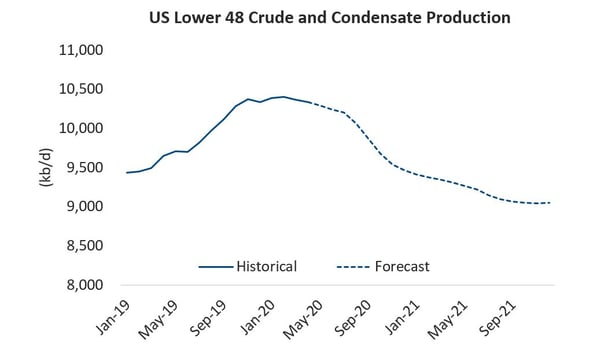

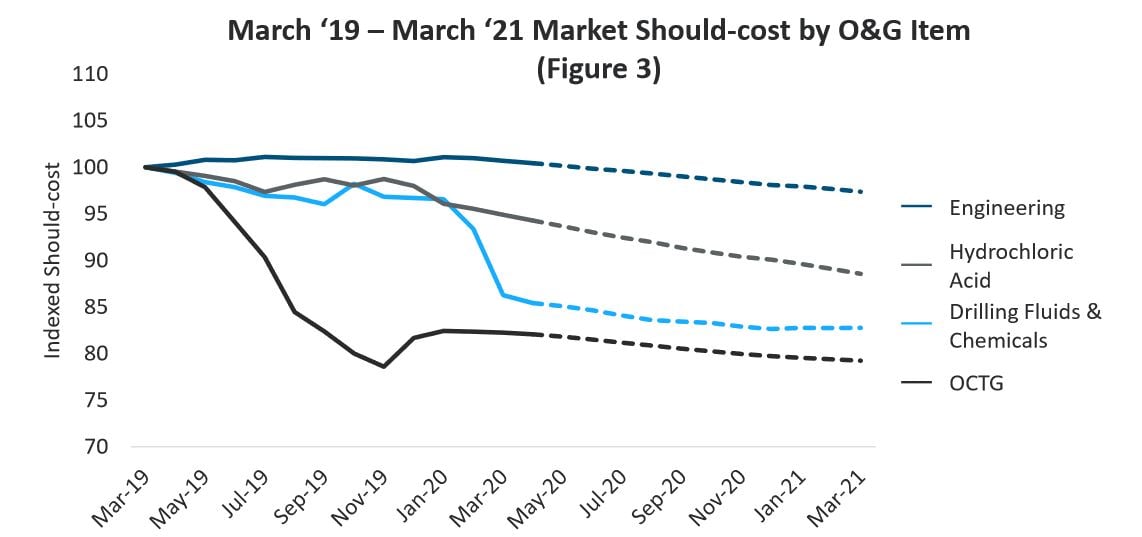

The Russia-Ukraine conflict has rattled global commodity markets, sending crude oil prices to their highest level in more than a decade, while prices for natural gas, nickel and aluminum have also spiked. Transport disruptions and the possibility of additional sanctions on Russia have raised the prospect of tighter supplies for various commodities.

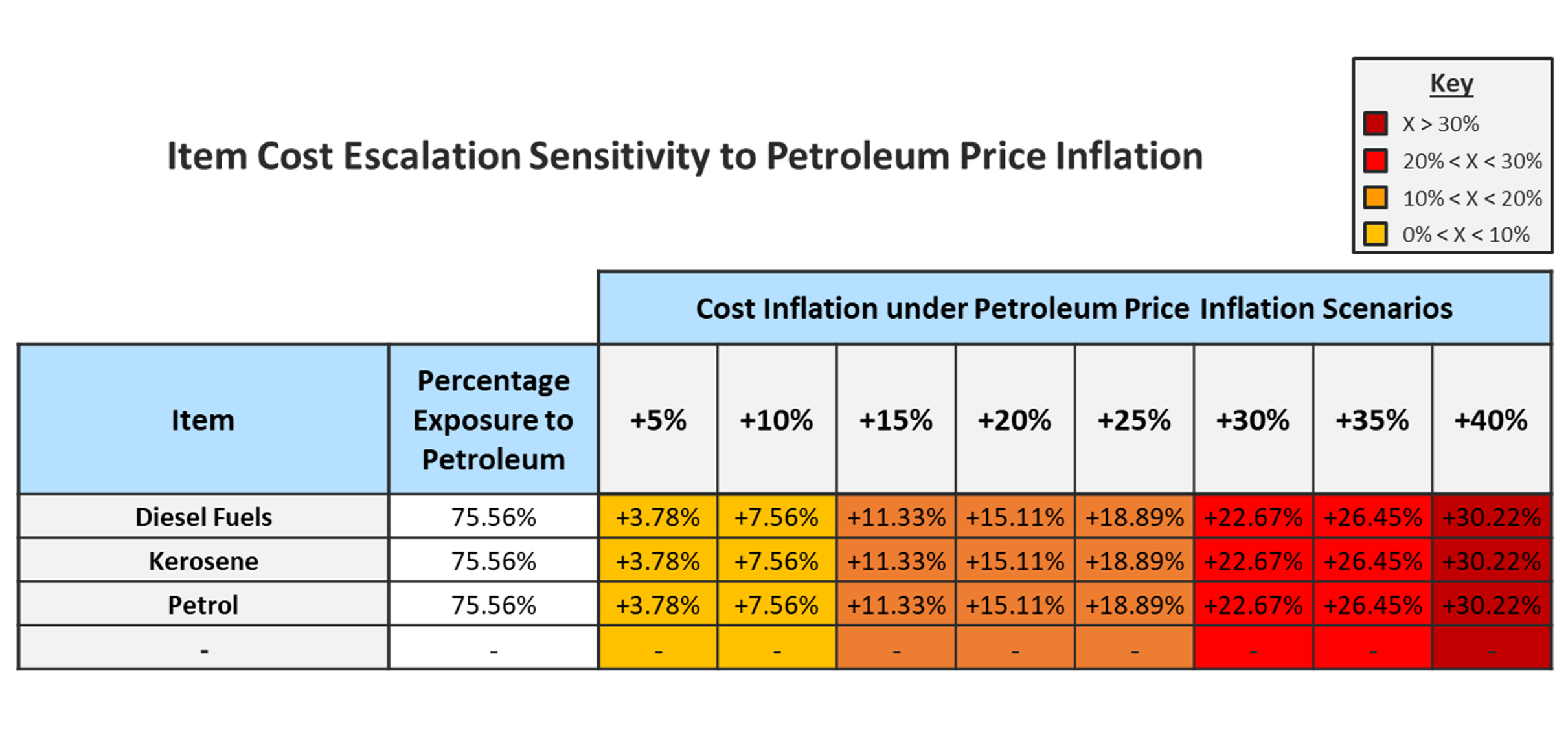

Given high oil and gas price volatility and uncertainty going forward, an understanding of the cost exposure to petroleum prices of key equipment and services procured by mining operators is key to strategically managing costs.

The following analysis leverages PowerAdvocate’s proprietary cost models to provide visibility into the exposure of key mining equipment and services to petroleum prices across the following commodities: fuel, miscellaneous; gasoline & diesel; natural gas; and petroleum products.