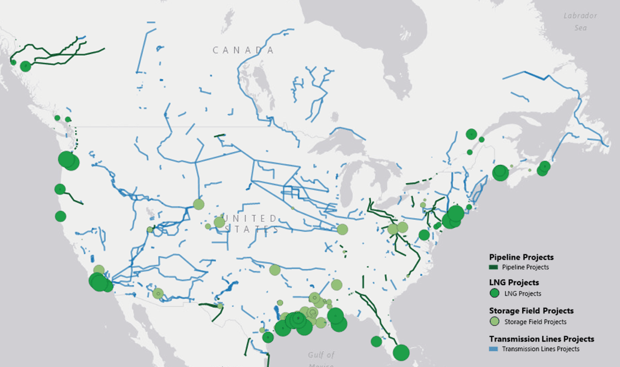

With the future of oil and gas prices still uncertain, many midstream and downstream firms are asking how much investment is still being planned for the coming years.

In today's project forecast update, we share how and where the market is planning projects in the midstream, refining, and petrochemical sectors over the next four years. Read on to view maps of the top areas of capital investment through 2020:

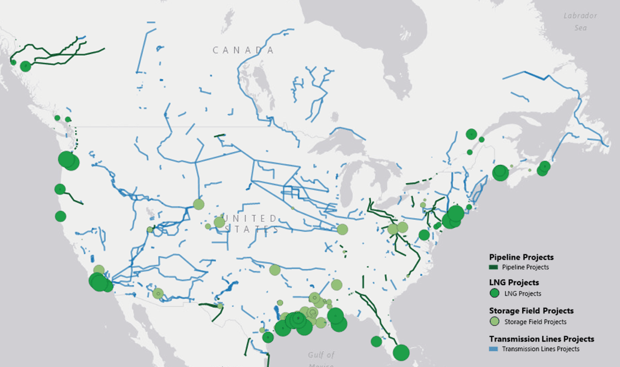

Billions are Planned in Gas Pipeline, LNG, and Energy Storage Projects

Sources: SNL, Oil & Gas Journal

This map of planned midstream investment suggests three important observations:

- Large LNG projects will ramp up over the next 4 years

- The Gulf Coast continues to be an area of some of the largest investments, with many pipeline projects still planned for the Northeast

- Storage projects are not to be overlooked as an area of competing investment

Let's next take a look at the downstream market.

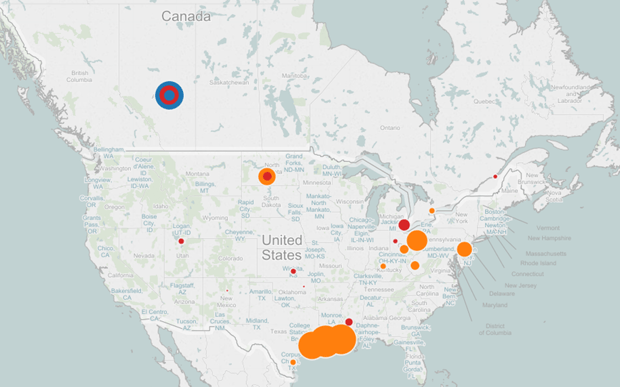

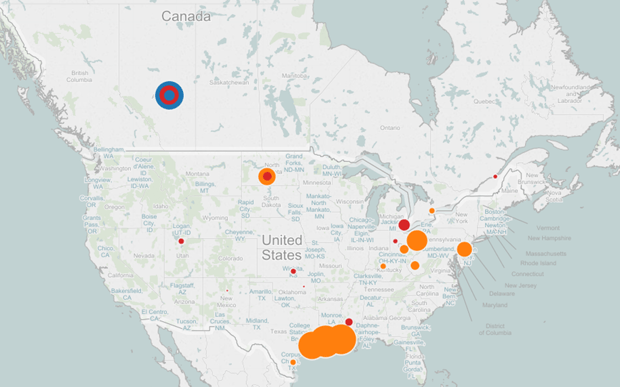

More than $100B of Downstream Projects Planned through 2020

Sources: Oil & Gas Journal, Petrochemical Update, ICIS Chemical Business Magazine