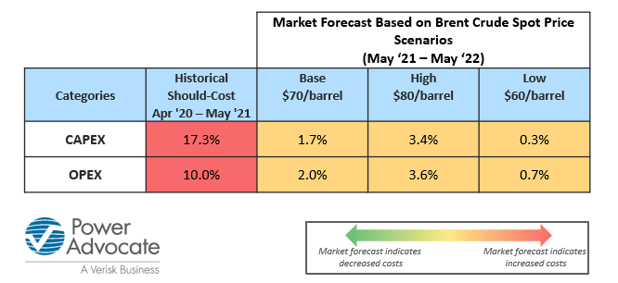

As US GDP growth, WTI prices and E&P activity continue their strong recovery, upstream operators have the opportunity to leverage CAPEX and OPEX forecasting to drive cost savings within an inflationary market.

In our June report, we identify and provide cost forecasts for key CAPEX categories, including OCTG and drilling fluids and chemicals; and key OPEX categories, including compression services and well testing services. Operators are leveraging these forecasts to estimate key cost changes, forecast spend and use market data to optimise costs.

Notable future cost trends include inflections from high inflation to moderate deflation for OCTG and Compression Services: from 67% to -1.1% and from 22.8% to -7.5% respectively. Moving in the opposite direction, Equipment Rental is likely to see 13.4% inflation, compared to a historical trend of -2%.

If you have any questions or would like to learn more, please don't hesitate to contact us at costinsights@poweradvocate.com.