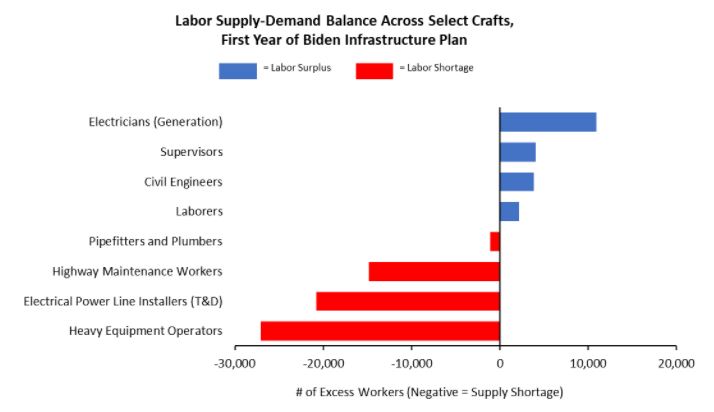

The US construction sector is facing a confluence of supply chain disruptions, cost increases, and worker shortages as the economic recovery from the pandemic accelerates. Now, President Biden’s proposed plan to invest $2T over 8 years in infrastructure could further boost demand for construction services, putting even more pressure on the limited labor supplies providing services to energy firms.

PowerAdvocate’s analysis of the proposed investments in roads, bridges, power transmission networks, and other physical infrastructure shows that higher demand will impact some craft labor types more than others. As the chart shows, demand is expected to exceed supply for several key crafts in the first year of the plan, with heavy equipment operators and electrical power line installers seeing the severest shortages. Both crafts saw minimal job losses in 2020 amid pandemic-related work stoppages and are currently near full capacity with few qualified workers remaining jobless. Meanwhile, both will see significantly higher demand if the infrastructure bill passes Congress. At a national level, PowerAdvocate forecasts that construction sector employers could face a shortage of 27,000 heavy equipment operators, or nearly 7% of the currently employed labor force of 405,000. For electrical power line installers, we forecast a shortage of 21,000 workers, or 18% of the current labor force of 114,000.

Labor shortages are a major risk for energy firms, impacting everything from costs, to safety, to project continuity. PowerAdvocate works with firms to quantify their exposure to these shortages and execute key supply chain strategies to mitigate the risk, including managing demand, improving supplier productivity, and enhancing volume commitments.