With the future of oil and gas prices still uncertain, many midstream and downstream firms are asking how much investment is still being planned for the coming years.

In today's project forecast update, we share how and where the market is planning projects in the midstream, refining, and petrochemical sectors over the next four years. Read on to view maps of the top areas of capital investment through 2020:

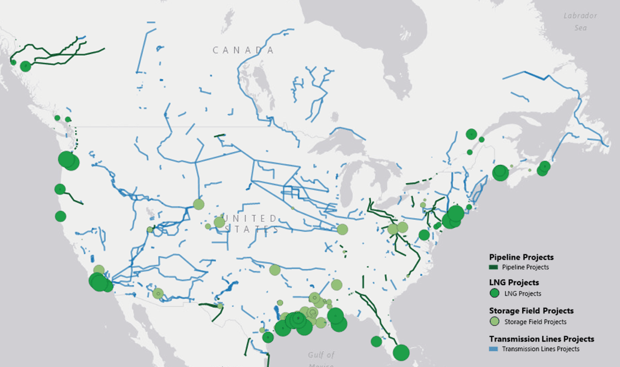

Billions are Planned in Gas Pipeline, LNG, and Energy Storage Projects

Sources: SNL, Oil & Gas Journal

This map of planned midstream investment suggests three important observations:

- Large LNG projects will ramp up over the next 4 years

- The Gulf Coast continues to be an area of some of the largest investments, with many pipeline projects still planned for the Northeast

- Storage projects are not to be overlooked as an area of competing investment

Let's next take a look at the downstream market.

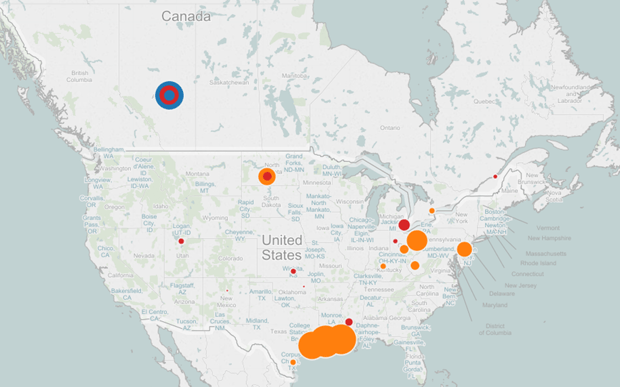

More than $100B of Downstream Projects Planned through 2020

Sources: Oil & Gas Journal, Petrochemical Update, ICIS Chemical Business Magazine

In this map, the size of the bubbles correspond to the size of the project, and the colors correspond to the market sector. Red is for refining, orange is for petrochemicals, and blue is for oil sands projects.

While petrochemical investment may look geographically sparse, in fact, the magnitude of each project is far larger than that of most midstream projects. We expect petrochemical projects to land in the multi-billion dollar range, whereas typical pipeline or storage projects tend to fall in the multi-million dollar range. Overall, more than $100B of investment in the downstream sector is expected in the next four years.

---

So what do these project forecasts mean for Oil & Gas firms looking to plan for the next few years? The greatest impact for O&G Supply Chain teams is the high risk of supply shortages and price spikes.

Increased demand for materials and labor, especially in areas of significant investment such as the Gulf Coast, suggests the potential for rising prices and even logistical shortages. This is especially the case in supply-constrained craft labor markets, but is also true for both EPC bids, which we expect to rise with rising demand, and for materials shipments.

To prepare for that potential, we recommend:

- Locking in rates far in advance to avoid price spikes, especially if you're working in the Texas Gulf Coast or Louisiana

- Tying contracts to indices that trend downwards or escalate slowly over time

- Requesting granularity in RFP's to identify where margin might be hidden. For instance, it can be valuable to ask not just for a base wage for labor costs, but to request that each contractor provide a breakdown of base wage, benefits, health care, overhead, and margin.

- Developing project cost models to identify how prices are expected to change over the course of the project's lifetime to inform purchase timing decisions

- Leveraging your spend volume to develop relationships with preferred partners who can put you at the top of the delivery list in times of supply constraint

- Vigilantly tracking pricing to ensure that you're not being charged overtime or premium rates that aren't specified in your contracts

Interested in learning more? Just send us a note at costinsights@poweradvocate.com