Summary

- The US administration recently announced two new rounds of tariffs on $300 billion of imports from China at a rate of 10%, effective September 1 and December 15.

- This is the fourth round of US tariffs on imports from China, which now covers over $500 billion of Chinese imports, covering nearly all remaining trade with China.

- China has responded by cutting US imports and by threatening additional tariffs on US goods.

- The new tariffs largely focus upon consumer products; however, the tariffs also cover numerous steel & aluminum products in both finished and intermediate states that may impact energy supply chain teams. However, the lists will not include products for which China maintains monopolistic market share, such as rare earth minerals and barite.

- While trade negotiations between China and the US are expected to continue, should the talks fail to result in an agreement, the list 4 tariff rate is anticipated to increase to 25%, in line with lists 1 – 3.

- Supply Chain teams should evaluate how exposed they are to key commodities such as steel and aluminum and be able to evaluate potential risks to cost structure.

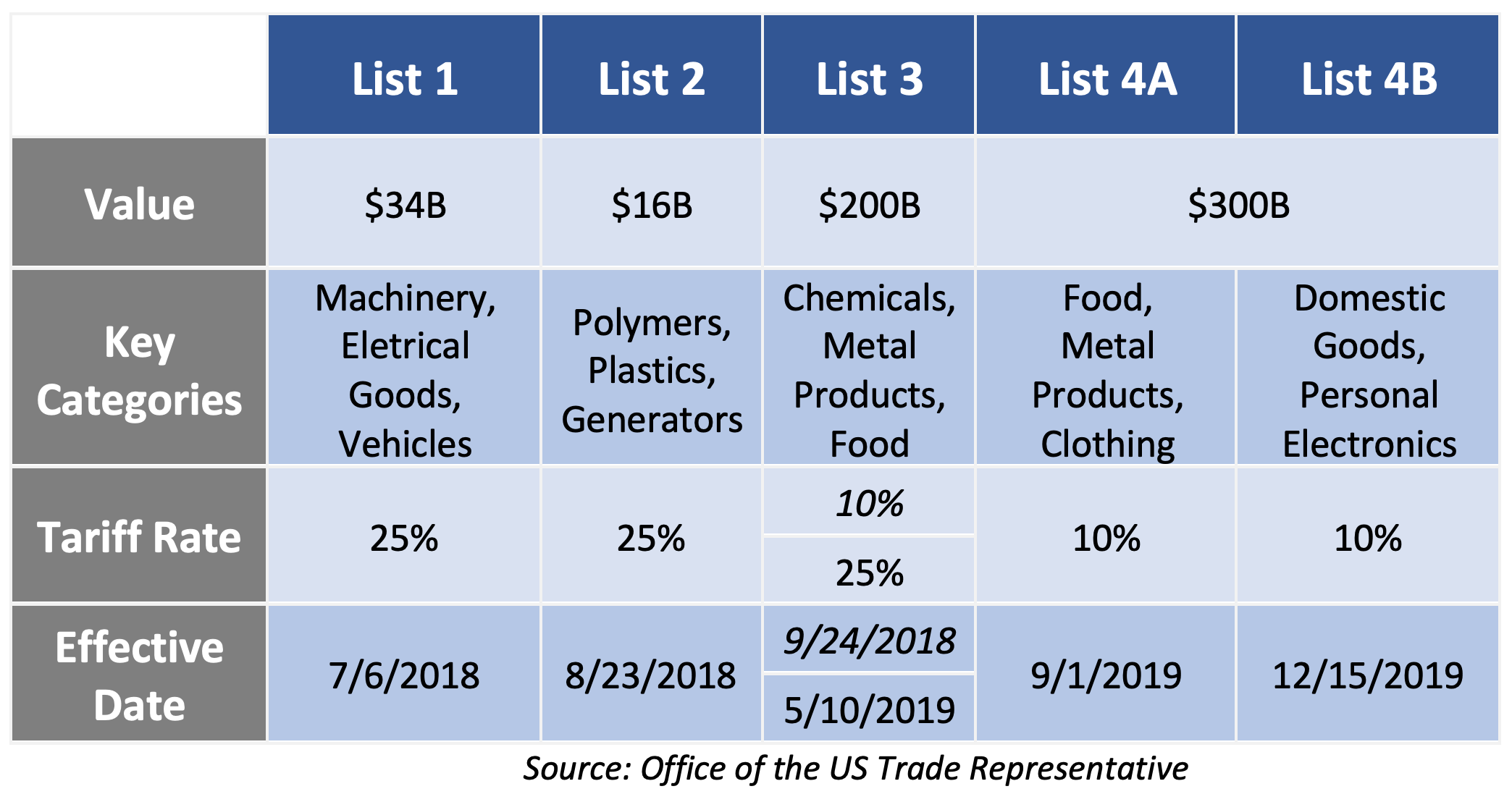

Figure 1: Section 301 China Tariff Lists

Impact of New Tariffs on Energy Firms

The new tariffs affect nearly all remaining Chinese products. On August 1, US President Donald Trump announced that Washington would implement list 4 tariffs at a rate of 10% on $300 billion of Chinese goods under the Section 301 trade dispute (see Figure 1). But what does this mean for energy firms?

Despite the large value of goods covered by this tariff list, the majority of goods covered are actually consumer goods, such as clothing, food, and personal electronics unlike the earlier lists which were primarily centered upon industrial goods (for our earlier write-up on 301 tariffs, click here). Regardless, it should be noted that there are still a significant number of goods that will be impacted by this list that are of importance to energy supply chains. For instance:

- Steel & aluminum products in both finished and unfinished states, along with grain oriented electrical steel & stainless steel products

- Industrial safety clothing and materials

- Germanium (a rare metal used in the production of glass lenses), fiber optics and semiconductors

- Batteries, both lithium-ion batteries and nickel-cadmium storage batteries

Key personal-use items such as cell phones and laptops have been temporarily removed from the list 4 tariffs in order to limit the cost impact for American consumers during the upcoming holiday season, so the delayed items will not be tariffed until December 15, 2019. Outside of the purchase of office electronics and other similar devices, such a move will not significantly reduce the impact of the list 4 tariffs on the US energy industry.

What Comes Next in the Trade War, and How Could That Impact the Energy Industry?

The list 4 tariffs are the latest in a series of such measures enacted by the US and Chinese governments over the past two years. To put this most recent measure in context:

- The trade dispute centers around claims of unfair trade competition against China.

- Since the introduction of the Section 301 tariffs, the US and Chinese governments have engaged in diplomatic negotiations to resolve the dispute, yet an agreement has remained elusive.

- As continued rounds of negotiation have failed to generate demonstrable results, the US has continually increased tariffs, leading to the introduction of list 2 and list 3 at 10% and later 25%.

- It is expected that if a breakthrough in negotiations is not achieved by the time list 4 is fully implemented in December, the US government will increase lists 4a and 4b tariff to 25% as was done with list 3.

- The Chinese government has responded to each round of US tariffs with a retaliatory round of its own.

It is worthwhile for energy firms to evaluate if they are prepared to absorb future cost risks due to tariffs. Below, we share a few tactical strategies for supply chain teams in particular.

What Does This Mean for Energy Supply Chains?

First, we encourage firms to monitor potential risks. For example, China currently produces 80% of the global rare earth mineral supply, which is used in numerous industries and processes including O&G downstream operations and wind turbines, so a ban of Chinese-produced rare earth minerals could heavily impact the industry. While such a ban may be difficult to effectively implement as 1) re-exported materials from intermediate countries would find their way to US markets and 2) countries such as Australia and Somaliland are investing in growing their rare earth mining and processing capacity which will serve to undermine China’s dominant market position, supply chains should evaluate their exposure to key commodities and materials.

Second, while the future of the trade war remains murky, new tariffs are arriving soon and with them price increase requests and similar negotiations with vendors. To ensure costs stay as low as possible amid this tumultuous period, supply chain teams should be prepared to consider key questions such as:

- What are the HTS codes of items in question? HTS codes could allow you to verify the regulations on any items.

- How exposed are affected products to the various tariff lists? Some goods may have only a portion of their supply chains effected by the tariffs, so it is important to verify that unnecessary fees are not being charged by suppliers.

- Is an exclusion request feasible? A tariff waiver request can sometimes be applied for.

- Are insurance fees and shipping costs included in the tariff? According to US tariff regulations, international shipping and freight insurance costs should not be included in tariff calculations.

- Can the item to be shipped in an alternatively-configured or differently-finished state to avoid tariffs? In some cases, a similarly-configured or finished item may not be covered by the same tariffs and thereby enable your supply chain to avoid cost increases.

In order to answer these and other key questions, actionable analysis and incisive data insights about the market are critical. If you’re interested in learning more about forecasted cost risks in the industry, or interested in hearing about how >100 energy firms are already leveraging market data to manage costs, feel free to reach out to us here.