Steel is the largest metallic cost driver in energy supply chains. As such, its volatility over 2016 has led supply chain teams to look for ways to manage this cost and mitigate the potential impact of further large increases in the price of steel.

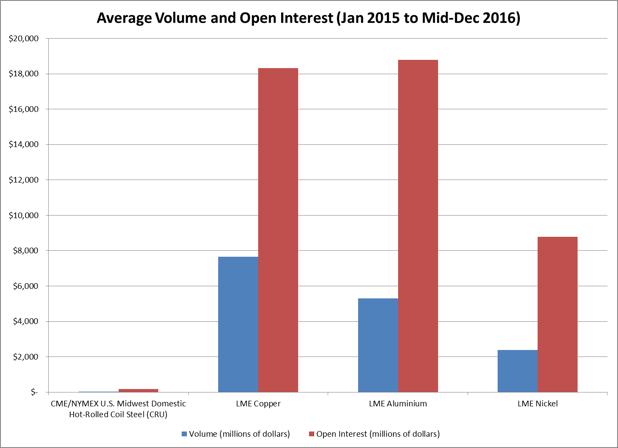

In contrast to base metals like copper, aluminum, and nickel, which have deep and liquid financial derivatives markets, steel production and consumption is fragmented amongst differing grades. This has inhibited the development of a robust hedging market for steel.

Indeed, volume and open interest in exchange-listed steel contracts looks miniscule relative to major base metals benchmarks. While steel is admittedly a relatively expensive and difficult commodity to hedge, this post examines the cost and efficacy of options available to American firms wishing to mitigate their steel exposures.

Sources: Bloomberg, PowerAdvocate Energy Intelligence Group

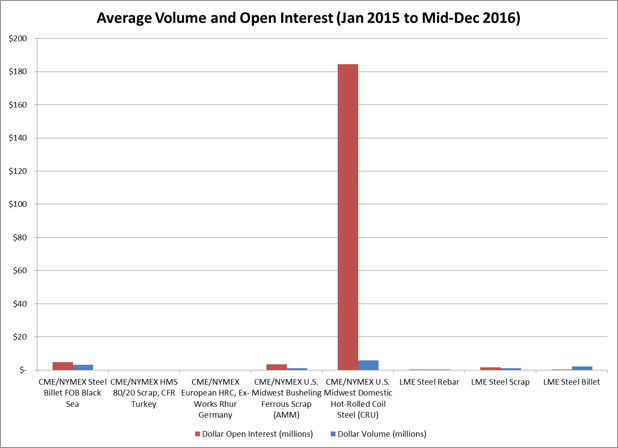

Out of the limited activity in steel derivative markets, hot-rolled coil futures appear to be a dominant benchmark, with volume and open interest dwarfing most other American and European steel contracts.

Sources: Bloomberg, American Metal Market, PowerAdvocate Energy Intelligence Group

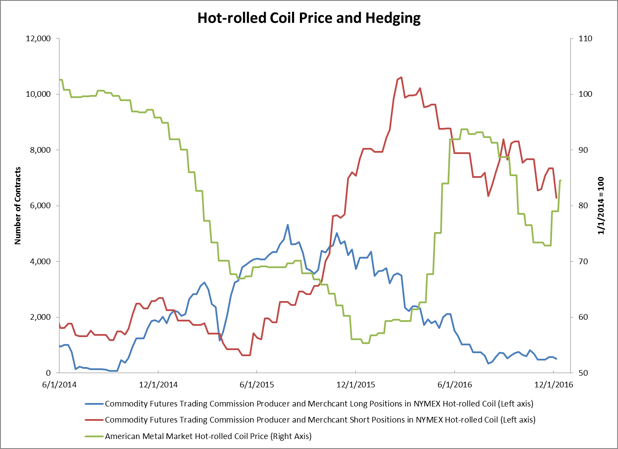

Nevertheless, neither short nor long positions in benchmark hot-rolled coil futures appear to correlate well with either the price or the volatility of the metal. This implies that neither buyers nor sellers of hot-rolled coil are systemically hedging in response to price movements.

Sources: American Metal Market, US Commodity Futures Trading Commission, PowerAdvocate Energy Intelligence Group

A number of firms (including Cargill, Stemcor, JP Morgan, and Koch Supply and Trading) offer steel hedging products to industrial clientele. While such firms may be able to provide custom instruments which address the specific exposures of supply chain managers, their pricing is generally opaque and these services are likely expensive.

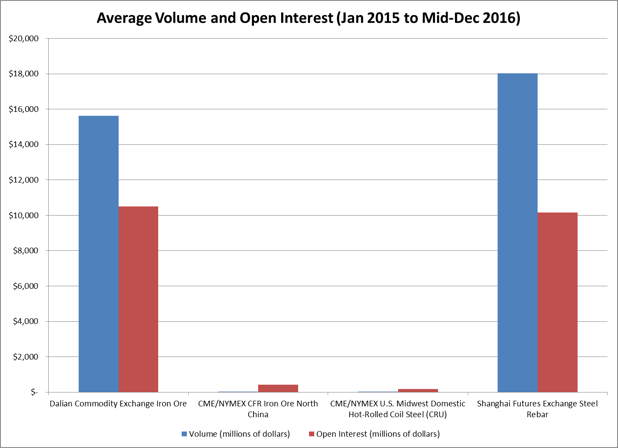

Robust derivative markets for steelmaking ingredients like iron ore have emerged over the last decade and are traded on the Singapore Exchange (SGX), Dalian Commodity Exchange (DCE), and CME (formerly the Chicago Mercantile Exchange). If pricing in these markets correlates well with the steel grades to which supply chain managers are exposed, they could prove to be effective hedges even if supply chain managers have no exposure to iron ore. Additionally, a very active rebar contract exists in China. While this development has partially come about as a result of government encouragement, it nonetheless demonstrates that deep markets for steel can emerge under the right circumstances. While non-Chinese firms are generally restricted from accessing Chinese futures markets, they are typically eligible to trade similar contracts listed on the Singapore Exchange.

Sources: Bloomberg, PowerAdvocate Energy Intelligence Group

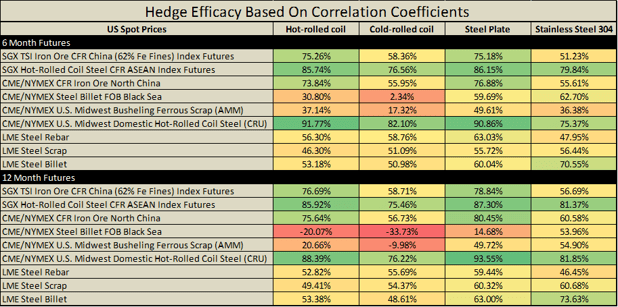

The hedging efficacy of listed futures contracts for various American steel grades can be estimated by looking at the correlation coefficients between the spot pricing of the steel grade and the futures price at various durations. Using correlation coefficients this way is a somewhat common industry practice.

From January 2015 through mid-December 2016, these coefficients indicate that in addition to hedging hot-rolled coil well, the CME’s benchmark hot-rolled coil futures contract is also a robust hedge for steel plate (and to a lesser extent for cold-rolled coil). In fact, one-year forward pricing actually appears to track spot steel plate prices better than spot hot-rolled coil prices. Singapore’s benchmark hot-rolled coil contract also correlates well with American hot-rolled coil and steel plate spot prices. By contrast, most other CME and LME listed steel contracts appear to be poor hedges for American steel grades.

Negative Correlation  Positive Correlation

Positive Correlation

Sources: Bloomberg, American Metal Market, PowerAdvocate Energy Intelligence Group

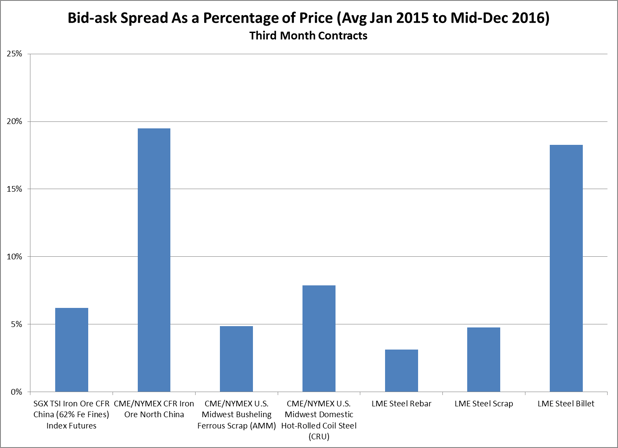

In addition to efficacy, hedgers should take transaction costs and contract liquidity into account when choosing financial instruments. Widely used contracts are typically more liquid and are henceforth cheaper to access. To some extent, this can inhibit innovation on the part of hedgers. In other words, the optimal contract for a given hedger is often the most popular contract since utilization lowers transaction costs.

Bid-ask spreads are often used as a proxy for transaction costs in financial contracts. In this case, they validate that steel hedging is expensive in absolute terms. Since the scales of different steel grades can vary dramatically, looking at bid ask spreads as a percentage of pricing can enable an apples-to-apples comparison. Somewhat surprisingly (since it is the most widely used domestic steel futures contract), hot-rolled coil futures appear to have a slightly wider bid-ask spread than other steel contracts (implying higher transaction costs). However, these spreads don’t necessarily reflect broker fees or commissions, and hedgers should check actual pricing before transacting.

Higher spreads are generally indicative of higher transaction costs. Sources: Bloomberg, PowerAdvocate Energy Intelligence Group

In summary, despite the enormity of steel as a commodity market, its commodity derivatives are only lightly traded. Resultantly, steel hedging transaction costs are high relative to other transaction costs and most organizations do not hedge their steel exposures. Nevertheless, some options for hedging steel do exist and are occasionally used. When hedging steel, supply chain professionals should be careful to ensure that the instruments they are using to hedge exposures correlate well with those exposures and that their transaction costs are both reasonable and competitive.