This post is part of our "5 Steps to Preventing Cost Overruns" series. Click here to start from the beginning.

If you're anything like the rest of us, you can't see into the future.

So when you're creating a project estimate that requires you to predict future project costs, how can you ever get it right?

With a delicate balance between great data and a healthy dose of realism, it is possible to develop a scientific approach to accounting for changes in market conditions over time and ultimately creating more accurate project estimates.

Here's how you can do it:

1. Use historical data to leverage past projects:

You likely have a wealth of historical project data waiting to be used to inform future project estimates. But if you can't translate costs from the past into costs in the future, you're left with a dusty archive of not-so-relevant numbers.

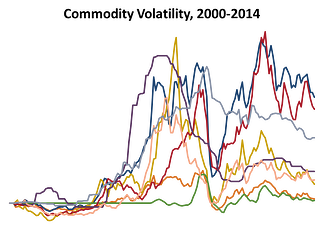

And when you add in the extreme cost volatility that we've seen over the last 10 years in key midstream project categories, it becomes even more difficult to use past costs as a guide.

To leverage historical data and generate more accurate estimates, you'll need to precisely quantify the differences in market conditions in each period of time. To do that, we suggest that you collect market indices that track changes in key commodities and then model how those commodities affect your project categories.

Interested in learning more about developing that market data? Click here.

2. Use the best available data to forecast the future:

Even with total visibility into past and current market conditions, no one can know exactly what the market will look like months or years down the line.

So how do you answer key strategic questions like:

- What will costs be when we start project procurement?

- What will our O&M costs be at our in-service date and beyond?

- In which categories am I exposed to the most market risk?

The answer lies in the data: with data on historical cost trends, commentary by experts in the field, and data on market factors like supply and demand, you can come up with category-specific forecasts that show you where costs will likely go in the future.

3. Put your projects through rigorous scenario testing:

Great data tells you where the market should go in the next few years. But no one can predict a recession, an unprecedented price spike, a major change in OPEC strategy, or other "black swan" events that could make or break project profitability.

To make informed investment decisions, you also need to rigorously scenario test each project to evaluate whether it would still be the best possible investment for your limited pool of capital if a different set of market conditions were to occur.

Let's say your company forecast expects steel prices to stay low for another year. But what if that doesn't happen and steel recovers in the next two months, increasing the costs in typical project categories like line pipe and valves? By testing different market scenarios, you can understand the limits of your forecasts and make investment decisions with full visibility into the risks to project profitability under each set of circumstances.

Great project estimation uses the best available market data to normalize past projects from different times and to forecast future projects. But the most sophisticated estimates recognize that no forecast is ever future-proof, and they actively analyze what their project costs might be if differing risk scenarios were to occur.