In the midst of $30 oil, no savings opportunity should be overlooked. Even still, with so many categories of spend among a multitude of suppliers to consider, it's difficult to prioritize, and even more difficult to find unexpected areas of savings.

Read on to find out how freight is one of the greatest (and most overlooked) savings opportunities in 2016…

Due to weak demand, a sluggish manufacturing sector, and a strong U.S. dollar, freight rates are low and not likely to rebound anytime soon.

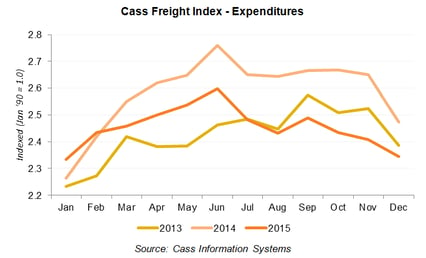

The Cass Freight index below, which measures North American freight volume and expenditures, shows that freight expenditures declined significantly in 2015, ending the year below 2013 levels.

This decline holds true across the entire freight industry—whether it be rail, trucking, or maritime. However, to get a full picture of what’s happening in the market let’s look at the factors that have driven the price decline in each sector:

![]()

Trucking

Trucking prices have dropped significantly, with 8% YoY decline, and rates are expected to stay low through the beginning of 2016. Both internal and external factors are placing downward pressure on the industry, including:

- Excess vehicle/fleet capacity (for the first time since the recession)

- Contraction in the manufacturing sector

- Lower than expected consumer spending

For the near term, this sector will remain depressed. Many firms are renegotiating contracts now with this in mind, especially given the potential for rebound. As the industry continues to face a shortage of drivers, resultant from an aging and retiring workforce, the driver shortage is likely to force upward pressure on rates.

![]()

Maritime

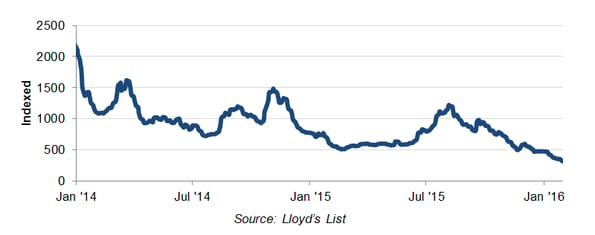

As we move into 2016, the maritime shipping sector can be summed up in one word: overcapacity.

Over the past year, global fleet capacity rose by 8.5%. Maritime freight rates are down 9% and the Baltic Dry Index, a leading indicator of the cost of shipping dry bulk, ended 2015 with the lowest levels ever recorded. The decline has been so severe that it is now more affordable to hire a 1,100 foot merchant vessel for the day than a Ferrari F40!

Baltic Dry Index

To stall or slow further decline, freight suppliers are attempting to cut capacity by scrapping older vessels and selling deadweight tons of capacity for demolition.

However, the capacity cutback won’t be quick enough: Expect lower prices to continue through 2016 as the industry slowly grapples to cut back on overcapacity and consolidate its operations. In the meantime, lower maritime shipping prices mean more savings opportunities to capitalize on.

![]()

Rail

It's been a tough couple of years for the rail market. 2015 marked the greatest decline in U.S. cargo over the past six years, accompanied by a 3% rate decline. This story remains unchanged as we enter 2016.

The strong drop in demand for commodities like coal, metals and crude oil continues to challenge the foundation of rail shipping. Consequently, rail companies will continue to cut jobs in the midst of fledgling demand, thinning out spend to remain afloat.

How can I use these market changes to save money?

The opportunity: Across the board, shipping costs are down. Even better, these low rates are likely to continue for the next year, with rail and maritime the least likely to rebound in the foreseeable future. This lull in the market is low hanging fruit for energy companies to grab.

The approach:

- Identify items heavily impacted by freight costs

- Check how your pricing on categories affected by freight has changed in the last year, and confirm whether your rates have fallen in line with the freight market

- For rates that don’t reflect the market decline, renegotiate contracts where possible: Utilize indices, cost models and should costs in these negotiations to anchor prices in market realities

- Go to market for categories heavily impacted by freight: Be sure to include freight indices in your bid packages to confirm that bids are competitive with the market

This shouldn’t be a once and done discussion. By tracking freight indices over time, you can ensure that your suppliers’ freight prices are in line with the market. So long as the market is down, your freight rates should be too.

Finally, of the freight sectors we’ve covered, maritime and rail in particular, will have the hardest time rebounding. While not all forms of freight can be substituted—if and where applicable, switching a greater proportion of your shipping to maritime or rail could help ensure your rates remain low for as long as possible.

Actively taking advantage of this freight market decline can save you millions.

Interested in better understanding how your business can save millions on freight and other categories of spend?

Click here to learn more