As the Texas and Louisiana Gulf Coast recovers from Hurricane Harvey, Supply Chain organizations face the challenge of navigating its effects, from chemicals to logistics to labor.

While Harvey has affected Supply Chain in many ways, today's post will focus on Harvey's impact on ethylene-based products, such as plastics and resins. Curtailed capacity for one of the most widely used petrochemicals presents large market risks for Supply Chain teams.

Below, we share a debrief on the post-Harvey ethylene market, and then we highlight insights and recommendations for Supply Chain teams as they navigate supply constraints and price hikes in the aftermath of the hurricane.

Harvey and Ethylene: A Debrief and Outlook

Although Harvey has disrupted many parts of Supply Chain, Supply Chain teams face substantial market risks from Harvey shutting down more than 50% of US ethylene production capacity. As major ethylene producers impacted by Harvey work to reboot operations, they face a variety of issues:

- Operational hurdles such as inconsistent access to electric power, limited access to feedstocks, and a lack of access to facilities cut off by floodwaters;

- Logistical disruptions because of Harvey’s damage or disruptions to large parts of port, trucking, and rail infrastructure.

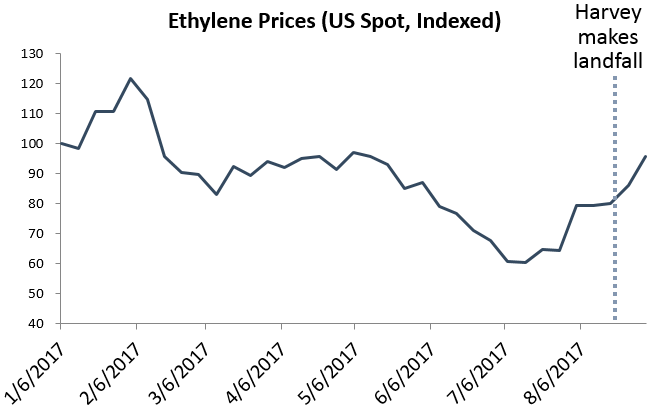

As a result, the ethylene market is facing a short-term supply crunch: various suppliers have reported that they will not be able to fill orders for plastic products in August, while other suppliers have reportedly announced plans to raise prices. Assessed US ethylene prices reflect this reality, with a 19% increase from the week of August 18th to the week of September 1st:

Source: Bloomberg

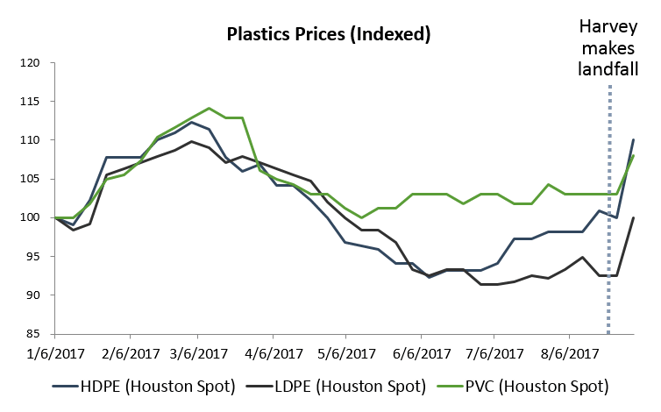

This surge in ethylene prices has also resulted in significant price increases for important downstream products, such as plastics and resins. Most manufacturers maintain low inventories of ethylene, often with only 7-28 days of onsite stocks, requiring reliable access to logistics networks for resupply.

For example, there have been significant upward pressure on prices for plastic products like HDPE, LDPE, and PVC:

Source: Bloomberg

However, despite initial chaos and supplier claims, supply disruptions from Harvey will only be temporary and prices should correct over the next few months for a couple of key reasons:

- Firstly, while there might be a short-term supply crunch driving ethylene-based product prices up, producers will have renewed access to ethylene to supplement existing onsite inventories in the long term. Much of the port and rail freight network is bouncing back more quickly than expected, with many refineries starting to receive oil imports again.

- Secondly, most of the damage to plants is not lasting. As the floodwaters recede and plants reboot operations, operational hurdles like inconsistent access to electric power will prove to be temporary. Even as early as last week, major producers have announced they were working to restart operations, with multiple other producers following suit.

- Lastly, the supply crunch for ethylene-based products will be further eased as several new plants come online.

What do these forecasts mean tactically for Supply Chain teams as they manage risks in the aftermath of the storm?

Recommendations for Supply Chain Organizations

Despite tumultuous market circumstances post-Harvey, there are tactical approaches that Supply Chain teams can use to manage additional cost risks. With ethylene production and prices expected to become less volatile in the coming months, we share three key recommendations for Supply Chain leaders managing enterprise risks and costs resulting from Hurricane Harvey:

|

What Should Supply Chain Teams Do? |

|

Validate price increases by running should-cost analyses to determine whether the price increase is appropriate or not. |

|

Push back on significant increases by asking your supplier for the reasons driving the price escalation and counter increases with updated market data and outlook. |

|

Don’t lock in unfavorable prices or delay purchases as Harvey will not have a long-term effect on the domestic ethylene market, making the supply crunch temporary. |

If you’d like to have further conversations about the effects of Harvey on Supply Chain, cost modeling, data-based negotiation strategies, or the chemicals market, please contact us here.