The variability of supplier responses to bid events can pose significant financial and operational risks to energy companies, especially as this behavior is prone to change when market and economic conditions shift. Variances in bid responses during the recent economic recession and recovery motivated PowerAdvocate to analyze the impact of macroeconomic factors on supplier bidding behavior. The aim of this analysis was to uncover trends that, when coupled with project and company-specific data, will enable industry leaders to better anticipate and mitigate project and supplier risk. If you missed our introduction of this analysis, you can read our previous blog about it here.

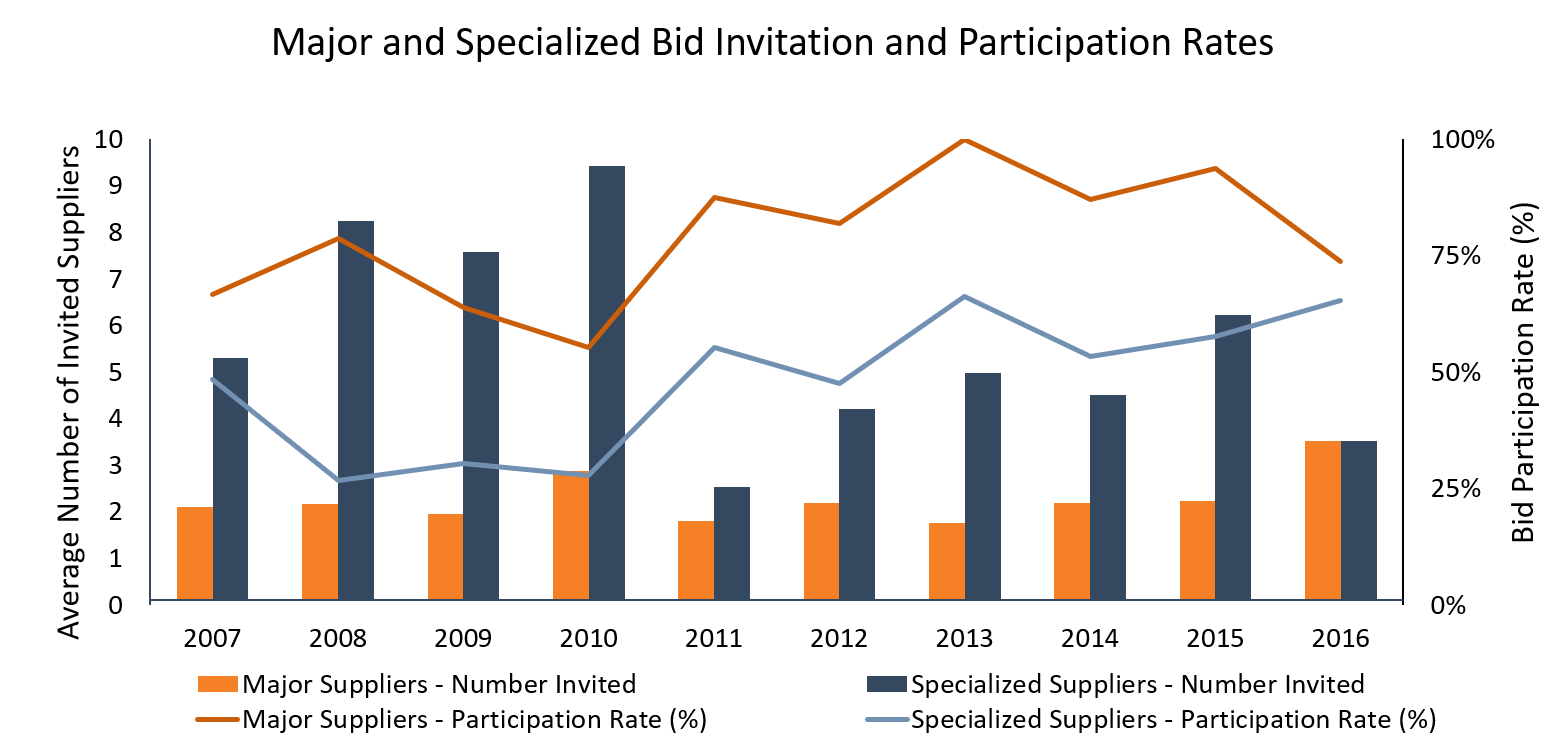

Our team hypothesized that suppliers who offer a diverse range of services, work across multiple industries, and service a wide geographic area respond to macroeconomic circumstances differently than smaller or more specialized suppliers. To measure these differences, and to better understand how a supplier’s profile influences their behavior, the team categorized bid data into two groups: bids from major suppliers and bids from specialized suppliers.

In our analysis of nearly 700 bid responses across 140 transmission and distribution projects, the team’s hypothesis was confirmed. Not only do the two groups bid differently, but the way they respond to evolving macroeconomic conditions is different as well. In the graph below, note the bid participation rates following the onset of economic recession in 2007. The two groups display opposite reactions to the economic shift, with the participation rate of major suppliers increased the next year by about 10%, while the participation rate of specialized suppliers fell to nearly half of what it was. This reaction is just one example of the behavioral differences uncovered between the two groups. Recognizing and understanding these differences is key in order to accurately anticipate a supplier’s behavior the next time the market shifts.

For further analysis on how major and specialized suppliers differ, the impact of changing market conditions on bid participation and pricing, and general strategies for limiting supplier risk – check out the full whitepaper.

This is the second part in our two part series on how to reduce supplier risk by understanding your supplier bidding behavior lead by PowerAdvocate's team of Capital Project consultants. Read the first post Reduce Supplier Risk by Predicting Bidding Behavior.

About Our Capital Projects Consulting Team

PowerAdvocate's Capital Projects consulting practice helps energy clients plan, source, and execute large, complex capital portfolios and projects across a wide range of industries. From helping design organizational approaches, leveraging market data to estimate and forecast project costs, procuring and negotiating large contracts, and implementing sophisticated risk-reward programs, the practice has added value to our clients' projects across North America, Europe, and the Middle East.

Read our Capital Projects blog posts: www.costinsights.com/topic/capital-projects

Want to learn more about our Capital Projects Consulting Team ?