![]()

In our last post, we delved into what should-cost models are, and how they can drive significant incremental savings, especially in high-commodity-swing environments (such as the current one). In this piece – the 2nd in our Smart Savings Series – we describe an equally important savings exercise: Price Variance Analysis. In our experience, companies that effectively standardize pricing across major spend items drive 10-20% higher savings than their peers do.

Same Item, Same Supplier, Different Price?

If we claimed you paid four different prices for the same item, with the same supplier, in the same basin, on the same day last month, you might accuse us of lying. After all, you have contracts in place with your major suppliers that should prevent this. And yet, with every E&P spend dataset we cleanse, we encounter the same unfortunate trend: rampant price variance.

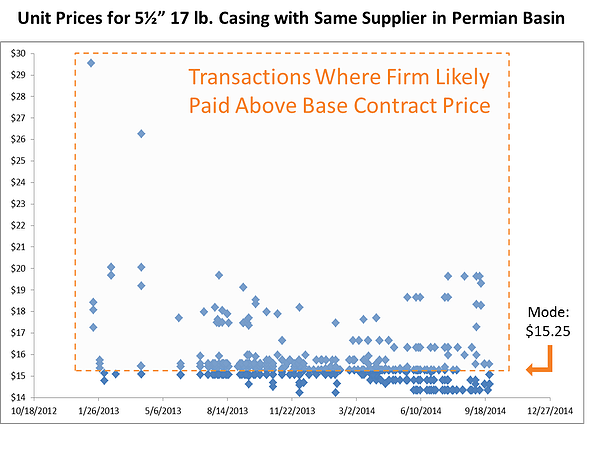

The scatterplot below illuminates just how inconsistent pricing often is for large E&P firms. This real world examples shows an E&P company paying more than its base contract unit price with its biggest OCTG supplier in the Permian Basin > 40% of the time. The average premium paid was ~20%, and the overall cost of this premium was > $10 Million per year.

Why Variance Exists and How to Address It

At first blush, this problem is a bit confounding. Why would you be paying different prices for the same thing? Are your suppliers consistently ripping you off? Not exactly. Though vendors certainly don’t mind receiving more money for the same items, the premiums you pay may be attributable to inefficiencies on your end.

In many cases, price variance is caused by ‘hot-shot’ orders placed by your rigs’ company men in the field. When a company man needs an item delivered on short notice, that item’s associated costs (e.g., freight) rise, as does its per-unit price. While you may not be able to eliminate hot-shot orders from your procurement process entirely (as some circumstances are impossible to forecast), you can take a number of steps to optimize the way you contract around and execute these short-notice orders.

If you’re interested in a more tactical step-by-step guide to conducting your own Price Variance Analysis, and mitigating the root causes of this variance, we invite you to view our Tactical Savings Guide to Conducting Price Variance Analysis.