The Russia-Ukraine conflict has rattled global commodity markets, sending crude oil prices to their highest level in more than a decade, while prices for natural gas, nickel and aluminium have also spiked. Transport disruptions and the possibility of additional sanctions on Russia have raised the prospect of tighter supplies for various commodities.

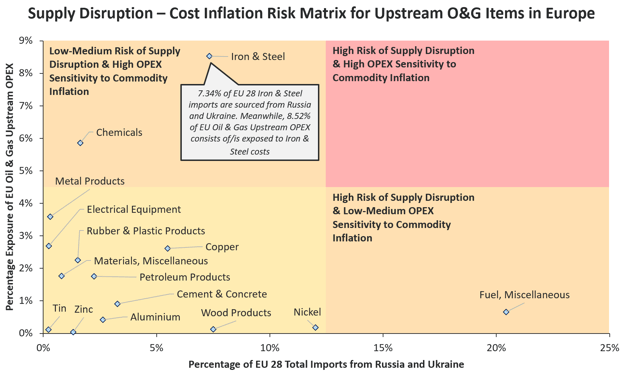

In our Russia-Ukraine Conflict Cost Risk Analysis Series, we focus on key commodities assessing: 1. the risk of supply disruption as conflict interrupts the normal flow of trade exports from Russia and Ukraine; and 2. the cost inflation impact of such disruption on high spend and critical items within the Energy & Natural Resources industry.

This report in particular examines the risks for O&G Upstream OPEX in Europe.