- As China’s economic expansion matures and its GDP growth rate slowly declines, global supply chains will shift as they restructure around new economic realities in China

- A major contributing factor to declining GDP growth rates in China is a slowdown in manufacturing, which constitutes nearly 30% of the country’s GDP

- Increasing costs of production, which include rising labor wages, are making manufacturing in China costlier and thereby exports more expensive to global markets

- The current US-China trade war, in which up to $250B of imports from China are subject to tariffs by the current administration, is adding additional pressure to global trade

- It is imperative that Oil & Gas firms leverage better market data to stay abreast of global macroeconomic developments that can potentially impact their supply chains

Seismic Shifts in the Chinese Economy

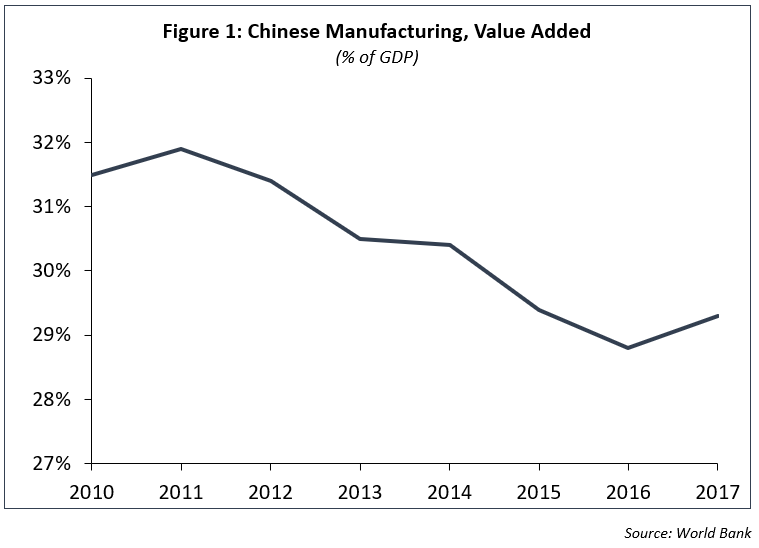

Slowing global demand, the bruising US-China trade war, and rising costs of production have dampened China’s growth outlook. GDP growth has sunk to three-decade lows, with signs of further deceleration in manufacturing activity. As the Chinese economy continues to mature, production costs are expected to rise and trade balances shift. In 2018, the US imposed a series of tariffs on up to $250B of Chinese goods, impacting China’s export-oriented manufacturing sector and contributing to factories cutting production. In fact, the export sector in China dropped by 21% in February and exports to the US shrunk by 14%, largely due to trade issues. This downturn is also reflected by a 3% decline from 2011 to 2016 in Chinese manufacturing output (Figure 1). The manufacturing sector is slowly becoming a smaller percentage of the overall Chinese economy, and this general downward trend is projected to continue.

Current economic factors, both within China and globally, have certainly influenced the downward trend in Chinese manufacturing, however, it is important to note that this began in 2011. What other factors helped drive the downturn?

- The Chinese government has actively pushed to diversify away from manufacturing as the economic centerpiece in an effort to move towards a services-based economy, adding greater protection to the Chinese economy during global downturns or recessions

- Rising costs of production have made Chinese manufacturing costlier and thereby exports more expensive to global markets

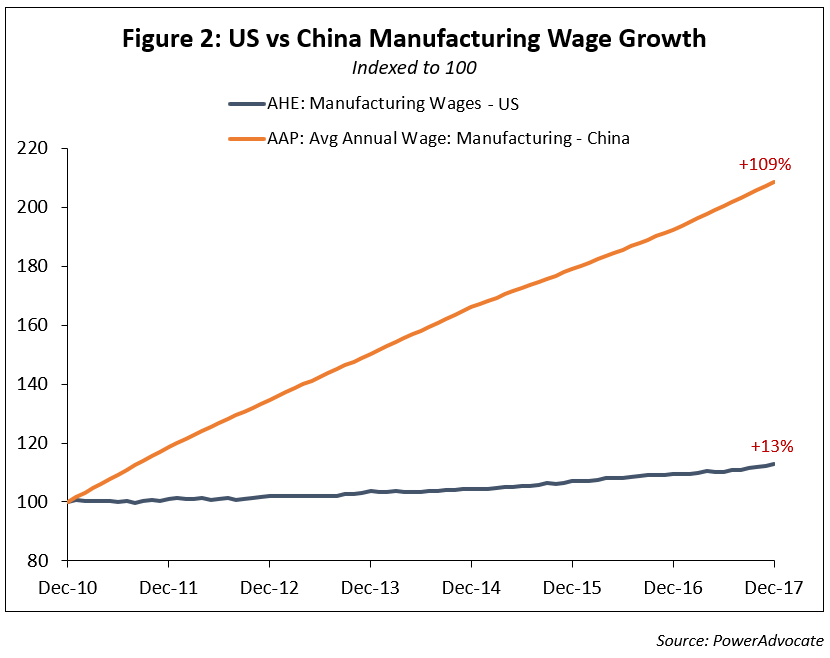

- Manufacturing wages (Figure 2) have escalated more quickly in China than in the US between 2010 and 2017 (109% in China vs 13% in the US) and have escalated 204% over the past decade - however, even with the rapid wage growth in China, raw wages still remain significantly lower than in the US

- In 2018, corporate debt defaults in China rose by over 415% YoY, indicating that Beijing’s aggressive capital expansion initiative is losing steam- these figures paralleled record levels of household debt, damaging consumer spending

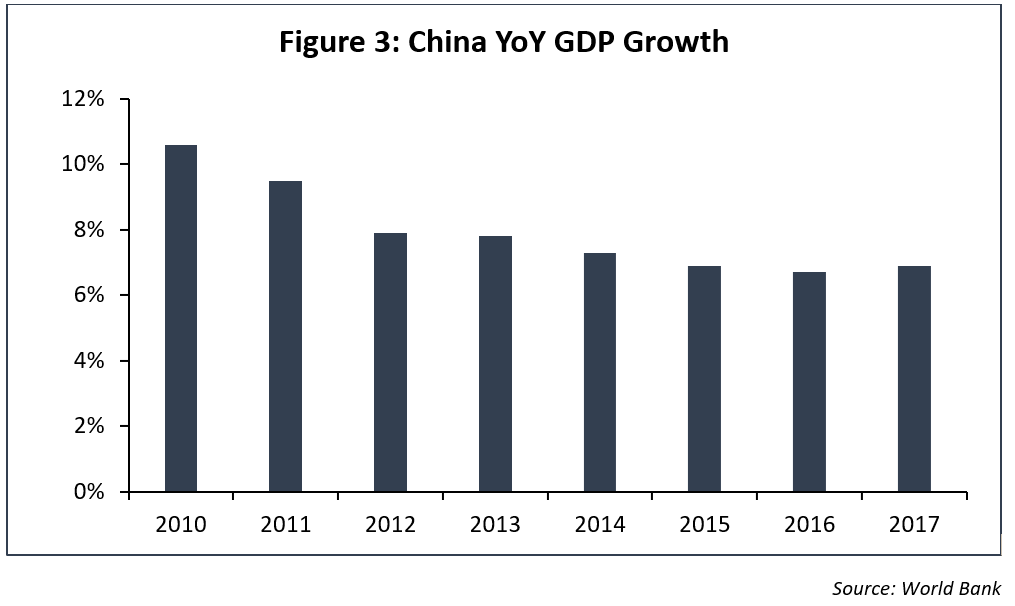

It is evident that the shift away from manufacturing, whether from natural economic pressures or government economic policy, has taken a toll on Chinese GDP growth. The Chinese economy is still dependent on the manufacturing sector, and as a result, YoY GDP growth (Figure 3) fell 6 years in a row and 3.5% overall between 2010 and 2017.

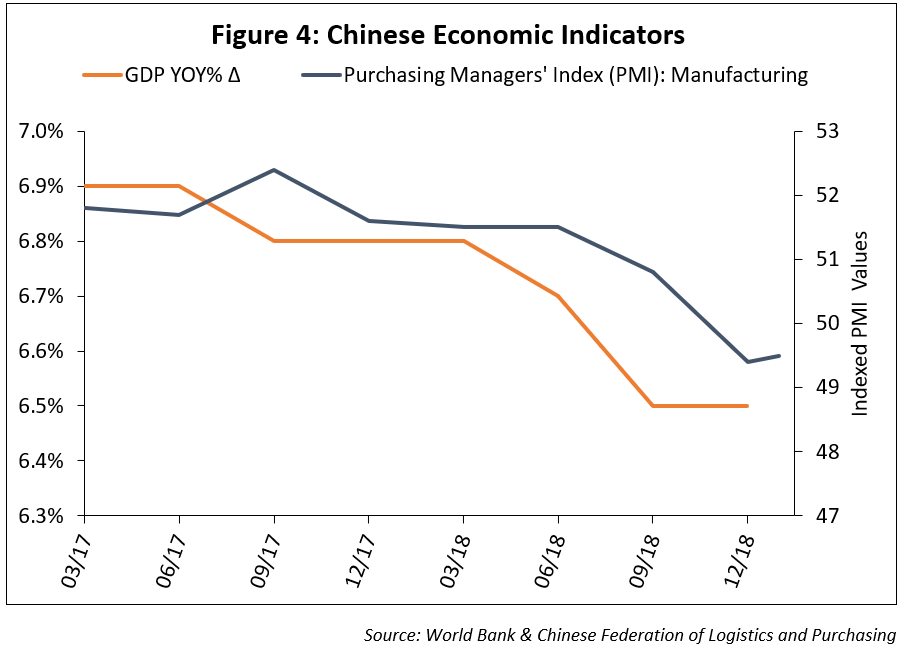

Furthermore, protectionist tariffs have increased pricing pressure on manufacturing. This shift in sentiment is reflected by the purchasing managers’ index (Figure 4).

- The index tallies industry views amongst supply chain procurers across the manufacturing sector and provides valuable insights for forecasting and monitoring industry health

- The sharp drop at the end of 2018 is reflective of mounting economic pressure on Chinese industrial production as a lack in confidence proliferates into 2019

What’s the Impact to Oil & Gas Supply Chains?

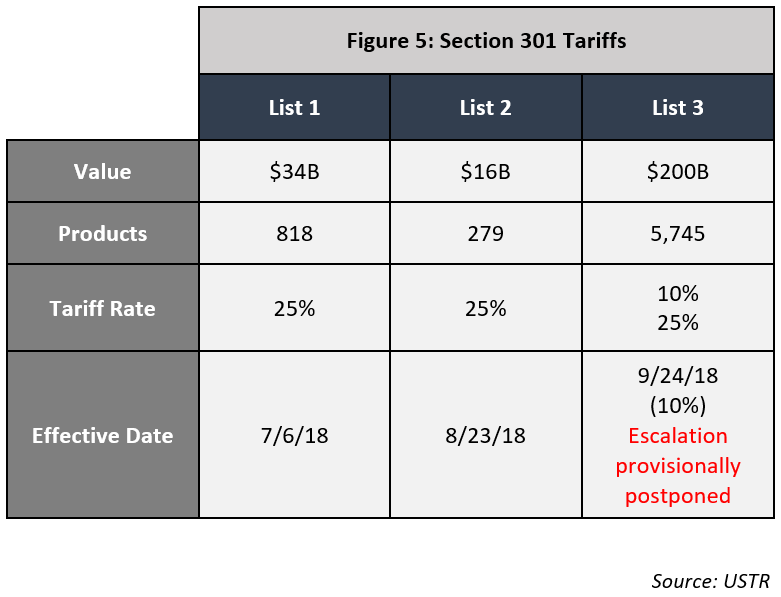

For Oil & Gas firms, tariffs are top of mind, and rightly so. The current trade war between the US and China has begun to shift supply chains and trade balances. Most recently in 2018, the US levied tariffs on nearly $250B of Chinese goods through Section 301, in addition to sweeping 25% tariffs on steel imports and 10% tariffs on aluminum. Subsequent talks between the two countries have primarily revolved around:

- Addressing unfair trade practices by China, including intellectual property theft and forced technology transfer

- Increasing Chinese purchases of U.S. energy products including coal, natural gas, and crude oil

- Establishing policies on a local level to create a more encouraging environment for U.S. businesses operating in China

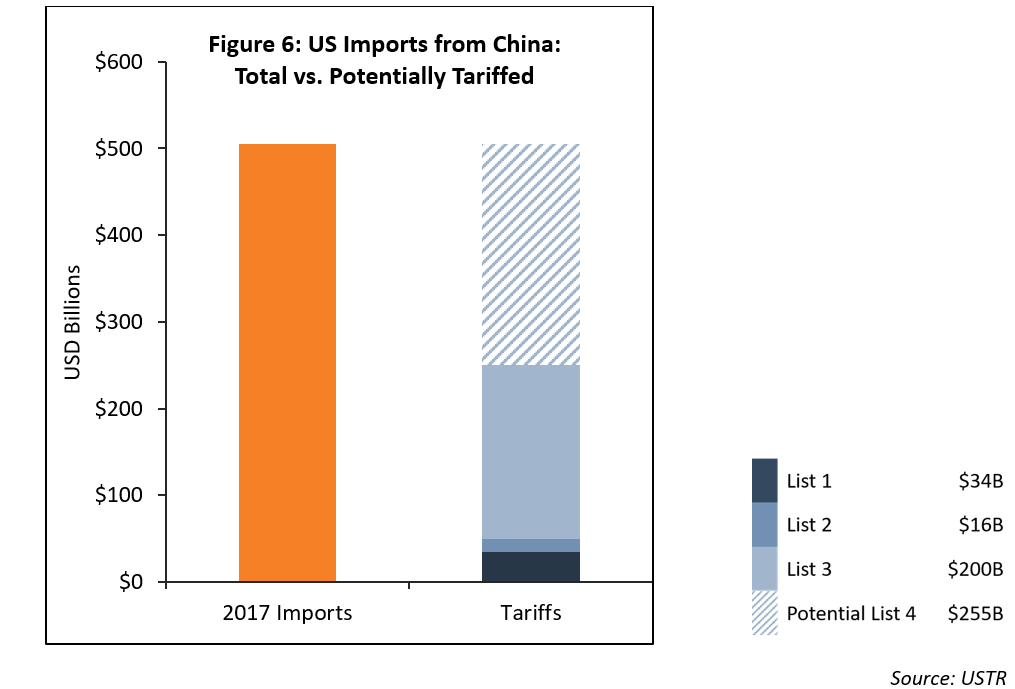

President Trump and the Chinese state-run Xinhua News Agency have announced that recent rounds of trade talks yielded “substantial progress,” and therefore the March 2nd tariff escalations have been postponed. The measure was due to increase duties on $200 billion of Chinese goods covered in Section 301 List 3 from 10% to 25%. Despite this development, there is still another $255 billion worth of goods subject to a potential Section 301 List 4 tariff (Figure 6). Pending final negotiations, plans have been announced for a late-March conclusive summit at Mar-a-Lago between President Trump and President Xi.

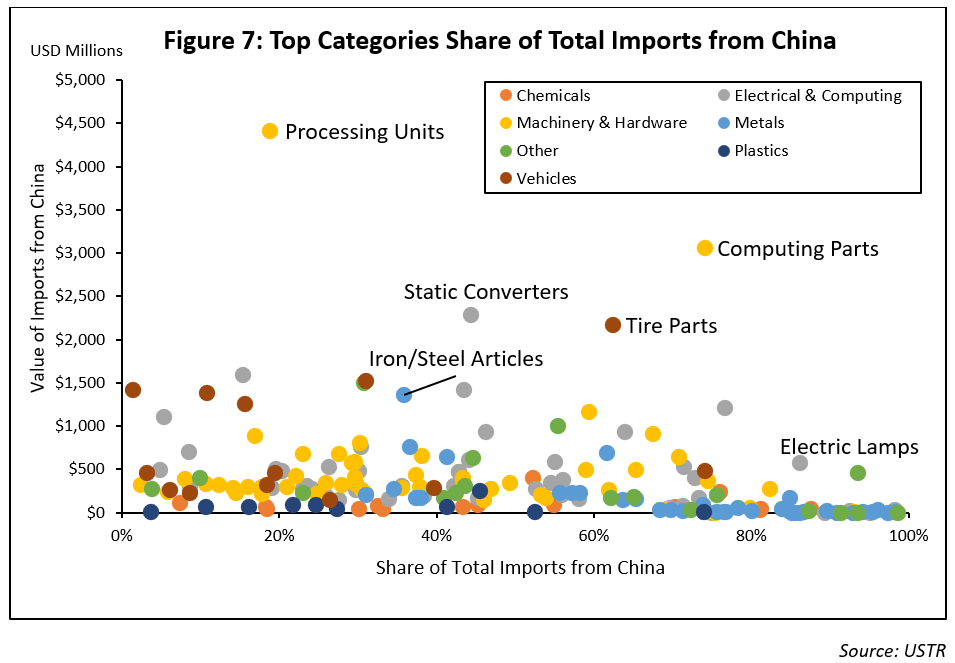

Oil & Gas firm’s exposure to these tariffs is dependent upon their supply base and sourcing strategy. Certain goods are heavily imported from China and thereby more likely to be subject to tariffs. In particular, metal products (light blue dots, Figure 7) are high risk due to the reliance on imports from China, ranging between a 30-95% share of total imports.

Fittings, for example, are on list 3 of the Section 301 tariffs, and therefore tariff duties on fittings imports from China will remain at 10% pending the trade negotiations in late March. As a result, suppliers are beginning to move their manufacturing and supply chains out of China, some even to the US. However, it is important to note that despite relocating to avoid Section 301 tariffs, some suppliers could still face Section 232 tariffs on raw steel and aluminum imports depending on their sourcing strategy.

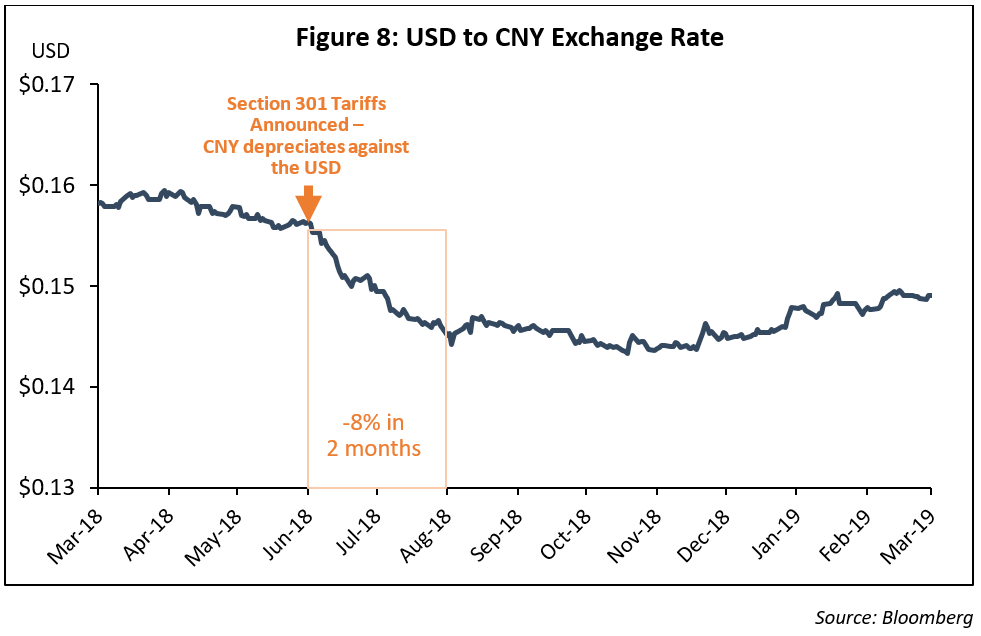

Even with increased tariffs and rising manufacturing wages, some suppliers may have avoided significant cost pressures due to the depreciation of the Chinese currency, the Yuan:

- When Section 301 tariffs were announced in June of 2018, the Yuan depreciated against the Dollar by 8% in the following 2 months, making Chinese goods cheaper when bought in USD (Figure 8)

- Depending on when goods were purchased and the currency used in the transaction, suppliers may have purchased parts and raw materials for cheaper

How Can Oil & Gas Supply Chains Prepare?

International markets today operate at a fast pace, with high stakes, meaning that economic pain points can travel far, quickly. Therefore, it is crucial to remain vigilant in monitoring global economic conditions in order to realize maximum cost savings. Critical supply chain questions to keep top-of-mind include:

- Is the supplier citing tariffs or wages as reasons for moving manufacturing locations?

- Where does the supplier source their raw materials?

- What currency does the supplier use to purchase goods from China?

- When did the supplier purchase any parts or raw materials from China?

As the global economy evolves and subsequently impacts Oil & Gas supply chains, firms can prepare by staying abreast of changing markets and through a better understanding of market-based risks and opportunities.

Interested in learning more about how global economic shifts could impact your costs, or about the data in this post?