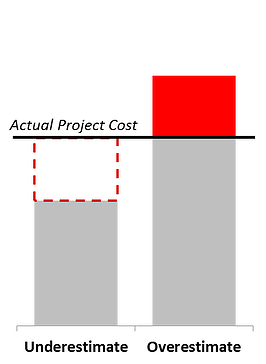

Accurate estimates are the best tool that midstream companies have to assess project feasibility and drive profitability, and they're the key to allocating your total available capital to the best possible mix of investments. So whether you overestimate and miss out on profitable investments or underestimate and execute unprofitable ones, bad estimates mean bad investments. Here's why:

1. Cost Overruns Have Enterprise-Wide Impact

Underestimates make unprofitable investments appear profitable. When midstream companies execute underestimated projects, costs end up exceeding expectations and threaten project profitability.

What's worse, the hit to profitability isn’t limited to underestimated projects: to make up cost overruns, you either have to take on more debt to finance the gap or take money from other projects, causing a ripple effect throughout your portfolio.

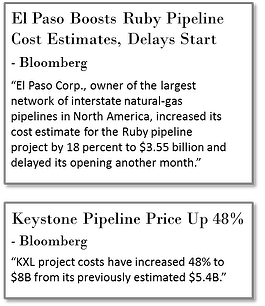

In just the last year, midstream companies have experienced project cost overruns of up to 40%. With numbers like those, missed estimates can threaten midstream companies at the enterprise level.

Whether in the form of destroyed quarterly earnings, ballooning debt, delayed projects across the investment portfolio, or diminishing rates of return, missed estimates endanger the highest-level financial success of any midstream company.

2. Overestimates Lose Profitable Investment Opportunities

It’s not just underestimates that threaten midstream companies: overestimates cause you to lose profitable investment opportunities in two ways:

- Good investments appear to be bad ones, causing internal decision makers not to execute potentially profitable projects

- High project bids are uncompetitive, so you lose projects to companies that have more visibility into actual project costs

What's more, even when overestimated projects are executed, the result is that more capital has been allocated to a project than necessary, tying up precious resources and losing additional investment opportunities.

3. Misestimates Undermine Professional and Financial Reputations

Whenever projects don’t go according to plan, reputations end up on the line. That’s true for individuals and for companies.

Misestimates embarrass executives in charge of project planning and ultimately lead to tough board discussions and changes in management.

But misestimates are also the swiftest way to cause public relations disasters and destroy investor confidence. That’s because misestimates indicate a fundamental inability to make strategic investment decisions, causing shareholders and investors to question the long-term stability of their investments.

The Bottom Line? Misestimates cause midstream companies to choose the wrong mix of investments and to suffer the financial and reputational consequences of doing so.

Sources: Bloomberg, Natural Gas Supply Association Pipeline Cost Recovery Report