Executive Summary

Stakeholders are increasingly setting expectations that energy companies invest time, money and energy into understanding and improving ESG performance. The good news is Supply Chain groups are uniquely positioned to lead and contribute to the organisation’s ESG performance. They have been doing so for quite some time under different names like safety, diverse supplier programs and energy efficiency.

Prioritize ESG domains

Prioritization is a critical step. There are over 20 different topics within ESG. Each of which may or may not be relevant to the nature of the business of an organisation, supplier or category. To focus efforts and to align on a common definition of what is important, organisations need to perform a materiality assessment of each ESG domain to prioritize efforts.

How supply chain can prioritize ESG domains:

• Check in with your sustainability team and your company’s sustainability report. They typically contain a subset of ESG domains most relevant to your organisation

• Identify performance metrics tied to executives’ incentives. This is typically a strong indicator for what the organisation considers a priority and where you can expect the most executive support

• Speak to portfolio leads and portfolio business partners to determine what priorities they have today and want to work towards in the future

• Speak to top-tier suppliers to determine what they have prioritized in their own organisation and where they want to partner.

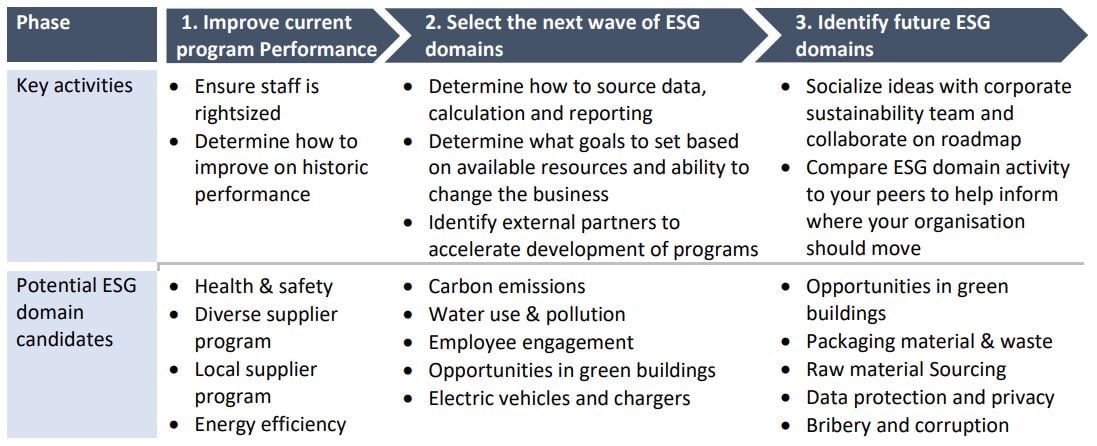

Develop an ESG roadmap

Tackling all ESG domains at once would prove nearly impossible. The good news is many supply chain groups have already started their ESG journey through rigorous safety and diverse supplier programs. Both of these sit neatly under the social pillar of ESG. As a result, teams should take a phased approach when establishing an ESG roadmap that builds on past activities, determines what programs to tackle next and sets a course for what is possible in the future.

Drive ESG performance

Dedicated staff

Investing in a dedicated team is a signal that you are taking a topic seriously. Historically, it has been pretty common for supply chain to have dedicated staff for diverse and local supplier programs. With the emergence of ESG, now is the time to determine the right size of a team to drive all relevant ESG topics through all supply chain processes. Team size, mandate and executive sponsorship will all play a role in the amount of influence teams will have to drive positive change.

Supply chain processes

To support ESG ambitions, supply chain must make concrete modifications to their processes if they expect teams to improve ESG performance. These changes should facilitate communication of priorities to all stakeholders and enable teams to capitalize on opportunities to improve ESG performance:

• Contracts – describe expectations for the existence of any programs, KPIs that are tied to compensation and the targets that suppliers must reach

• Request for quotation – incorporate language that states ESG goals and ambitions so suppliers understand how seriously the organisation takes ESG domains. Ask specific ESG questions that allow evaluation teams to score each supplier on their ESG readiness and willingness to partner on improvement initiatives

• Evaluation scorecards – decide what percentage should be allocated for ESG and all of the subcomponents of ESG. Connect the ESG-related questions to specific ESG evaluation criteria to facilitate supplier scoring

• KPIs – create a library of ESG-specific KPIs with explicit language that defines required data, sources and calculation methodology. Teams also need to decide if and how they will tie ESG KPIs to supplier revenues

• QBRs & operation meetings – update all meeting agendas to include topics tied to ESG to facilitate the understanding of past and current performance and to allow room to innovate on ideas that will drive improved ESG performance

• Sustainability questionnaire – distribute regular supplier questionnaires that determine supplier readiness to engage on ESG topics. These might be hard to conduct and achieve robust participation but using an electronic platform where top suppliers are already registered could help. Additionally, the data collected in these questionnaires should be used to help ESG teams determine what is possible across the supply base and which suppliers make the most sense to partner with to improve ESG performance.

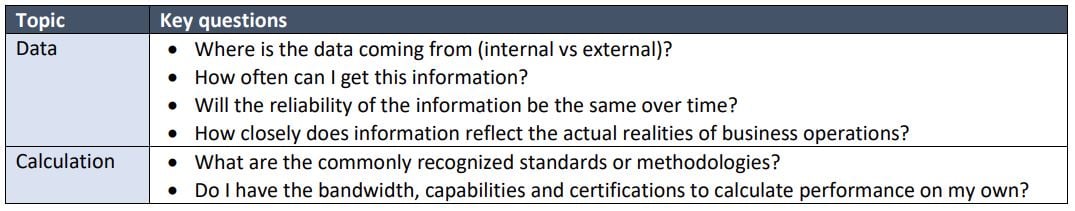

Measuring and reporting

Teams need to understand current performance to unlock opportunities for improvement. Regular reporting enables teams to provide a baseline to determine if ongoing efforts are significantly improving performance. Providing reliable and repeatable reporting for ESG domains requires teams to answer the following data and calculation questions:

Once reporting is established, teams need to decide how to distribute results both internally and externally. Internally, the right stakeholders need to be aware of performance so they understand what it will take to improve. Externally, public sustainability reports can signal to the market that your organisation is taking each relevant ESG domain seriously. Teams can also look for ways to tie the results of these reports to internal and external incentives that reinforce desired behaviours and the right allocation of funding.

Setting targets

If teams are comfortable that reports adequately reflect the realities of business performance, they should consider setting attainable performance targets for supply chain and business partners to strive towards. Target setting should be based on at least three things:

• historical performance

• what others in the industry have been able to achieve (such as benchmarking)

• how rapidly the organisation plans to improve ESG performance

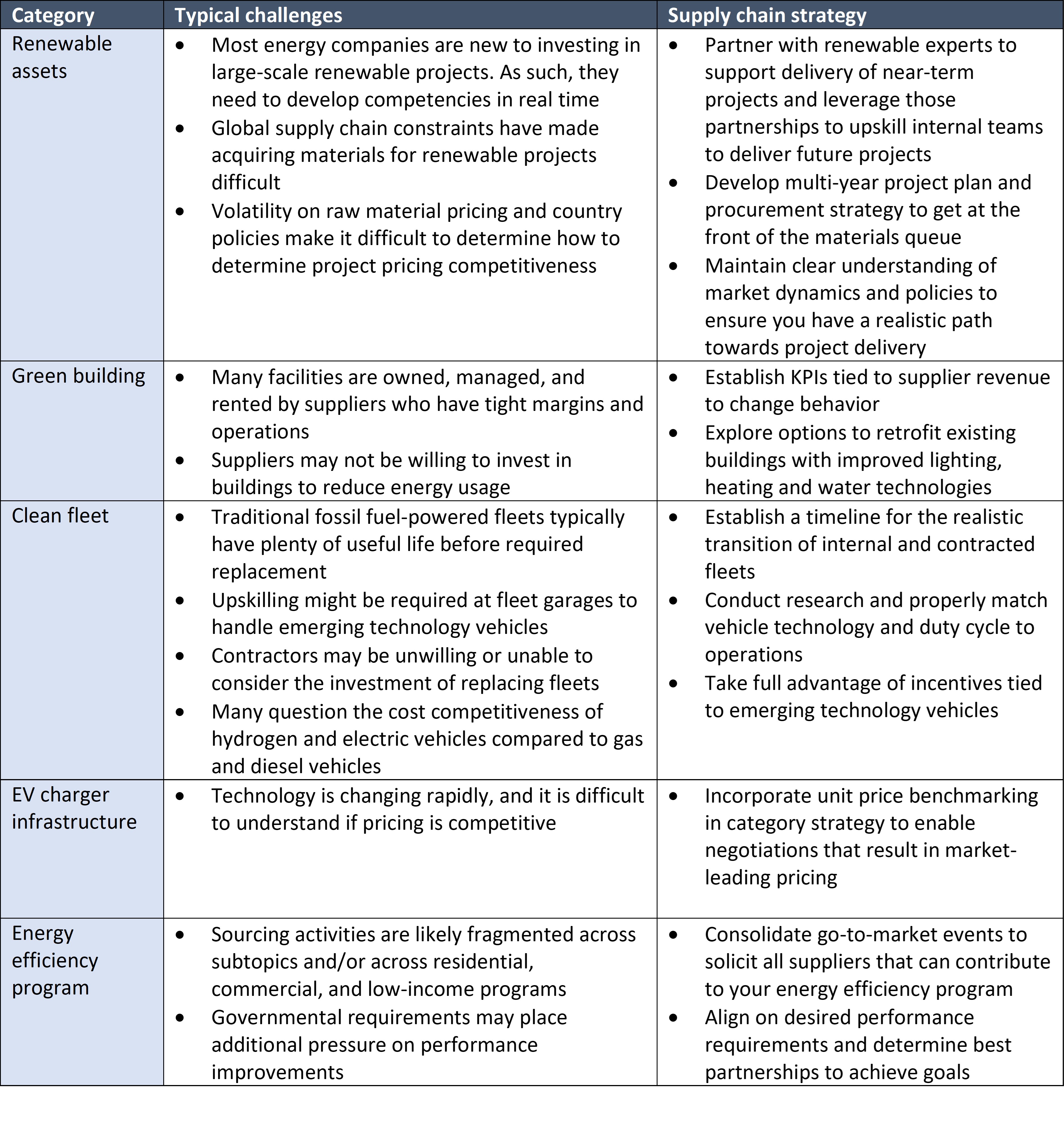

Develop category strategies

There are several ESG domains – such as green buildings, electric vehicles and energy efficiency programs – that sit squarely in a particular ESG domain because they are typically outsourced to a vendor. This is where supply chain can leverage its core competency of creating robust category management strategies to improve value derived from the category. By establishing strategies that manage costs and extracting more from supplier partnerships, business partners will be more successful.

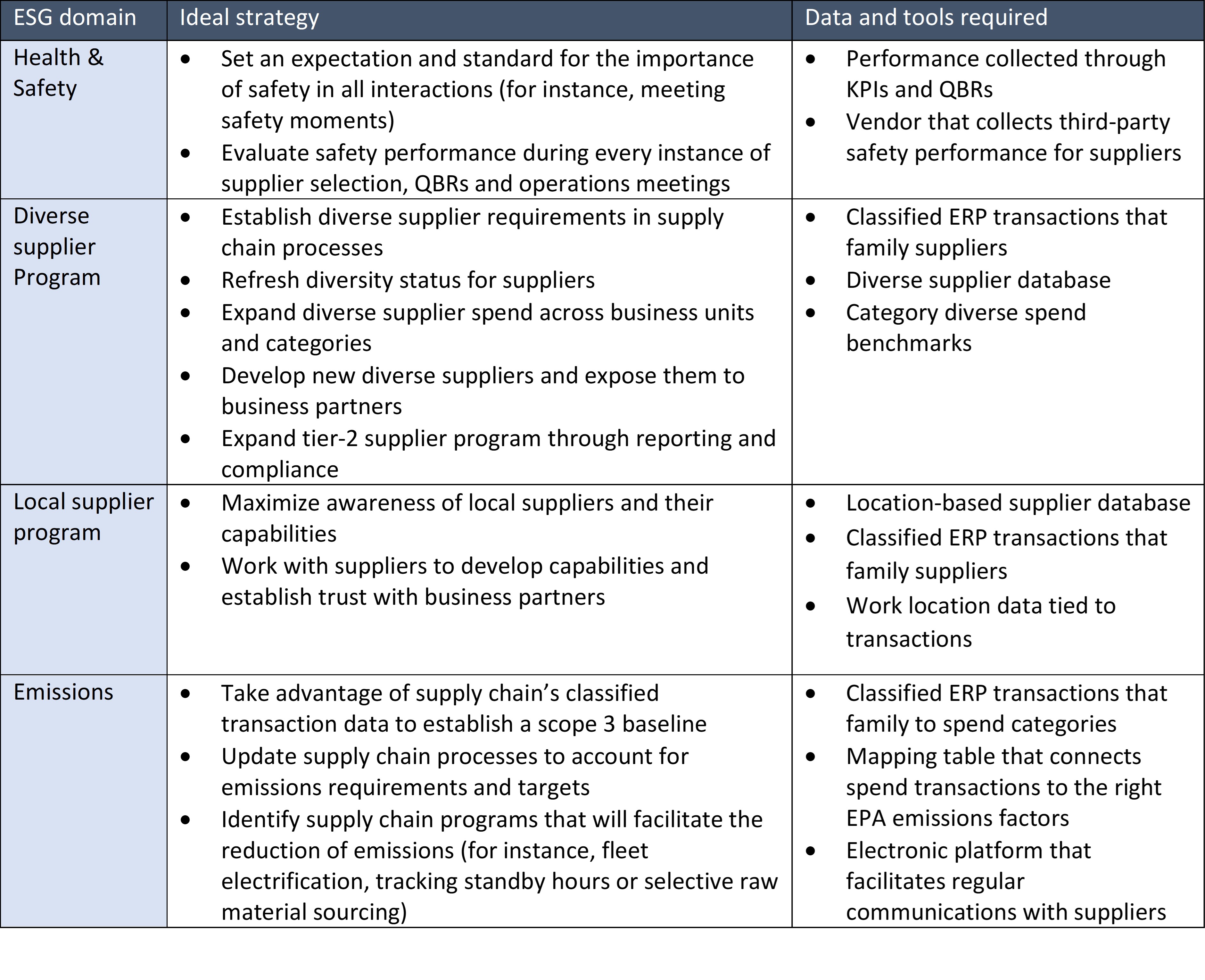

ESG domain-specific strategies

Supply chain has varying levels of experience working with each ESG domain. So it’s important to align on where to start and how to achieve more within each particular domain. The below assumes an average level of maturity across supply chains so ESG teams can make plans to evolve ESG practices.