![]()

This week’s analysis – the 7th in our Smart Savings Series – focuses on spend distribution with top suppliers, and how to optimize it across categories. Conducting a Supplier Distribution Analysis will highlight significant consolidation opportunities, and enable you to save millions of dollars in volume discounts. In our experience, E&P firms typically achieve 10%+ savings when leveraging the output of this analysis to redistribute spend and renegotiate contracts accordingly.

What is Supplier Distribution Analysis?

Supplier Distribution Analysis provides two layers of advanced visibility into your spend with any top vendor. First, it reveals how your spend with this vendor is spread across product and service categories. Second, within each of these categories, it benchmarks your spend with this vendor against your spend with other top vendors.

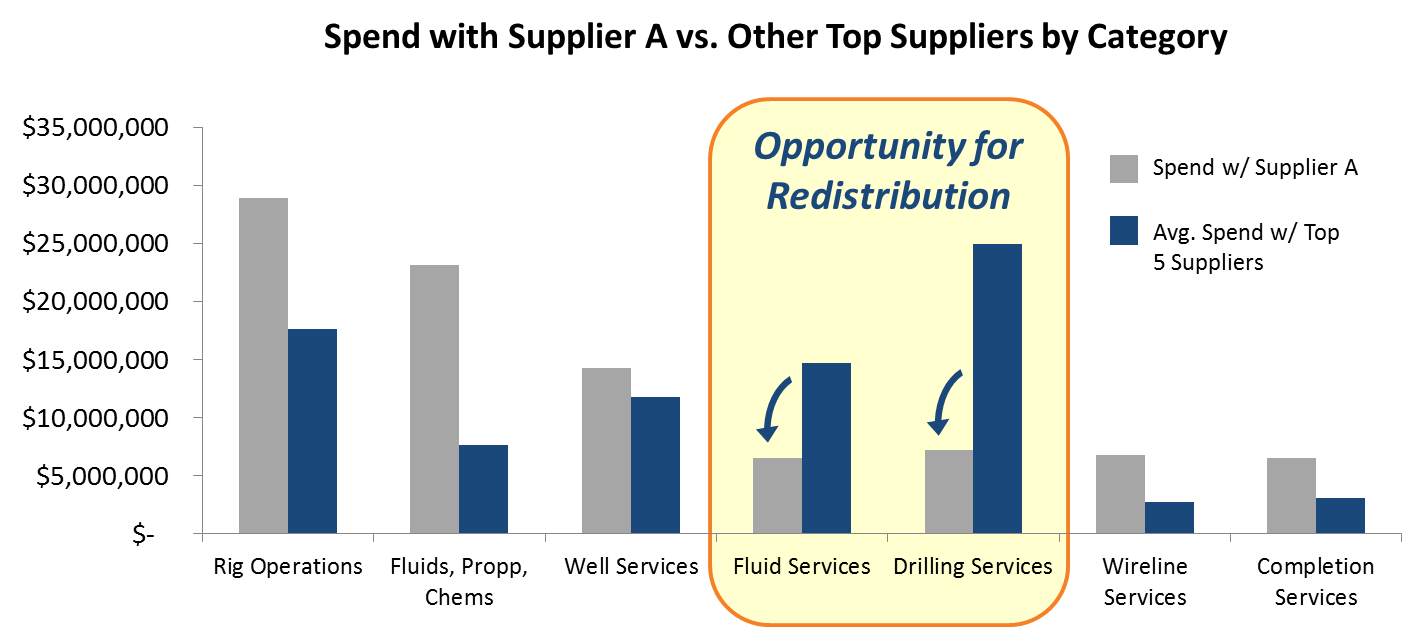

Depicted below is a Supplier Distribution Analysis that PowerAdvocate recently conducted for an E&P client (actual data has been disguised). It reveals the client’s spend breakdown with its biggest OFS provider by category, and highlights areas that could be better consolidated around this vendor. In this case, shifting spend to Supplier A in Fluid and Drilling Services is a multi-million dollar savings opportunity.

How Do I Evaluate and Address a Supplier Distribution Analysis?

Once you’ve conducted a Supplier Distribution Analysis on as many vendors as you see fit (you should investigate at least your top five), you need to determine which opportunities for consolidation are addressable. Some fragmentation is inevitable; for instance, while it appears that the client referenced above should spend more with Supplier A on Fluid and Drilling Services, there may be specialty services this supplier simply cannot, or does not, provide. Alternatively, you may not want to rely too much on one vendor for certain services.

After you’ve identified which inefficiencies you can feasibly act on, you should pursue a two-pronged approach. First, for each tenable opportunity, you should determine how much spend you can redistribute to the relevant top supplier, and then renegotiate your terms with this supplier around added volume (e.g., “If I spend ‘X’ more on drilling services with you this year, I expect ‘Y’ discount”). Second, you should ensure that your team in the field ultimately drives the incremental spend to the suppliers with whom you’ve renegotiated.

If you’re interested in a more tactical step-by-step guide to conducting Supplier Distribution Analysis, we invite you to read our follow-on post, Tactical Savings Guide – Supplier Distribution Analysis.