Summary

- Many industry players operating in the Lower 48 have a large amount of cash on their balance sheets in 2019 due to accommodative tax policy and cheap debt

- Longer-term strategic capital deployment will help firms lay a foundation for continued business growth, hedging against weakening macroeconomic fundamentals

- These economic conditions are expected to drive more funds towards M&A activity

- However, to capture M&A value by realizing merger synergies, operators should evaluate whether they have the right data insights on enterprise spend, costs, and market trends to build a savings roadmap

Weak Oil Markets Meet Liquid Capital Markets, Setting the Stage for Greater M&A Activity

Strong balance sheets, a maturing shale revolution, and stabilizing oil prices are creating new opportunities for industry M&A. While low oil prices since the 2014 crash have shaken up oil majors and spooked investors, consolidation has proven an effective strategy for streamlining operations and reducing breakeven costs. Although low oil prices create a challenging energy business landscape, they also contribute to lower corporate valuations, making M&A transactions more palatable for those with capital.

Interestingly, we have seen an increase in deal-financing for E&P companies in the Permian from non-traditional partners. Examples include Berkshire Hathaway’s $10B contribution to the Occidental – Anadarko takeover and Elliot Management’s $2B+ bid for QEP Resources. According to data from Bloomberg, in 2019 YTD, financial (i.e. Private Equity and Venture Capital) buyers accounted for nearly 30% of M&A transactions, as opposed to strategic buyers. This is nearly double the percentage seen in 2018, indicating that although capital may be tight within the industry, there is substantial space to improve profitability through changes in management strategy, and financial firms have the assets to do so.

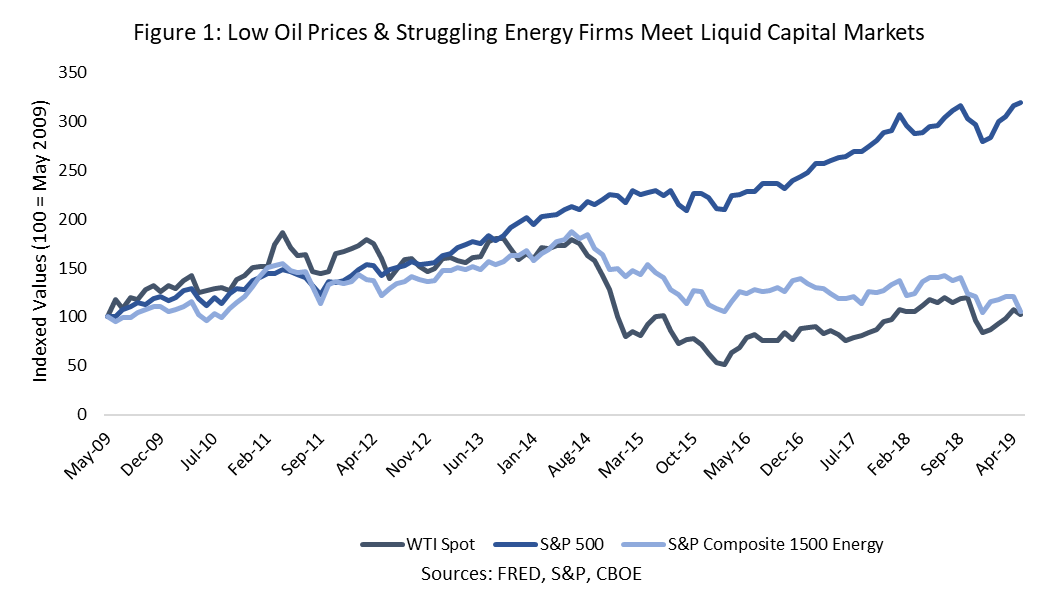

Additionally, while low oil prices have dampened the market capitalization of energy companies, general equities have grown significantly over the past ten years, freeing up capital for M&A deals (Figure 1).

While capital in the energy industry is tight due to low oil prices, the general marketplace has abundant capital to invest in energy assets

How Can Firms Capture M&A Value?

After years of costly exploration, investors are signaling that they want operators to consolidate and use improved depth of knowledge and resources to facilitate more efficient production and capital discipline. There is more attention than ever focused on business portfolio growth through the acquisition of valuable assets, with a particular eagerness to operationally consolidate and acquire acreage in the hotspot Permian basin (evidenced by skyrocketing acreage prices in the basin, which rose from roughly $2,000 in 2016 to as high as $95,000 per acre in 2018 according to the Bureau of Land Management). We expect deal volume and valuation growth through 2019 as buyers battle for treasured drilling rights in the Permian.

However, as M&A activity surges, operators should evaluate if they have the data needed to develop a post-merger savings roadmap that ensures the capture of merger synergies. Historically, 70% to 80% of acquisitions fail to generate shareholder wealth, highlighting the imperative of post-merger forethought. Developing a savings roadmap will require being able to answer critical questions such as:

- Where can we capture market-based savings across the new enterprise?

- Where can we leverage newfound market power more effectively?

- Are there opportunities for us to rationalize the supplier base and capture volume discounts?

- Is there a broad spread in my unit pricing across the newly merged business, and how can we identify and capture best pricing?

- Are teams across the merged business equipped with a holistic, central view of key performance metrics?

- …and more

The industry faces an exciting period of M&A activity, but the difference between merger value captured and merger value lost will depend on the depth of data insights leveraged in the critical post-merger integration period.

If you’re interested in seeing our O&G merger savings roadmap or would like to learn more about how PowerAdvocate has supported dozens of energy-specific mergers to drive hundreds of millions in savings with data, reach out to us at costinsights@poweradvocate.com.

For more of our insights on the Permian specifically, check out our Permian data blog at PermianCosts.com