This post lays out the details behind a tactical execution of Supplier Fragmentation Analysis (if you’re not sure what Supplier Fragmentation Analysis is, check out our high-level intro piece on the subject), and provides strategies for consolidating highly fragmented categories.

Specifically, it outlines:

- Data requirements: What data do you need access to?

- Steps of the analysis: What are the steps to follow in running the analysis?

- Suggestions on execution: How have we seen other companies actually execute and realize the savings opportunities uncovered by the analysis?

Data Requirements

The data requirements to run this analysis are far less demanding than some of the other analyses we’ve shared to date. However, if you do not have access to all this data, you’re not alone…many E&P companies are in the same boat. We can help – just ask us how.

1. Fully Rolled-Up Supplier Families: Without complete and accurate supplier hierarchies, the output of this analysis will inevitably mislead you. For example, if you contract with Baker Hughes and three of its subsidiaries in the same category, but treat these entities separately in your spend data, this category will appear to be far more fragmented than it actually is. Given that virtually every major E&P firm purchases from both parent and subsidiary companies across major categories, failing to maintain in-tact families can result in an analysis output that is entirely un-actionable. The chart below depicts a PowerAdvocate client before and after it invested in proper supplier familying.

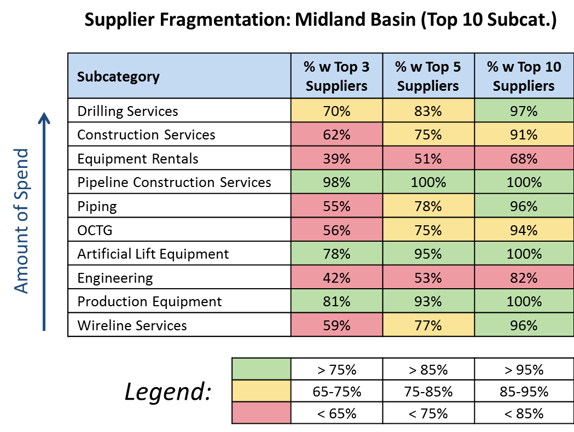

2. Regional IDs at the Transaction Level (Optional): Determining which categories are fragmented across regions should be the first step you take when conducting Supplier Fragmentation Analysis. However, a useful follow-on step is to conduct a more targeted analysis for each of your areas of operation (e.g., basins). The narrower your regional scope, the less justified supplier fragmentation becomes. Thus, whereas fragmentation revealed by an enterprise-wide analysis requires subsequent validation, fragmentation at the regional level is almost immediately addressable. As long as you can link transactions to specific basins (see regional breakdown below), you’re in good shape; you gain very little from conducting this analysis at the field or formation level.

How to Run the Analysis and Identify the Savings Opportunity

With the right data quality, executing this analysis for any given category requires little more than some simple arithmetic. Automating the process across all categories is a bit trickier. If you’re curious how to do that, just reach out, and we’ll show you. But, for now, here are the basic steps required to manually identify savings opportunities using Supplier Fragmentation Analysis:

- Rank-order your top spend categories.

- If possible, export total spend by supplier for your top category, spanning the last 4 quarters. If a summarized export is not possible, export this data in transactional form, and create a pivot table in Excel to achieve aggregated spend amounts by supplier.

- Add your category spend with your top 3 suppliers together and divide this number by your total category spend.

- Repeat Step 3 with your top 5 suppliers and your top 10 suppliers.

- Repeat Steps 1 – 4 for all of your major categories (how many you cover is up to you), and organize your spend percentages in a table like the one depicted below.

How to Execute on the Savings Opportunity

Once you’ve conducted a Supplier Fragmentation Analysis, you should identify and pursue your lowest hanging fruit: categories that are high-spend, highly fragmented, and highly addressable. As noted in our overview post on this analysis, some fragmentation is impossible to eliminate, though most should be ripe for consolidation (in keeping with the fruit theme). Once you’ve identified your largest savings opportunities, you should approach each with the following two courses of action: consolidation, and improved internal contract compliance. The former is impossible without a strict execution of the latter, so taking these approaches in tandem is imperative.

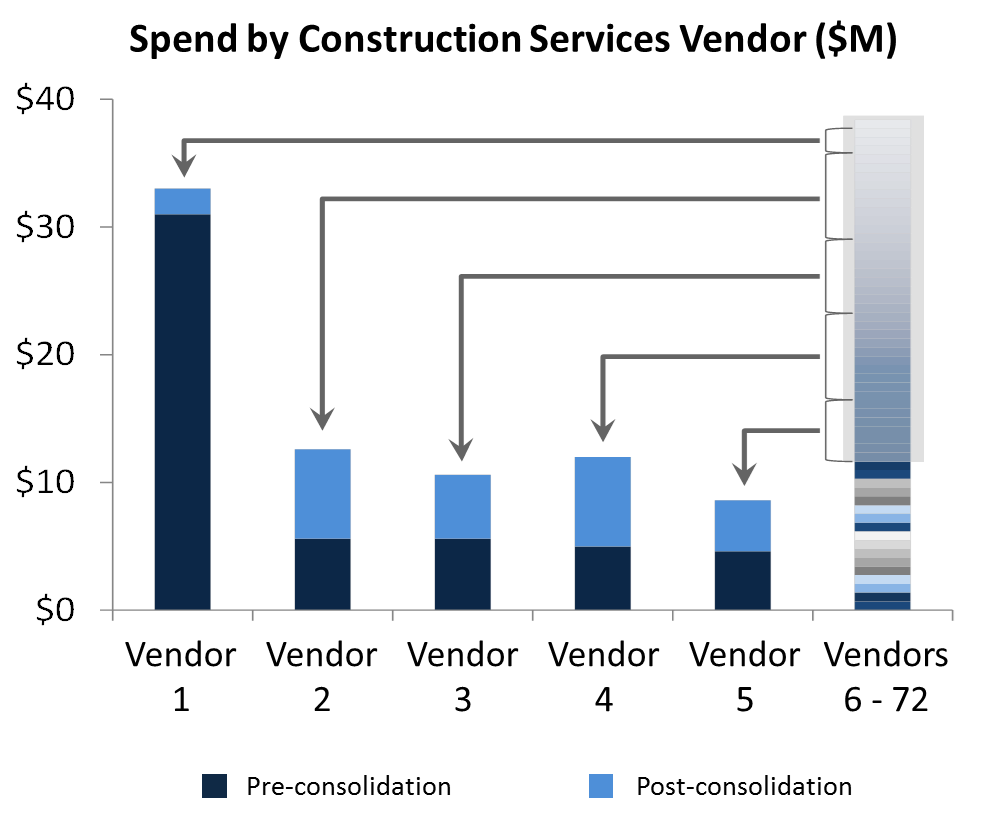

Consolidation: To redistribute your fragmented spend in a category, you should first calculate how much you spent outside of your top 3-5 suppliers over the last 4 quarters – this is the spend that will drive your savings. Next, you should organize a rapid sourcing event, and invite all of your top suppliers to bid on as much of this future business as you can possibly redistribute. This will result in a variety of volume discount offers; it’s your job to decide which is the most attractive. If you’re looking to reduce risk or strengthen multiple strategic supplier relationships, it may make sense to redistribute your fringe spend in multiple “chunks”; it all depends on where your priorities lie.

Contract Compliance: Once you’ve cut fresh contracts around this soon-to-be redistributed spend, you cannot assume your internal teams will adhere to them. Off-contract, “rogue” spend is one of the biggest inefficiencies plaguing E&P firms today, and one of the biggest drivers of spend fragmentation. Thus, through whatever internal training or directive process you have, you need to ensure that purchases made in the field go through your preferred suppliers. It may even make sense to provide incentives tied to contract compliance to the employees that make these purchases.

If you follow these two approaches with each of your addressable fragmented categories, you will achieve something similar to the consolidation depicted below, and, as a result, you will save millions of dollars for your organization.

Need help accessing the data needed for this (and other) analysis?

Need help running the analysis?

Need help executing supplier negotiations?

We can help – ask us how.