There’s been a lot of talk about the negative impacts of the crude price decline on midstream companies, whether it be declines in revenue or pressure on growth projects.

But did you know that the same decline that’s pressuring your top line is also opening up unprecedented cost reduction opportunities that can end up giving you a sustainable advantage?

In this post, we’ll show you how to identify "quick win" opportunities to capture millions of dollars in market-driven savings from the decline in fuel prices alone. Stay tuned for our next post, where we’ll show you how to take advantage of recent declines in metal prices.

But first, let’s define a 3-question diagnostic that helps to identify and prioritize fuel-based savings opportunities out of a much broader set of cost categories:

Savings Opportunity Diagnostic

1. Does fuel compose a significant portion of category costs?

2. Should the decline in fuel translate into a decline in total category costs or are there upward pressures in other cost components?

3. Does the savings opportunity 'move the needle,’ i.e., make a significant impact on the enterprise?

Savings Diagnostic: Freight

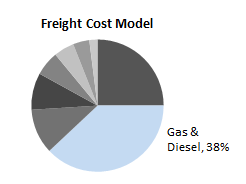

1. Does fuel compose a significant component of freight costs?

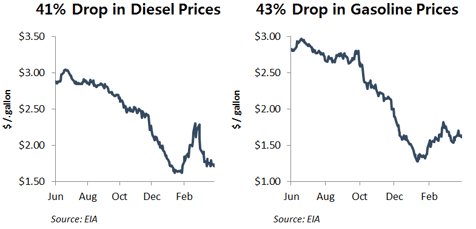

Yes, when we break up the cost of freight into its constituent components, we can see that fuel composes a full 38% of the cost.

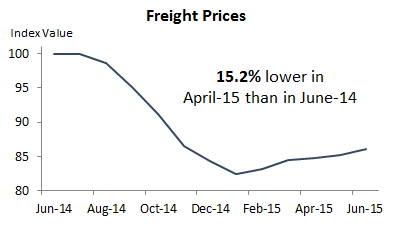

2. Should total freight costs be decreasing?

Yes, the should-cost model below indicates that total freight costs should have declined 15.2% since June. (If you haven't been seeing those declines in the market, it's likely because suppliers haven't been proactive in passing along savings. Arming yourself with data like this allows you to have more favorable and fact-based negotiations with suppliers.)

3. Does freight 'move the needle'?

Yes, for a midstream company with a 'typical' asset profile and $1.5B of sourceable spend, the decline in freight costs translates into $5.5 million in savings.

But it's not just freight. Two other categories offer an additional $5.1 million in savings for the same 'typical' midstream company.