With a market full of savings opportunity, many of North America's top Oil & Gas firms are turning to cost modeling to help identify, quantify, and execute on market-driven savings.

But cost models only become valuable when they're taken off the shelf and used to drive value in practice.

In today's post, we share 5 cost modeling best practices Oil & Gas firms can use to drive maximal value. Interested in learning more about developing a cost modeling capability? Click here to learn more.

1. Quickly identify top market-driven opportunities

As 2016 approaches, Oil & Gas Supply Chains are beginning to set their agendas for the coming year. The question on everyone's mind is: how do we target the categories of spend that present the greatest opportunity?

Cost models provide a data-driven way to develop a savings roadmap based on the top opportunities in the market.

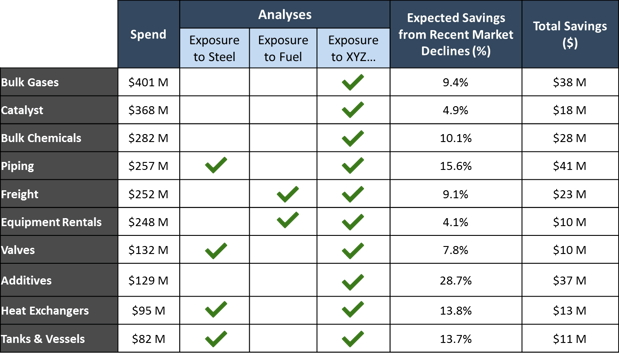

Below, we show a sample savings roadmap executed by a downstream firm. Cost models enabled this firm to not only identify categories that were most exposed to commodities that had recently declined, but to also quantify total expected savings based on recent market movements.

The result was a prioritized list of top savings opportunities based on actual market trends, enabling the firm to focus its resources on the most promising opportunities.

2. Improve negotiation outcomes

Many leading Oil & Gas firms are using cost models to move beyond identifying savings into executing on savings through direct negotiations.

Cost models are a particularly effective negotiation tool because they anchor suppliers' pricing in quantifiable market realities. Because cost models show how each input cost of a particular item or service has moved over time, they force suppliers to reckon with real market conditions as they propose new prices.

Negotiations like these can save Supply Chain teams incredible amounts of time by shortcutting the full strategic sourcing process and capturing quick wins from market-driven negotiations.

In fact, studies have shown that negotiations powered by cost models typically result in 5-15% savings over negotiations that are driven by suppliers.

3. Drive down supplier bids

Negotiations aren't the only time you talk pricing with suppliers: one of the most impactful best practices we've seen is to include cost models in the bid packages that you send out to suppliers in competitive bid events.

By including a perspective on the market with your bid specifications, you ensure that suppliers start bidding at a lower price point that's anchored in your perspective on the market. When layered on top of a competitive bid environment, cost models yield high returns for their users.

4. Hold down your pricing by tying price movements to indices

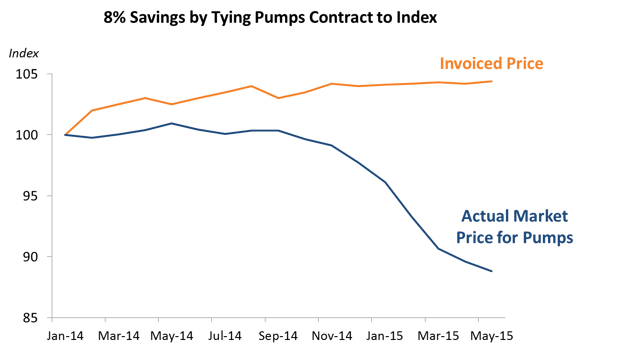

Once you've negotiated low prices, the key to sustainable savings is to ensure that prices continue to track the market over time. A best practice for O&G firms is to use cost models to tie contracts to market indices in order to validate that suppliers' prices track the market.

For instance, in the example below, we show how one firm could have saved 8% over the life of their pumps contract by tying it to an index vs. enabling the supplier to propose its own price changes over time.

5. Answer strategic questions about the market

We're all bombarded by news stories about commodity markets, but the question on Oil & Gas executives' minds is how those macro-economic stories apply to their own business.

But answering those questions is easier said than done: What does a 35% decline in steel mean for the organization? What does a 10% increase in labor costs do to our project forecasts? What would a bump in freight prices mean for our upcoming budget? Cost models enable O&G firms to easily answer questions like these by tying their own firm's spend profile to the external market, making it easy to run scenario analysis based on differing economic forecasts.

----

Today's post has highlighted just 5 examples of using cost models to drive down costs and sustain savings over time. To learn more about using cost models in your own organization, click here to request a demo of our cost modeling platform.