Geopolitical tensions around Taiwan, the fallout from the war in Ukraine and China’s zero-Covid policy and property sector crisis continue to unsettle commodity markets, testing the resilience of solar, wind, battery storage and utility supply chains.

With market volatility continuing to impact the upstream industry, geopolitical factors such as the Russian blockade of the Black Sea and Chinese lockdowns have fuelled uncertainty.

The resulting energy shock and economic instability have put businesses strategies under the spotlight with particular attention being paid to supply market inflation and supply constraints.

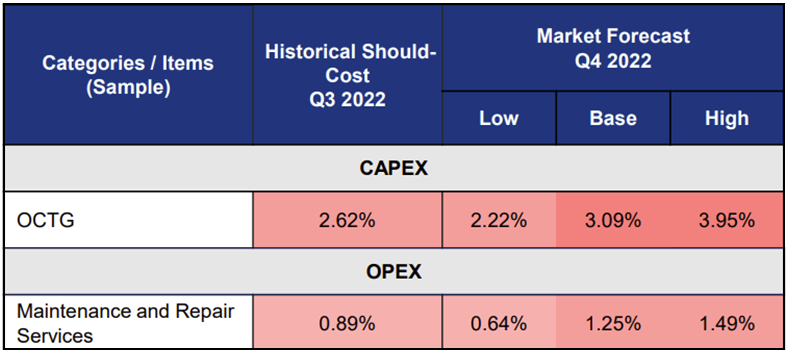

In Q3 this year, as policies and economies adapted to volatility, we saw an easing in the cost of some items and services. Global offshore rig utilisation rates were expected to reach 80% in 2022 due to pent-up demand and tight global supply caused by limited new build orders and the high cost to reactivate cold stacked rigs. However, our high-case scenario outlines the volatility that remains.

In our Q3 APAC Upstream inflation report, we look ahead to some of the impacts on key CAPEX categories including OCTG, Valves, and Drilling Fluids and Chemicals and OPEX categories including Fuels and Specialty Chemicals.