within the Energy & Natural Resources industry.

This report in particular examines the risks for Onshore Wind CAPEX in France.

Russia-Ukraine Conflict Cost Risk Analysis Series: Mining in Australia

April 4, 2022 at 9:30 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Mining

The Russia-Ukraine conflict has rattled global commodity markets, sending crude oil prices to their highest level in more than a decade, while prices for natural gas, nickel and aluminum have also spiked. Transport disruptions and the possibility of additional sanctions on Russia have raised the prospect of tighter supplies for various commodities.

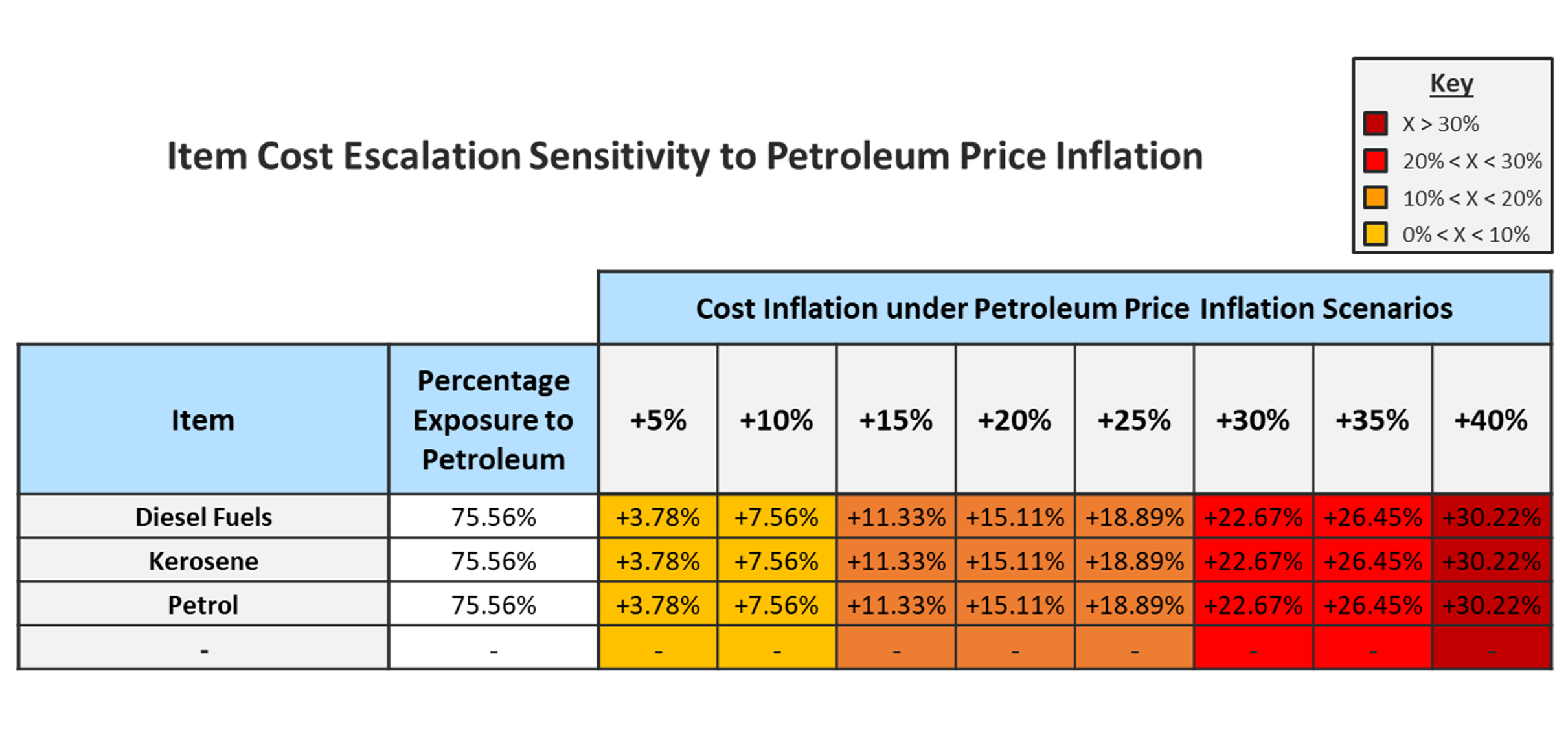

Given high oil and gas price volatility and uncertainty going forward, an understanding of the cost exposure to petroleum prices of key equipment and services procured by mining operators is key to strategically managing costs.

The following analysis leverages PowerAdvocate’s proprietary cost models to provide visibility into the exposure of key mining equipment and services to petroleum prices across the following commodities: fuel, miscellaneous; gasoline & diesel; natural gas; and petroleum products.