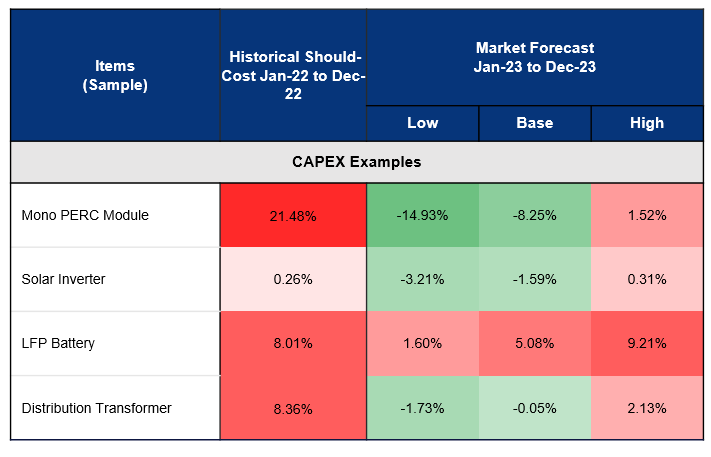

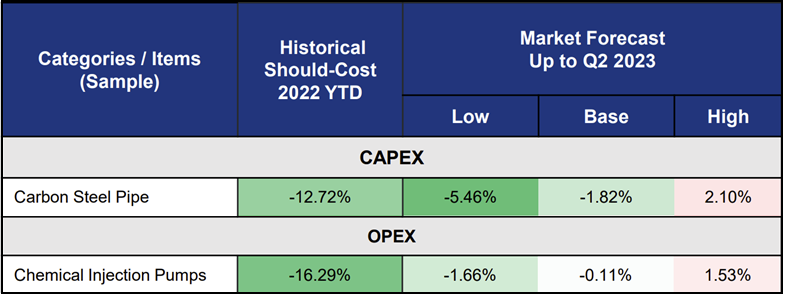

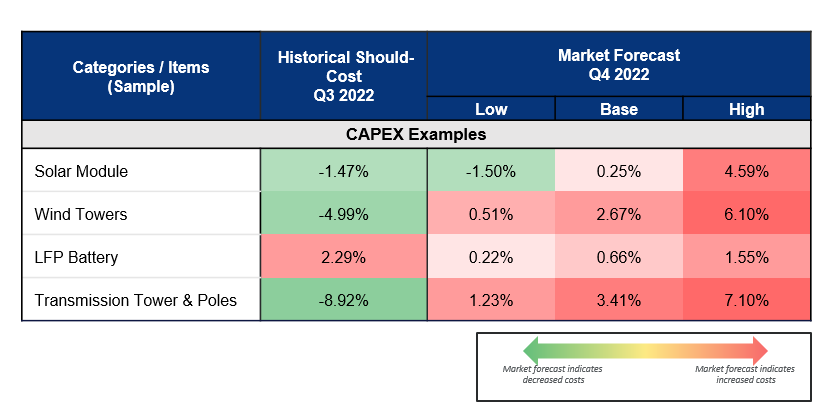

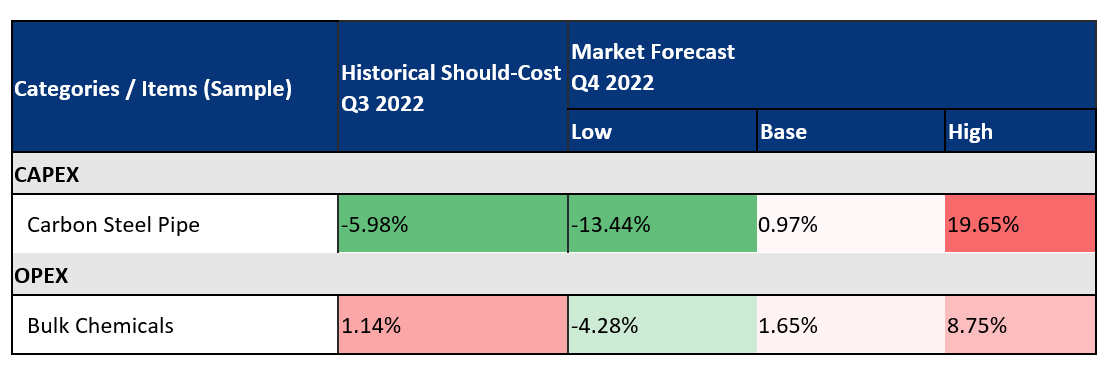

The power and renewables sector heads into the new year in unchartered waters. Continuous commodity volatility, trade protectionism, and high interest rates will challenge operators in 2023.

In our APAC Power & Renewables Inflation Report, we delve into key themes, such as: