As a result of the US economy's glut of steel imports, the International Trade Commission (ITC) has received more than 50 complaints since 2013 from domestic producers calling for new tariffs on imported steel for both antidumping and countervailing actions. Antidumping tariffs are duties that offset predatory pricing, defined as selling below cost, whereas countervailing duties offset subsidies applied by foreign countries to their domestic industry.

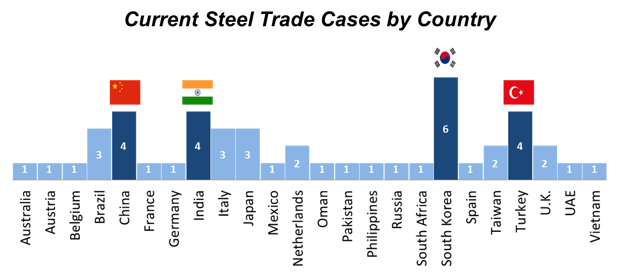

The ITC is currently investigating eight trade cases, affecting 24 different countries. South Korea, China, India, and Turkey are the most frequent targets. South Korea is under investigation in six cases, while China, India, and Turkey face three cases each.

Outlook

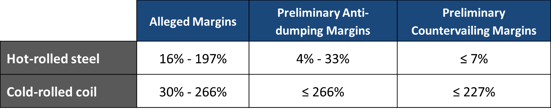

Two essential steel grades—hot-rolled steel and cold-rolled coil— have final determinations scheduled for September. Duty rates released in initial determinations by the ITC earlier this year are the following:

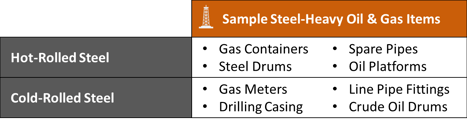

The oil and gas sector has some of the highest exposure to these steel grades, with around 15% of the industry’s spending going towards hot-rolled steel or cold-rolled coil. In particular, steel products are heavily used in drilling and crude transportation in the oil & gas sector. Here are some of the items that will be most effected by steel trade case decisions:

After the Department of Commerce (DOC) initiates a trade case, the ITC begins its investigation and suggests a preliminary tariff rate. The DOC then revises and posts the preliminary ITC rate. At this point, ports begin collecting preliminary duties, and, based on analysis of previous trade cases, this is when the market tends to slash imports.

The hot-rolled steel and cold-rolled coil cases seem to follow this same pattern. Import levels of both grades decreased after the filings and preliminary determinations, with an average lag of 1.5 months. When final determinations are released this September, we expect import levels to dip, and supply contraction to push prices up. However, we expect that the largest market shocks already occurred with the ITC's release of preliminary determinations earlier this year.

Recommendations

Moving forward, the finalized tariff rates will offer buyers a greater degree of certainty, and the markets will likely stabilize over the next few months. In the meantime, as tariffs continue to work their way through the ITC and DOC, there are a few strategies you can follow to mitigate your risk and minimize costs.

- Evaluate shipping times and determine how they align with trade case timelines

- Look ahead and assess your risk from the moment a new trade case is filed

- Historically, import levels see the greatest shocks after preliminary tariff determinations

- Consider adjusting your buying calendar to work around this

- Where possible, leverage favorable exchange rates to offset losses from tariffs

To speak with a member of PowerAdvocate's Energy Intelligence Group on how to optimize your steel market strategy, reach out here.