![]()

In our last post, we demonstrated how benchmarking suppliers by per-unit pricing can help E&P firms drive back costly premiums. This post – the 5th in our Smart Savings Series – details a more high-level analysis that will help you identify categories where consolidating your vendor base will likely yield significant savings: Supplier Fragmentation Analysis. Once you recognize where your “long tail” spend exists, you can redistribute it across your top suppliers to achieve maximum volume discounts, strengthen relationships with key vendors, and reduce administrative costs. We typically find that when firms leverage this analysis to reduce fragmentation, they achieve ~ 10% savings on their redistributed spend.

What is Supplier Fragmentation Analysis?

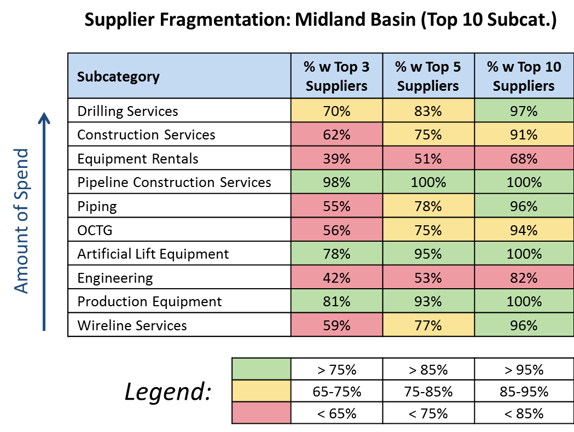

Supplier Fragmentation Analysis is a means of visualizing and benchmarking your spend distribution across suppliers at any level of your taxonomy (e.g., category, subcategory, item). The chart below represents the truncated output of a Supplier Fragmentation Analysis that PowerAdvocate recently conducted for an E&P client (actual data has been disguised). This client was particularly fragmented around categories like “Equipment Rentals” and “Engineering”. By leveraging this analysis to redistribute fringe spend in these subcategories alone, the company achieved savings of over $11 Million.

How Do I Evaluate and Address Fragmentation?

A table that reveals which of your categories are fragmented across suppliers is not, in and of itself, a fully actionable piece of intelligence – it simply shows you where to start digging deeper. Once you know which categories to focus on, the next step is determining where fragmentation can effectively be addressed. In some cases, fragmentation is unavoidable. For instance, if you operate in numerous remote regions, and must rely on local vendors in each of them for a certain item or service, then consolidation is likely not possible. For this reason, we recommend that, in addition to an overarching analysis, you conduct Supplier Fragmentation Analyses at the regional level across all of your major areas of operation. Whereas cross-regional fragmentation is sometimes justified, fragmentation within, say, the Delaware Basin is almost certainly not.

Once you’ve dug into your fragmented categories and determined which are prime for consolidation, you should take a two-pronged approach to maximize savings. First, for each of these categories, add up what you spent outside of your top 3-5 strategic suppliers over the last four quarters, and effectively auction off as much of this future “long tail” spend as possible (given your business circumstances) to your top suppliers through a rapid sourcing event. Second, improve internal purchasing processes by ensuring your team in the field purchases only from these top suppliers, with whom you’ve now negotiated the most favorable terms possible. These practices will help you transform your fragmented categories into consolidated units that yield millions in savings.

If you’re interested in a more tactical step-by-step guide to conducting Supplier Pricing Analysis, we invite you to read our follow-on post, Tactical Savings Guide: Supplier Fragmentation Analysis.