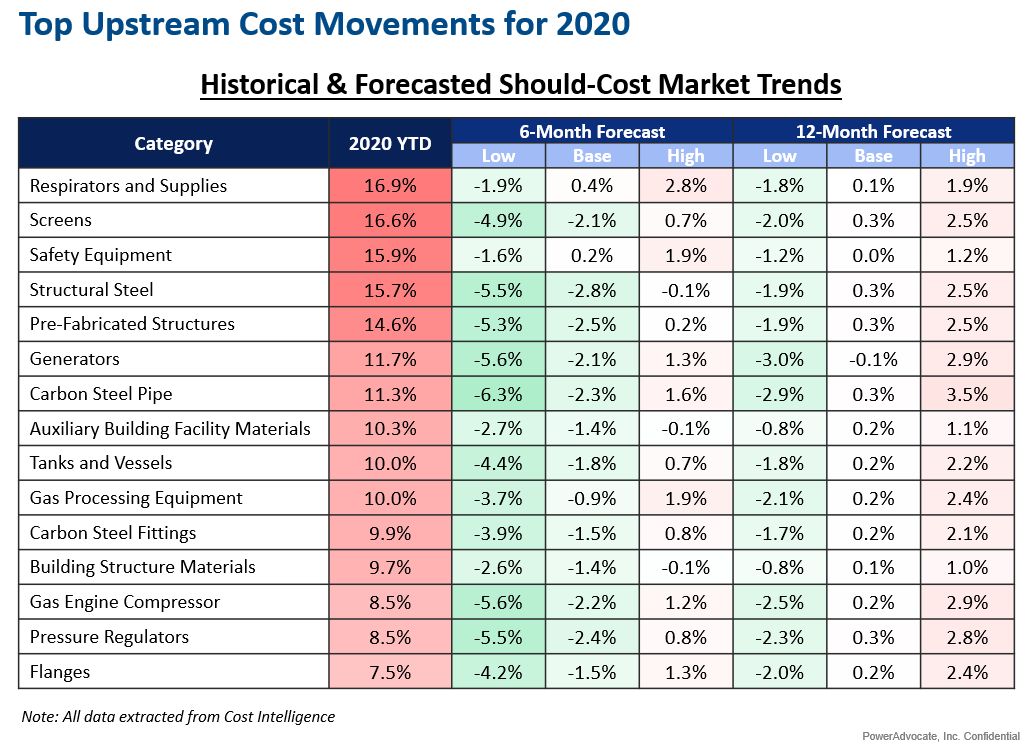

2020 has been a volatile year for upstream supply markets in Europe, and several key cost categories have experienced inflationary pressure. For example, since January,

- Screen costs have increased by 16.6%

- Generator costs have increased by 11.7%

- Carbon Steel Pipe costs have increased by 11.3%

Understanding how key cost markets are trending unlocks value across the entire cost management lifecycle: from identifying market-driven opportunities and risks to support category strategy development, to executing data-driven vendor negotiations, to tying contracts to favorable indices to underpin contract resilience.

Our team recently put together a list of upstream cost categories which experienced the most inflationary pressure during 2020.