The drastic decline in E&P production over the last 6 months has fundamentally shifted supply & demand dynamics, opening up significant opportunities for midstream companies to save money with suppliers that supply into both the E&P and midstream markets.

In today's post in our market-driven savings series, we’ll show you how to negotiate savings based on recent E&P-driven drops in demand for your suppliers' goods and services. At the end, we'll provide you with a list of suppliers that are the most fruitful targets for renegotiation.

Opportunity Analysis

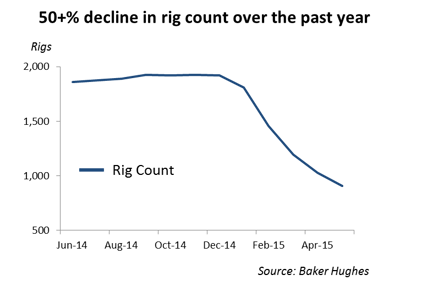

Nowhere is the decline in E&P production more evident than in the rig count, which shows that in just the last 5 months, the number of rigs in the U.S. has been cut in half: a drop we haven’t seen since the 2008 recession.

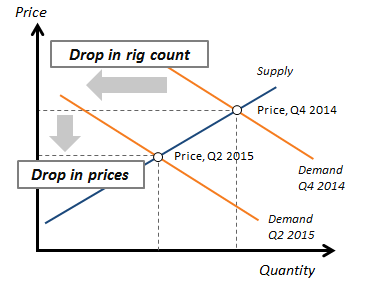

The chart below summarizes the effect of downward demand pressures: Before the decline in E&P production, prices stabilized at the point on the upper right. But once demand fell, suppliers found themselves with excess capacity, causing prices to drop to the point in the lower-left.

Even suppliers are conceding the point: one supplier reported in a Federal Reserve Survey that "the price of crude oil is a large factor that will impact selling prices for some of our products. If it remains low, we will see prices for some products drop significantly as demand drops."

Yet suppliers won't voluntarily move from higher price points to lower ones if you don't proactively identify the opportunity and renegotiate contracts.

How to Capture Savings

So how can you approach suppliers to capture demand-driven savings? We recommend 3 steps:

- Target the right suppliers: Identify your top 50-100 suppliers and then find key suppliers who also supply into the E&P market and therefore have significant exposure to downward demand pressure.

- Identify items shared between your business and the E&P market: With your list of suppliers in hand, you'll need to identify whether the items you buy are the same items that overlap with E&P. For instance, if you buy welding services from a supplier that sells welding services to both E&P and midstream, you'll likely have significant price leverage, but if you buy controls from a supplier who only sells technical services to E&P firms, you won't be as successful in negotiations.

- Prepare for renegotiations with data: Suppliers won't give you lower prices unless you make a data-backed case for them. To drive favorable negotiation outcomes, you should bring data that shows the extent to which the items you buy are affected by changes in demand factors (focusing on negotiable cost components like supplier margins and expenses).

By targeting the right categories with key suppliers, you can take advantage of favorable demand conditions and drive prices down. To help start the process, we've identified the top 20 suppliers that supply into both the E&P and midstream markets: