President Biden’s proposed $2T investment plan could strain an already tight labor market servicing utilities. As demand for various construction services increase, North American utilities will need to accomplish the same or greater levels of work compared to the past, but with a more constrained supply base. As a result, utilities must think about the potential higher costs that result from labor shortages.

For example, if labor shortages continue to increase, more overtime work will be required, per diem & incentives will need to be paid for more personnel more often, and contractors will be able to increase profits in a seller’s market. Additionally, utilities will be forced to be less selective in who they employ, taking on newly trained workers and employing the “last person off the bench.” This, paired with greater overtime work, leads to lower productivity. Even if a utility has long-term, fixed price hourly rates in place, they will still have significant cost escalation exposure related to the need to pay overtime, per diems, and incentives more often with crews that are likely to be less productive.

To understand how increased demand would impact costs for specific services, PowerAdvocate conducted an analysis on our proprietary data assets, including $6T of energy industry spend data. Across electric transmission and distribution (T&D) data for North American utilities, we analyzed how increased demand has correlated with higher costs incurred by utilities. We found that, on average, a 30% increase in spending on electric T&D services could result in upwards of a 22% increase in the effective labor cost per hour for T&D field labor.

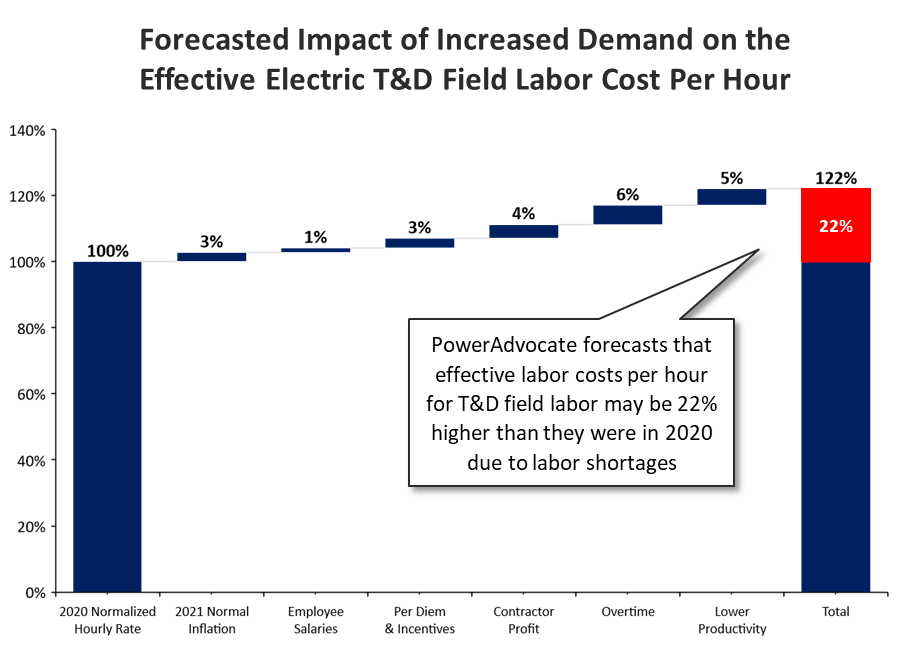

The breakdown of factors driving that 22% premium is illustrated in the chart below:

Figure 1. The chart above breaks down the cost drivers and their relative impact on labor premiums for electric T&D field labor when demand for T&D services is greater. Greater demand is tested under a sensitivity scenario in which spending on T&D installation services increases by 30%, relative to a 2020 baseline. The 30% spending increase is just one of a range of potential increased demand outcomes from the infrastructure bill, but many utilities’ T&D Capex budgets already reflect this level of growth and sometimes more.

The most significant cost driver of the effective labor premium could be overtime hours. The above scenario assumes utilities will have to add an estimated 5 more overtime hours per week and 2 more double time hours per week because of greater labor scarcity. As a percentage of 2020’s hourly rate for electric T&D field labor, overtime costs are followed closely by increased costs due to lower productivity, increased contractor profit, and per diem and incentives.

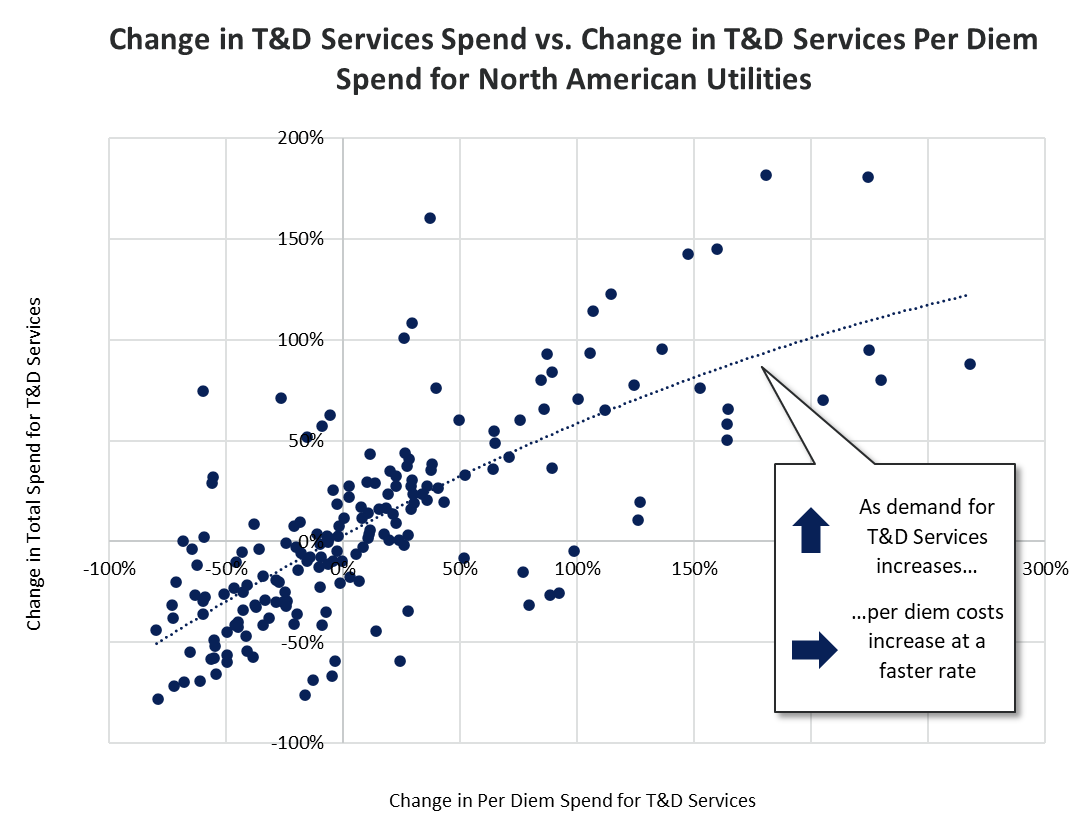

The positive relationship between demand and labor costs is well born out in the historical spending and cost patterns for North American utilities. A survey of the relationship between historical spending on T&D services and labor costs across our proprietary database reveals that a 1x increase in T&D services spending (i.e., higher demand) leads to upwards of a 2x increase in per diem spending (with per diem costs increasing faster than total costs), as further illustrated below.

Figure 2. The chart above illustrates the relationship between increases or decreases in spending on T&D services and increases or decreases in corresponding per diem spend on T&D services in the same month. Each data point plots the change in monthly spending relative to the monthly average over the January 2018 – December 2020 timeframe. Data is pulled for a sample of North American utilities from PowerAdvocate’s factbase of >$6T in spending from energy firms.

Ultimately, local market conditions will vary significantly in both investment and supply availability, but there is an increasing likelihood that most will feel greater pricing pressures across many total labor cost drivers. Fortunately, utilities have a wide range of “offset” strategies at their disposal which they can leverage to mitigate the impacts of inflationary pressures.

Click the link above for details on these offset strategies or subscribe to the right to stay informed about how you can best prepare for current market conditions.