![]()

In this week’s post – the 9th in our Smart Savings Series – we’ll cover Off-Contract Spend Analysis. More specifically, we’ll discuss which materials and services you’re likely buying off-contract, how to know where off-contract spend is prevalent within your organization, and how to drive off-contract spend on-contract. In our experience, E&P firms save 7-15% on every dollar of spend they bring on-contract.

Where and How Much Am I Likely Buying Off-Contract?

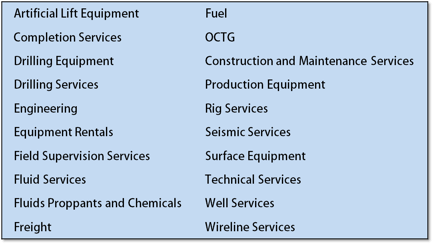

Having cleansed numerous E&P datasets over the years, we’ve learned a few things about off-contract spend at firms like yours. For one, the typical E&P firm spends the majority (and often the vast majority) of its money off-contract. Second, firms tend to spend off-contract across the same categories. Below are 20 categories where E&P firms spend the most off-contract:

Okay, But How Can I Gain Specific Insight into My Off-Contract Spend?

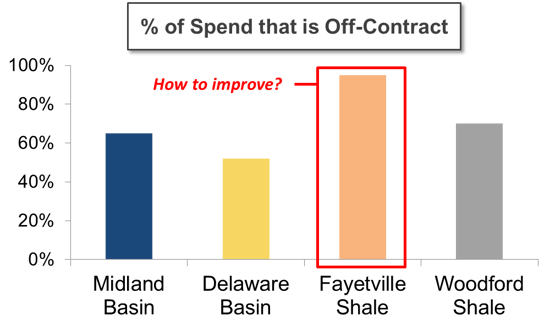

To uncover specifics on your organization’s off-contract spend, you first need to filter out transactions that have contract numbers attached to them in whichever spend data systems you have access to. This will reveal how much you spend off-contract in total. To determine where, on what, and with whom you spend that money, further segregate your data by business unit, classification, and vendor fields.

Parsing the data in this way will allow you to prioritize savings opportunities by category and supplier (see next section), and pinpoint which business units are spending least efficiently. If, for instance, you find that one BU spends proportionally more off-contract than others, you should investigate why this is the case, and how to improve procurement processes there.

Note: Organizing your data in these ways may not be possible with your current systems. In this case, your next-best option is exporting data into a spreadsheet or analysis tool (likely in piecemeal) and doing the work there.

I Have Visibility into My Off-Contract Spend…Now What?

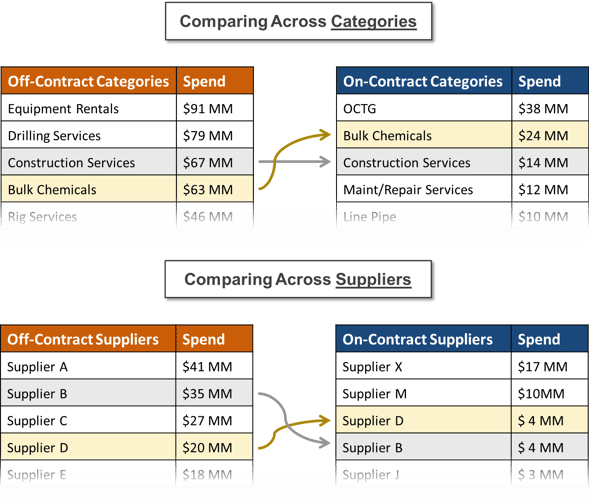

The ultimate goal of isolating and organizing off-contract spend is to bring it on-contract. To do so, you should first cross-reference your off-contract spend with your on-contract spend by category and supplier, and take note of where overlap exists. For a visual depiction of what this might look like, see below:

With categories where overlap exists, there is opportunity for consolidation or new contracting. For instance, in the tables above, it appears $63 MM in off-contract Bulk Chemicals spend can be brought onto existing contracts or onto new contracts, depending on how many vendors you want this category to include. On the other hand, all off-contract spend with overlapping suppliers (e.g., "Supplier B" above) should be brought onto existing contracts.

With off-contract categories where overlap does not exist, you are likely missing contracts altogether and should put them in place (unless there is a reason to purchase off-contract). Off-contract spend with non-overlapping suppliers is a bit trickier, and should be dealt with in consideration of the categories these suppliers operate in. Depending on where contract gaps exist, and what your ideal level of supplier diversification is, you should either consolidate spend with them around existing contracts, or create new contracts with them.

Note: Category comparisons may not be possible if off-contract spend isn’t sufficiently classified or your off-contract and on-contract datasets have differing schemas.