Platinum, a key input to critical refining catalysts, has already faced steep multi-year price declines and has recently hit a long-term low. However, recent hints at a price rebound point to substantial possible cost risks for downstream firms.

Potential Tariffs on European Automakers Create Savings Opportunity in Refining Catalysts

July 17, 2018 at 11:56 AM / by Wood Mackenzie Supply Chain posted in Industry Insights, Oil & Gas

What New Chinese Oil Futures Mean for Oil & Gas Supply Chains

May 18, 2018 at 4:35 PM / by Wood Mackenzie Supply Chain posted in Oil & Gas

Summary: What Happened?

In late March China launched its first oil futures contract that may fully appeal to non-Chinese risk managers. Since oil field service (OFS) providers and other companies often peg contract pricing to oil benchmarks such as WTI and Brent, this introduces a new option for contracts. However, O&G supply chain teams should beware the new option: rather than entertaining the new Chinese oil futures, teams should consider less risky and more established alternatives to mitigate risk and avoid unnecessary costs.

Why Have I Not Heard of Chinese Futures Before Now?

Despite surging activity on China’s three main commodity exchanges (the Dalian Commodity Exchange, the Shanghai Futures Exchange, and the Zhengzhou Commodity Exchange), until recently, several factors have precluded Chinese commodity futures markets from emerging as commonly referenced international price benchmarks:

- Lack of cross border access: Foreigners have seldom been permitted to access and utilize Chinese commodity futures. Only a limited number of Chinese state-controlled enterprises have been granted licenses by the Chinese government to transact in commodity derivatives outside China.

- Non-convertibility of the RMB: The Chinese government limits the convertibility of its currency, the RMB. This can make exchange rate transactions costlier to execute than those with other currencies. Market participants have expressed concerns that profits earned on Chinese commodity futures contracts may potentially be difficult to move out of China.

Both factors have contributed to large divergences between Chinese and foreign benchmark pricing across many commodities. These divergences make Chinese contracts unsuitable to hedge commodity exposure incurred outside of China and arguably make Chinese commodity derivative prices less reflective of global market conditions than their foreign equivalents. Traders and supply chain managers have thus been reluctant to use them.

Solar Tariffs Expected to Impact Costs for Solar Projects: How to Mitigate, Plan, and Prepare

February 26, 2018 at 2:49 PM / by Samantha Walter & Justin Steimle posted in Project Estimation, Cost Reduction, Industry Insights, Power & Utilities

Higher prices are on the horizon for utility-scale solar projects due to tariffs and quotas recently approved by President Trump. This new legislation could seriously impact financial plans for solar projects, but expertise in capital projects, specifically renewable projects, can help utilities, EPCs, and developers mitigate these costs and prepare for future changes.

Why are the rules changing?

In September, the International Trade Commission (ITC) determined that U.S. solar manufactures experienced significant injury due to imports of crystalline silicon photovoltaic (CSPV) solar cells and modules. This investigation stems from the United States’ Global Safeguard law, where an industry representative may petition the ITC to determine if imports are causing “serious injury” and recommend remedies. The petition was filed by the recently bankrupted Suniva and later joined by SolarWorld.

On January 22, the Trump Administration followed through with the recommendations from the ITC and imposed a four-year solar import tariff that will start at 30 percent in the first year and gradually drop to 15 percent. This tariff will apply to all CSPV solar cells and modules that are imported into the U.S. There is a quota specifically for solar panel cells which excludes the first 2.5 GW of cells imported into the U.S. each year, but the details on how the quota will apply remain undetermined. Like the tariff, the quota will last four years. All countries are included except for Generalized System of Preferences (GSP) beneficiary countries, which account for less than three percent of total imports.

Section 232 Threatens Steel and Aluminum

February 23, 2018 at 4:49 PM / by Wood Mackenzie Supply Chain posted in Industry Insights, Oil & Gas, Power & Utilities

UPDATE: In a surprising move, President Trump announced on March 1 that he intends to impose sweeping 25% tariffs on steel imports and 10% tariffs on aluminum -- the most severe of the potential trade remedies recommended by the Department of Commerce. Details of the plan are still unknown, but the announcement has already driven dramatic steel and aluminum price increases and spooked equipment manufacturers. Register for our March 13 webinar for the latest updates on Section 232.

Read on for our initial analysis of the Department of Commerce's recommendations.

What Utilities Need to Know about Energy Storage Cost Drivers

November 27, 2017 at 4:31 PM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Power & Utilities

More likely than not, your utility is already or soon will be procuring battery energy storage as part of its grid modernization strategy. In fact, according to BCC Research, the global market for grid-scale battery storage technologies is projected to reach nearly $4.0 billion in 2025, up from $716 million in 2015. Battery costs have fallen dramatically over the past decade. However, events in the Democratic Republic of the Congo are putting the brakes on further cost reductions. Here’s a look at what’s happening and how you can approach your battery procurement planning in light of these events.

Navigating Harvey's Aftermath: How Supply Chain Can Manage Market Risks

September 22, 2017 at 4:42 PM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Oil & Gas, Power & Utilities

As the Texas and Louisiana Gulf Coast recovers from Hurricane Harvey, Supply Chain organizations face the challenge of navigating its effects, from chemicals to logistics to labor.

Why Your Utility Should Do Should-cost Analysis

September 21, 2017 at 7:09 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Industry Insights, Power & Utilities

Do you manage a utility supply chain, procurement process, or supplier relationships? Or collaborate with and depend on teams that do? If so you know how heavy a lift it can be to effectively manage asset-intensive energy sector costs. Should-cost analysis helps address two key challenges that get in the way of delivering even more value for your organization.

Will New Sand Mines Crash the Proppant Market?

September 18, 2017 at 6:52 PM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Oil & Gas

Key Takeaways

- Since last fall, a surge in drilling and completions activity in the Permian Basin has led to a dramatic increase in sand demand and, in turn, substantial sand price inflation.

- In response, sand mining companies have begun investing in a slew of new mines in the area.

- While new sand mines will deepen the market’s oversupply, prevailing logistical bottlenecks will likely prevent significant sand price deflation from occurring.

Sand Demand and Sand Price Inflation Since Last Fall

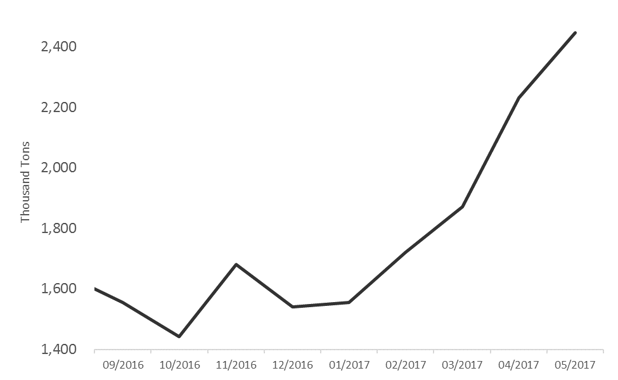

Demand for sand used in oil field operations plummeted after the oil-price crash in mid-2014 and the subsequent sharp drop-off in well completions activity. This trend, however, has recently reversed. Since late 2016, a surge in drilling activity in the Permian, coupled with the activation of drilled-but-uncompleted wells (DUCs), has led to a massive increase in sand demand in the basin (Figure 1). During the first half of 2017, total US sand proppant demand was 63 million tons per year, a 75% increase over 2016 levels.

Figure 1: Permian Basin Sand Demand

Sources: United States Energy Information Administration, Baker Hughes, PowerAdvocate

How Oil Price Spreads Have Changed Refiner Crude Sourcing Strategy

August 4, 2017 at 10:08 AM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Oil & Gas

Over the last five years, the United States has significantly increased its production of oil and natural gas, a phenomenon referred to as the Shale Revolution. US crude oil production has increased substantially, especially in the inland parts of the Gulf Coast and Midwestern states (Figure 1). This shift has impacted the economics of downstream operators; however, the benefits for specific refineries have varied depending on location and refinery crude slate.

[Webinar] Buckeye Partners Presents: Driving Out Cost with Data

July 11, 2017 at 2:00 PM / by Wood Mackenzie Supply Chain posted in Cost Reduction, Oil & Gas

Buckeye Partners presents a webinar in our Q&A with the Experts series.

In this webinar recording, Buckeye Shares:

- How they've used data to achieve >$10M in cost reduction through improved supplier negotiations and bids

- Specific strategies they've used across CapEx and OpEx categories

- How they've prioritized and executed on specific cost reduction opportunities

- And lots more...