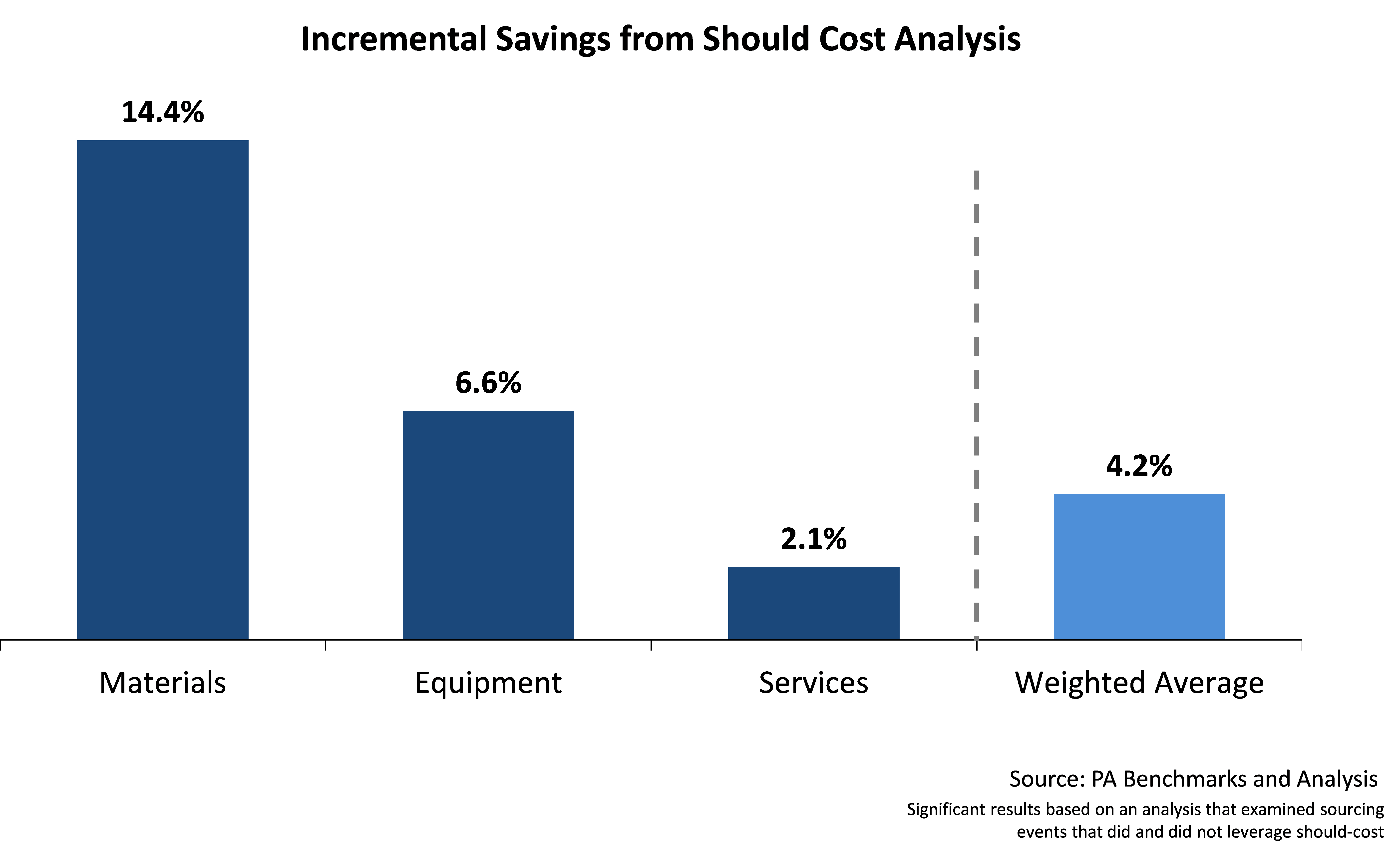

In our last post, we outlined 3 reasons why pursuing 20% (or 10% or 30%) savings across all suppliers is suboptimal. In this initial piece of our ‘Smart Savings Series’, we provide our first specific recommendation on how to leverage data for a more intelligent approach to savings. This piece focuses on ‘should-cost’ models and how they can help you realize an additional 5-20% savings in your next supplier negotiation.

Incremental Savings from Should-Cost

Data from multiple sources, and our experience with numerous oil and gas companies, shows that E&P companies can consistently drive an incremental 5%, 10%, even 20% savings in supplier negotiations when armed with should-cost models.

According to an IndustryWeek article, “estimates from different product cost experts [suggest an added savings range of] 5% to 20%” when using should-cost in a negotiation. This is supported by a study conducted by PowerAdvocate which tracked the results of actual bid events conducted through its e-sourcing platform. In this study, buyers who leveraged should-cost achieved an incremental savings off the starting price of ~2-15% on average compared with those who negotiated without a should-cost.

What Exactly is a ‘Should Cost Model’?

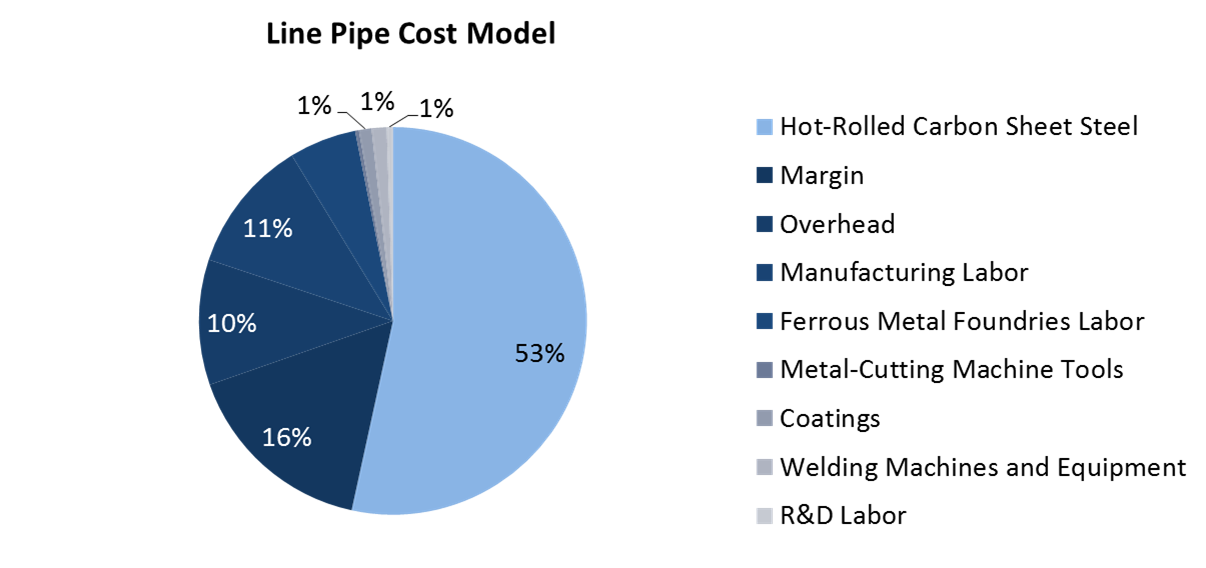

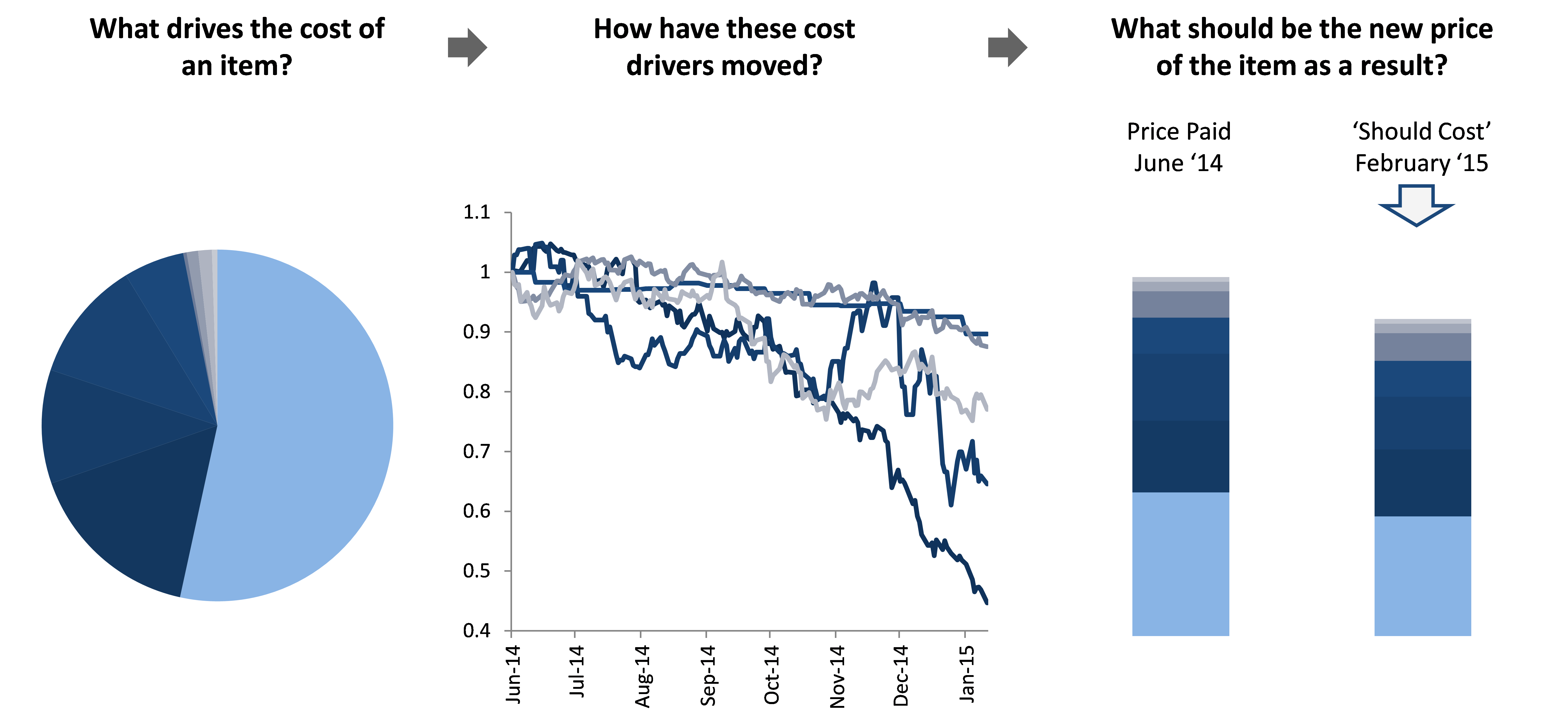

The premise of should-cost is simple. It starts with an item-level cost model which lays out the components that build up to the cost you pay for a particular material or service. For example, the cost model below shows which underlying inputs drive the price of the line pipe you buy. As you can see, in this example, 53% of the cost of line pipe is comprised of hot-rolled carbon sheet steel.

Over time, market forces move the price of these cost drivers. For example, in the period from June 2014 to January 2015, steel prices declined by more than 10%, which means that the cost to your supplier of producing line pipe has also gone down. A should-cost model simply tells you what the new price of line pipe should be given the movement in underlying cost drivers like steel and others.

Why You Can’t Afford to Wait (and How to Get Started)

In an environment like the one we’re in today, the potential of ‘should-cost’ is more pronounced than ever. Between June 2014 and January 2015, crude, natural gas, steel, copper, and nickel have dropped in price 55%, 35%, 10%, 12%, and 23% respectively.

This implication is simple - your suppliers' costs are going down. But don't expect them to pass those savings onto you...you need to go get them.

If you want a more tactical guide to implementing should-cost, get started by reading our post which outlines the step-by-step data requirements, analysis, and execution of should-cost: Tactical Savings Guide - Should-Cost Analysis